It’s important for a trader to examine, conduct research, and understand as many trading approaches as possible. This helps them in the adoption and incorporation of one that’s really suitable for their trading style. There are primarily seven setups that are extremely useful when it comes to technical analysis. No matter which trading approach one takes, a trader should always believe in the underlying logic of the strategy, make sure it fits their trading style, and make sure they recognize the patterns easily.

In the forex market, gaps occur mainly because trading usually occurs between set market hours. The interbank market in foreign exchange operates on a 24/7 basis while retail traders are active 24/5. Gaps might show up because of this particular time difference. In graphs, Gaps are the empty spaces between the closing of one candlestick and the opening of another. However, compared to stock markets, gaps in the forex market are usually uncommon. Most occur usually at the market open on Sundays, between a currency pair’s closing price on Friday and its opening price on Sunday.

The Sunday Gap is one of the most reliable patterns which traders use in the forex market. However, it is difficult to trade as well. The pattern forms when major news is broadcast over the weekend, with the market reopening on a new level on Sunday. Throughout the past 20 years, there have been numerous examples of Sunday gaps. These include the weekend of Saddam Hussein’s capture (bullish USD), the weekend where Greece voted against the bailout by the IMF ( bearish EUR) as well as the weekend when Turkey’s Erdogan made a declaration that financial markets are at war with his country( bearish TRY).

One of the most stunning features of Sunday Gaps is its ability to fully reverse within 48 hours. A study conducted in 2012 of 20 different Sunday Gaps revealed that about 85% of them which reversed to the prior Friday, closed within two days. After the market goes out of balance after getting overextended, it attempts to fund a new equilibrium in a thin market. Here there are only buyers and sellers, with nobody to take the other side. The resulting huge opening order imbalance forces the market to move more than normal. Liquidity returns to normal during the Asia session, and the overextension corrects substantially.

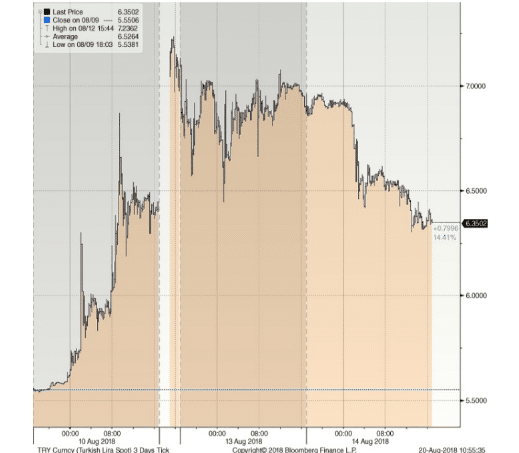

Turkish Lira Crisis 2018 – Example 1

In August 2018, Turkey’s massive corporate financing and current account deficits had Investors on the edge. The Central Bank was refused permission to raise interest rates by President Erdogan, which further escalated the situation. The market was expected to get better by Friday when President Erdogan was scheduled to speak on Saturday. Analysts and Investors all believed that he would make positive remarks in an effort to soothe nervous markets.

However, the opposite happened when with Erdogan’s fiery speech with anti US rhetoric. HE said that Turkey was in an “economic war” from which it wouldn’t back down.

The above graph shows what happened on Sunday. The USD/TRY, which closed on Friday at 6.40, opened at 7.10 (10% higher) on Sunday afternoon. The market then filled the gap, trading all the way back to 6.40 over the next 12 hours. The Sunday Gap hence reversed completely, even with the bullish USD/TRY news.

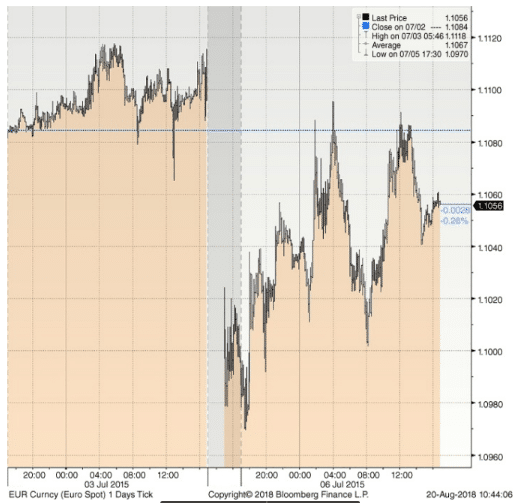

Greek Referendum 2015 – Example 2

Greek voters went to the polls in July 2015, to vote on whether to accept the bailout conditions which the ECB, IMF and European Commission Imposed. They voted a resounding no which was a negative outcome for the European Commission and the EUR.

The above graph shows how the EUR/USD opened on Sunday and is a classic Sunday Gap setup. On Friday, the market closed at 1.1084. It then gapped much lower on Sunday to open at 1.0970. This section is in gray in the above graph.

The EUR/USD probed to the downside for a second and last time to 1.0970, rallying back all the way to 1.1084 which was the Friday close. All of this occurred despite the unambiguously bad news.

Conclusion

Sunday Gaps are extremely difficult to trade and require the experience and knowledge of a skilled trader. This is because traders have to take the opposite side of any important news in order to fill the gap. The strategy is fairly simple though. Traders have to just take the other side of the gap in the opening trading hours. They can take whatever position size they feel comfortable with. They should install a stop loss one average daily range away and take profit when the gap is filled 90%. Trading the Sunday Gap is profitable precisely because it’s so difficult to trade

Leave a Reply