Before we can define what a forward swap is, it’s important first of all to understand what a swap is in foreign exchange.

A foreign currency swap is a mutual accord between two entities concerning the exchange of legal tenders.

Swap agreements usually contain a swapping of capital and returns of payments on a loan created in a legal tender for capital and returns of payment of a loan of equal value in a different legal tender.

Therefore, a forward swap is a swap agreement in the future commencing at a specified date as contained in the agreement.

A forward swap has an accord that contains a swapping of principal and returns payments on a loan made in one legal tender for principal and returns payments of a loan of equal value in another legal tender.

Simply, a forward swap is a contractual obligation between two different entities: a trader and a bank or another party who can act as a loan provider. The agreement entails exchanging a pair of legal tenders at a set rate in the future and at a particular date.

Types of forwards

Let’s look at the two kinds of forward contracts.

- Outright forward

- Non-deliverable forwards

Outright Forward entails the actual exchange of legal tenders at a future date and at a specifically consented rate.

Non-deliverable forwards allow cushioning of the trader against currency price fluctuations where government directives limit foreign access to domestic currency. Consequently, covering risk without the physical exchange of funds.

How to use forward swap

The purpose of a forward swap is basically locking the exchange rate between two legal tenders in the future on a particular agreed date to minimize currency risk.

For example, a trader is contract bound to make payment of a consented amount for the ensuing shipment of goods in a foreign legal tender and wishes to lock in the rate.

Firstly, forward swaps can be used for purchasing less costly loans. This is usually through looking for the most preferred rate accessible in the market of any legal tender and then exchanging it back to the preferred legal tender with parallel loans at a future date.

Secondly, forward swaps are usually used as a cover in case of exchange rate fluctuation risks. Using forward swaps can help in reducing the risks occasioned by fluctuations of prices of legal tenders. These fluctuations normally affect the profits/costs extremely on the parts of the businesses exposed to foreign markets.

Finally, forward swaps are helpful as financial crisis defense tools by different countries. Forward swaps allow traders to have access to profits in the future by allowing other countries to appropriate their legal tender at that agreed time.

Forward swaps, essentially being hedging tools with no upfront payments, involve binding agreements that cannot be broken when one party stands to lose.

For example, John’s Machineries, an organization in the US, is selling 100 machines to an organization in France for 50 euro each. The exchange rate is 1.18 US dollars to 1 euro.

Therefore, John’s Machineries will be expecting to receive 5000 in euros and exchange it for 5,900 US dollars. But John’s Machineries are afraid that in the near future, the exchange rate can change from 1.05 US dollars to 1 euro before the sale of the machines.

Consequently, it would mean that they would only be getting 5,250 U.S. dollars, leading to John’s Machineries entering a forward swap contract with their bankers. Who would, in turn, offer a 6-month forward rate of 1.08 US dollars to the euro?

John’s Machineries will receive 5,000 euros as forecasted and give it to the bankers, who would exchange it for 5,400 US dollars, according to the stipulations of the contract.

John’s Machineries would be on the losing side if the exchange moved in favor of the U.S. dollar. Forward swap payments are made on cash or delivery grounds.

The agreements are over-the-counter instruments and do not trade on the forex market. Depending on one’s banker, they may require some deposit to hedge the risk in case of failure to deliver on the part of the retail investor when entering a forward swap.

Forward swap pricing

When dealing with the forward swaps, it is important to be aware of the calculations of future rates to be able to make informed decisions.

The pricing of the contract is known by these factors:

- Spot exchange price

- Interest rate gap between the two legal tenders

- The length of the contract agreed between the two entities

Therefore, to compute the forward rate, we use the spot rate (which is the current exchange rate in the market of the said currency one is trading in) multiplied by the ratio of interest rates and adjusted for the time taken until expiration.

Therefore, we can conclude that the forward rate is equal to the prevailing rate x (1 + national lending rate) / (1 + foreign lending rate).

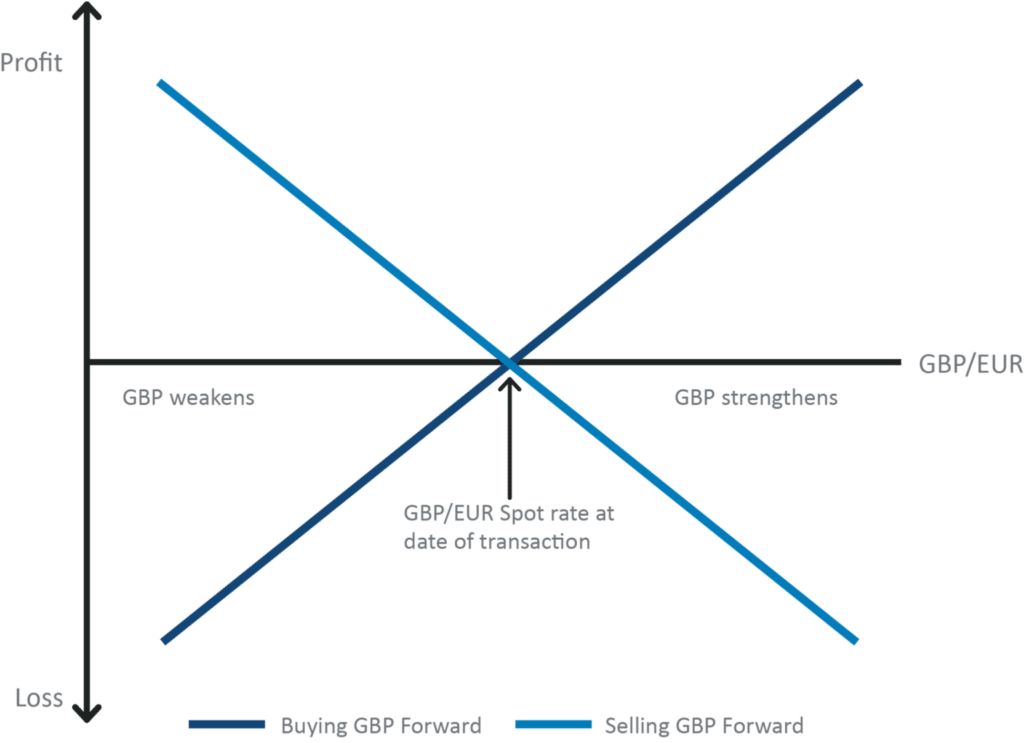

The chart above shows profit and loss changes of a GBP forward as the GBP becomes weak or strong.

For example, the U.S. dollar-to-the Canadian dollar exchange rate is $1.1365. The national lending rate or the US rate is 3%, and the foreign lending rate is 2.75%.

The result after feeding the figures in the equation is: forward rate = $1.1365 x (1.03 / 1.0275) = $1.1392. In this case, it indicates that the future price of the legal tender will be greater than the current price.

Conclusion

Forward swaps are good instruments for covering a trader’s foreign exchange risks. The risks are usually occasioned by currency prices moving up and down in a period.

Therefore, in such situations, forward swaps give certainty concerning future purchase costs. Finally, they can be made to suit the requirements of the buyer.

Leave a Reply