Over the years, top financial institutions and hedge funds have developed various trading tools to get an edge in the markets. With specific indicators, expert advisors, and similar doses, it is now possible to achieve consistency quickly. Strategies that utilize these options are easy to understand and are a top choice for beginners looking to step into their industry. The best one is available in the market for up to $10,000 at the starting price. Our article will cover some of these essential tools available for free that any trader can utilize to help out in their trading.

What is FX Blue?

FX Blue has one of the top developers in the fintech industry that creates or develops quality software and services for all participants. The company also has an analysis side that offers up-to-date information on the market, helping traders in over 120 regions globally.

Services by FX Blue

Following services are available on the FX Blue platform.

Record tracking

It is possible to track your trading results from MetaTrader 4/5, Wanda, and cTrader by just entering your login id and an investor password. Having verified records can prove your worth amongst others and make you stand out in the crowd to collect funds for account management. You can see your statement, statistics, risk, and portfolio by logging in to your FX Blue account.

Trading simulator

Trading simulators are available in the market for a hefty price that many cannot afford. FX video helps out traders practice their strategy and risk management with its free simulation software. With the program, you can use multiple timeframes, smart lines, different types of orders, and many more. The interface is simple and ready to use as you only need to download and place it in the EA folder of your MetaTrader 4/5.

Mirror trading

Dedicated EAs help send and receive trades from one MetaTrader account to another. The version turn of the software offers improved copying speed, automatic detection and allows you to run multiple parallel actions. FX blue features include lot size adjustment, stop loss and take profit adjustment, symbol-specific copying, email alerts, reverse mode, and trading hours.

Market data

Under the market data section of the website, you have access to the following functionalities:

- Real-time charts. There are diverse customization opportunities under the chart section. There are over 100 technical indicators, 50 driving tools, and the ability to choose amongst Renko, Heikin Ashi, and Kagi charts. The quotes are updated regularly to match the interbank rates.

- Future events scanner. This tool does not relate to the futures markets. Instead, you can use it for scanning incoming opportunities in the forex. It serves as a leading indicator predicting new highs/lows, breakouts, and trending markets.

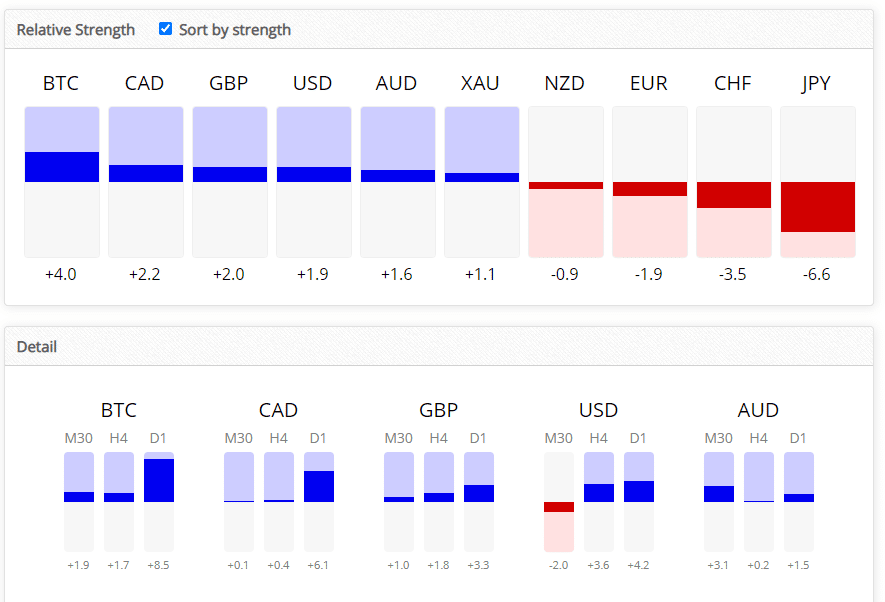

- Currency strength. As the name indicates, it allows you to see each currency’s relative strength over 30 minutes, 4 hours, and daily.

Image 1. The range of currencies under a lot of strength index.

- Technical analysis. Through this section, you can check out the relative history of any currency. Various tools such as moving averages oscillators and pivot points are there to watch for overbought and oversold conditions. You can also configure the videos of moving averages and oscillators. FX majors/minors, common metals, stock indices, commodities, and cryptocurrencies are available.

- Market overview. You can check out the price movement for the last 60 minutes, 24 hours, and five days. See if the currency has made some gains or losses while comparing them with the charts.

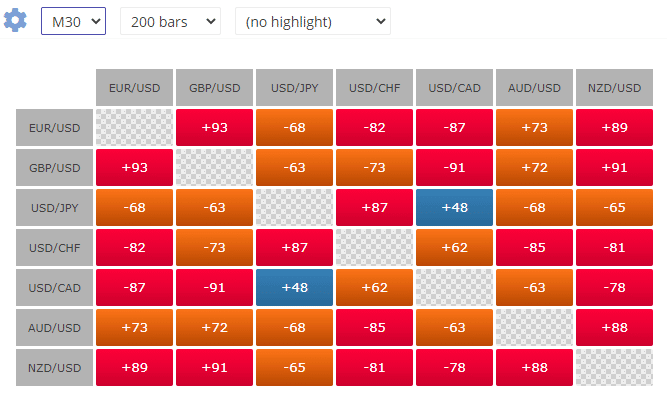

- Correlation matrix. As the name indicates, the feature enables you to identify pairs that move in confluence with one another. A value of +100 would mean that currencies have a high correlation, while -100 will state the opposite. It is also possible to tweak settings such as the time frame and the number of bars.

Image 2. The correlation amongst different currencies for the M30 time frame and 200 bars.

- Trading sentiment. This simple tool allows you to identify the market sentiment. Take a look at the red and blue percentages for determining bearish or bullish bias, respectively.

Other than the tools stated above, there are also currency heat maps to identify the biggest movers in the last 24 hours. You can filter specific currencies.

Maps are available for showing the active forex sessions according to your local time frame. You’ll be able to see the exchanges that are overlapping and the respective hours for which they are open.

Quote boards give updated information on the current price. Tons of different calculators are also available, including profit, SL, TP, position size, pivot point, Fibonacci, and currency converter. You can also use website widgets for accessing everything quickly.

A few different trading competitions are held here and there to keep traders motivated. The company handpicks several brokers and adds them to its list that compares each with another based on spreads, regulations, offers, blogs, etc.

End of the line

In the initial stages of trading, it is essential to use simple and user-friendly tools – and those offered by FX Blue are sure to meet the expectations of a new trader nearly. However, while gaining new knowledge and learning consistency, you will soon find yourself looking for more advanced tools to give you more data to build your strategy on.

While scammers flood the financial industry with their bogus get-rich-quick schemes, which novices readily give in, the platform we described has its own ways of adding fuel to the fire. Therefore, do not be tempted to use the tools on the website that were clearly made to motivate your active participation. Use them cautiously and only in a consistent combination with your strategy. And remember that learning as much as possible is your priority at the initial stages of your trading career.

Leave a Reply