Switzerland is the world banking capital and the country that holds the largest gold deposits and more than one-third of all private wealth on the planet. Switzerland is known for being neutral to political problems, making the Swiss franc one of the world’s leading safe-haven currencies.

On the other hand, Japan is the economic powerhouse of Asia, the third-largest economy, and one of the top high-tech exporters worldwide. Moreover, the yen is the third most widely held reserve currency. Although it is considered more volatile than the CHF, both are equally stable and are used as a refuge.

Would you like to know the fundamental and technical aspects of trading the CHFJPY pair? Due to the significance of these currencies, the guide will explain some technical analysis strategies, economic news, and indicators to consider when trading this currency pair.

Fundamental aspects

Interest rate differential

The CHFJPY pair has a strong correlation with the change in interest rates. If both governments keep interest rates low, the pair’s price usually rises due to the trust of investors in Switzerland’s economy. Likewise, if Japan raises interest rates and Switzerland maintains them, the price may decrease.

Volatility in times of uncertainty

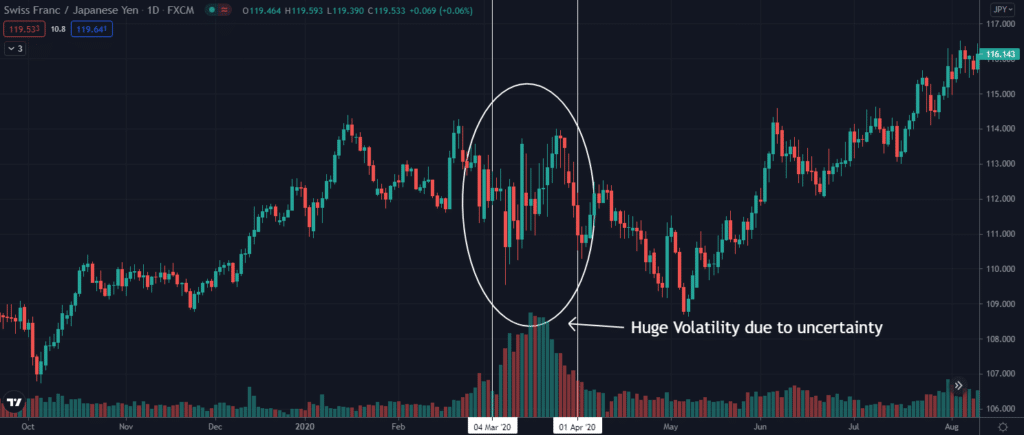

Although it is considered a safe haven pair, it can have moments of high volatility during periods of uncertainty in the world markets, complicating trading decisions.

During the beginning of the pandemic in 2020, there was a lot of uncertainty worldwide. Investors sought refuge in more stable currencies such as the Swiss franc, which caused the pair to rise from 110 to 114 in a few days. In the following chart, we can see how the price presented high volatility, evidenced by the increase in the volume bars.

Why did investors prefer to buy Swiss francs during the period of uncertainty? One of the main reasons is Switzerland’s geopolitical position.

The Japanese yen can be affected when there are problems in the Asian continent, such as diplomatic issues between China, South Korea, North Korea. On the other hand, Switzerland is a member of the European Free Trade Association, exporting to other nearby countries, making it one of the most important economies globally.

Another aspect to consider is natural disasters such as earthquakes in Japan, which in Switzerland is less likely to happen.

Economic data and policies

Data in Switzerland or Japan that concerns employment rates, inflation, Gross Domestic Product, exports, and trade deficits strongly impact CHFJPY.

The data can be obtained either from Forex news sites or directly from the websites of Central banks of the two countries.

Influence of Gold on the Swiss franc

Switzerland has the largest gold deposits globally, which makes it a crucial part of its economy, affecting the pair’s price. You will not find an exact correlation between the two, but if there is a significant percentage fall or rise in gold, the same will happen to the CHFJPY.

In the chart above, we can see how during June 2021, the price of gold was in a downtrend which then was followed by the currency pair.

Technical aspects

Keep in mind that this pair can be volatile at times but sometimes may lack liquidity, making it difficult to buy and sell due to thin liquidity, affecting all types of traders, especially intraday. However, when there is more volume, you will have no problem trading this pair.

What’s the best time to trade CHFJPY?

As we can see in the graph, the best time to trade this pair is between 02:00 – 12:00 UTC, when the London and New York markets are open simultaneously, making it the perfect time to take positions.

The volatility usually takes off during the sessions overlaps, so you should pay special attention to these time windows.

Best indicators and strategies to trade the CHFJPY

Depending on your trading style, you can have different strategies for this pair. However, we will show you two simple strategies.

Scalping

Trading at times of high volume is recommended for scalping. Time frames of 1, 5, and 15 minutes are ideal because they help you find good entry points in trends or divergences that originate in the day’s session.

The following chart shows an example of a short position after a range breakout. First, trading volume increases, then the range’s support gets broken, with the market initiating a downtrend.

Usually, the support turns into resistance, so taking a position on the rebound from the level is ideal.

Swing

Suppose you want to make longer-duration trades so that you don’t have to close trades on the same day. In that case, you should consider indicators such as the Moving Averages or the MACD, which are suitable for identifying trend-following setups.

In the example below, you can observe the strategy with the mentioned indicators using a four-hour time frame.

After the resistance breakout formed a few days ago, the MACD and the volume indicate the beginning of an uptrend. The exit points are offered by the bearish divergence.

Conclusion

The CHFJPY pair is an attractive instrument for intraday and swing traders due to the excellent movements that can be caught. High liquidity benefits short-term traders who base their trades on technical analysis.

Long-term investors should consider fundamental aspects such as news and economic indicators of both countries. Monetary policies tend to be very different due to geographical distance.

Combining the fundamental aspects with technical analysis through indicators will help to understand how to trade this currency pair in a profitable way. Remember to backtest your strategy and use proper risk management.

Leave a Reply