To see appreciable returns in Forex using smart trading methods is important. While some take the help of automated trading software systems, others use the signal services for their trading. And some go for the managed account services.

FX Deal Club is a managed account service that assures transparency and reliability to all its clients. Top security, convenient to use service, and a proven trading approach are the key features the system uses to lure its clients. In this review, we will analyze this system and provide our insight into the service’s reliability and transparency.

Detailed Forex Robot Review

FX Deal Club is run by a professional team of Forex traders with nearly two decades of experience in the field. The team uses a personal approach and continuously makes improvements to ensure client capital is protected to the maximum. However, the vendor does not reveal any further information about the team, their location, and other relevant details that will make them look reliable and transparent.

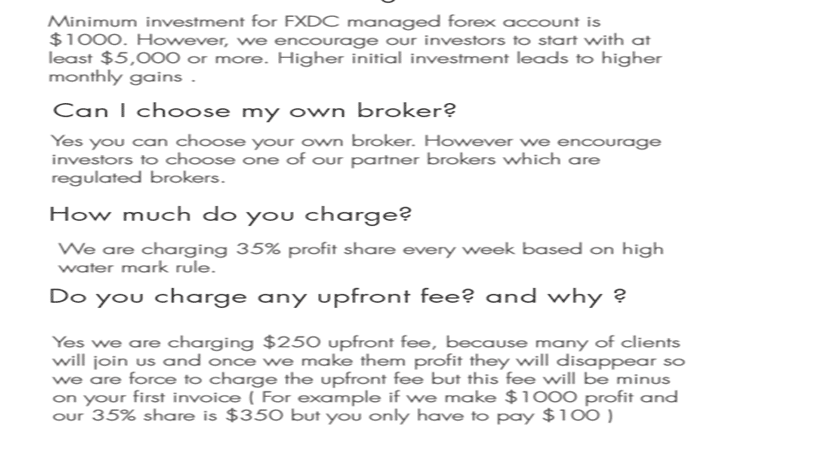

On the working mechanism, the vendor provides information about how to start using the managed account. Once you pay the required upfront fee of $250 and send your trading account information, the service will begin managing your account.

The service uses smart hedging options, a diversified trading approach, and a winning risk to reward ratio. According to the vendor, the minimum amount required for the trading is $1000 but the recommended amount is $5000.

As per the vendor information, the trading approach is based on daily trends and price action with detailed fundamental and technical analysis. The team monitors the financial markets and helps execute winning trades.

FX Deal Club Strategy Tests

No backtests are provided by the vendor on the official site. Despite claiming to be in the field for over two decades the lack of strategy test reports looks suspicious. Although backtests are not always predictive of future performance, they give a better perspective of the performance of the system.

Live Account Trading Results

The vendor provides trading results verified by the myfxbook site. But, the link is broken and we could not see the results. However, we found a real account managed by the service of which a screenshot is shown below:

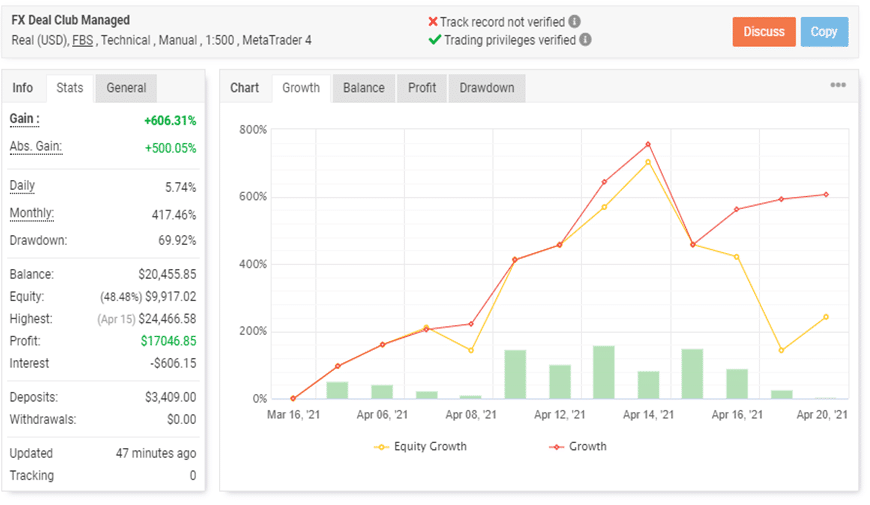

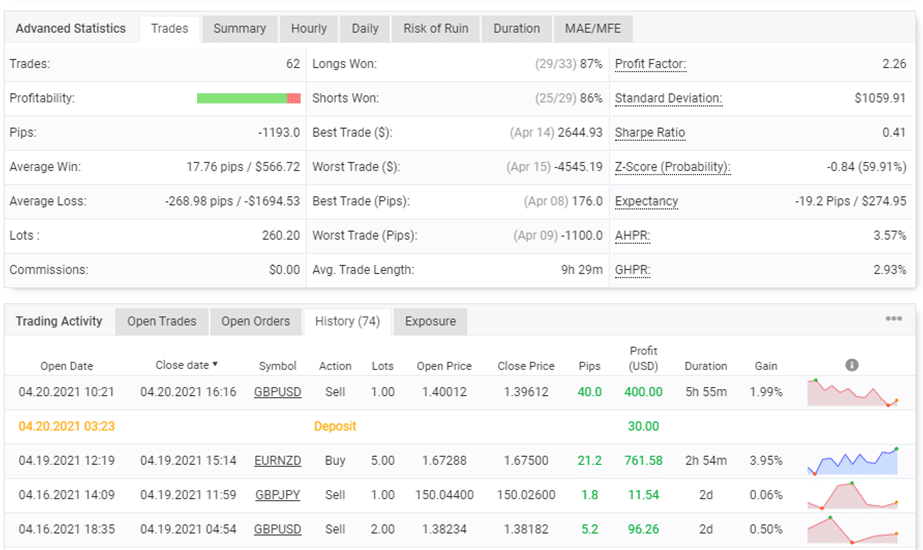

From the trading stats of the real USD account using FBS broker using manual trading with the leverage of 1:500, we could see a profit percentage of 606.31 and an absolute profit of 500.05%. The difference in the two values is puzzling. Further, the track record of the service is not verified by the site. Other trading stats include a daily profit of 5.74% and a monthly profit of 417.46%.

A drawdown of 69.92% is recorded. Such a high drawdown together with the big lot sizes in the trading history indicates the service uses a high-risk approach. The sample size is very small with the trading starting from March 2021 up to April 2021. The profit factor is high at 2.26 and the trades executed during four weeks are 62 in number.

Pricing

An upfront fee of $250 is charged by the service for managing a trading account. Further, if a profit is made the service takes a share of 35%. And, the vendor mentions using its own recommended brokers for better trading. The fees and share percentage look competitive although the system does not have a proper performance to prove its efficacy.

Customer Reviews

We found a few reviews for the service on the Forex Peace Army site. Here is a screenshot of the user reviews:

The reviews, all of them posted in the past 7 or 8 months, show that the service is capable of producing decent results.

Summing up our review of the FX Deal Club, we find the system shows potential with its positive user reviews and high profits as per the trading results. But, at the same time, the discrepancy in the total gain and absolute gain values, the high drawdown, and big lot sizes are factors that indicate the risk level is very high. Even with such a small duration of trading, the account has managed to register a drawdown of 62% which is not something many clients would be comfortable with.

Another factor we noted is the upfront fees and the 35% profit percentage. The price looks affordable when compared to other managed accounts that charge monthly rates. But, with a lack of vendor transparency and insufficient performance proof, the reliability of this system is not up to par. However, the service can look more reliable if it implements some changes. For starters, it can give ample proof of its performance and more transparency about the strategy used will also help.

From our analysis of FX Deal Club, we have found the following pros and cons:

Leave a Reply