Technologies are increasingly taking over all the facets of life. The capital market is one sector that is increasingly benefiting from game-changing technologies that make it easy to detect opportunities and make informed investment decisions. The forex market has undergone an immense technological transformation as the need to be in sync while spending the least amount of time glued to the screen has given rise to robots.

Understanding forex robots

The robot is simply a system programmed using chart patterns and technical indicators. It is designed to analyze the market for potential opportunities and, in return, open and close trades on behalf of humans. Contrary to perception, they are not physical robots but computer programs that come up with pre-set rules that they use to execute different trading functions.

The fully automated systems avert the need of spending hours glued to the screen in pursuit of opportunities. Instead, they scan the market for opportunities that meet pre-set rules. In return, they can generate signals that detail the best time to open and close positions. The fact that they run 24/7 ensures users don’t miss out on opportunities that crop up from time to time.

How they work

Forex robots work by simply scanning the overall market. Upon scanning, such programs can recognize chart patterns such as breakouts, potential reversals, and momentum. In return, they are able to open trades in response to the underlying pattern.

For instance, if a market has moved up significantly and is overbought, the emergence of a double top would often imply that the market is about to reverse. In this case, the automated system would enter a short position, allowing one to profit as price reverses and starts to edge lower.

If the reversal does not happen and the price continues to move up, the robot would be able to exit the position by using a stop-loss order. In addition, they can lock in profit once the price moves lower as expected.

In this case, forex robots are simply automated trading systems that trade on behalf of humans while deploying all the necessary risk management strategies.

What to consider while selecting a forex robot

Forex trading robots are readily available online but at a fee, thus eliminating the need of having to come up with one from scratch. The readily available programs are especially perfect for anyone just getting started in the business of trading.

While one is always sure to be spoilt for choice on which robot to go with, it is important to note that some are effective in detecting and executing profitable trades while others struggle a lot. When selecting a robot, it is important to consider a number of factors.

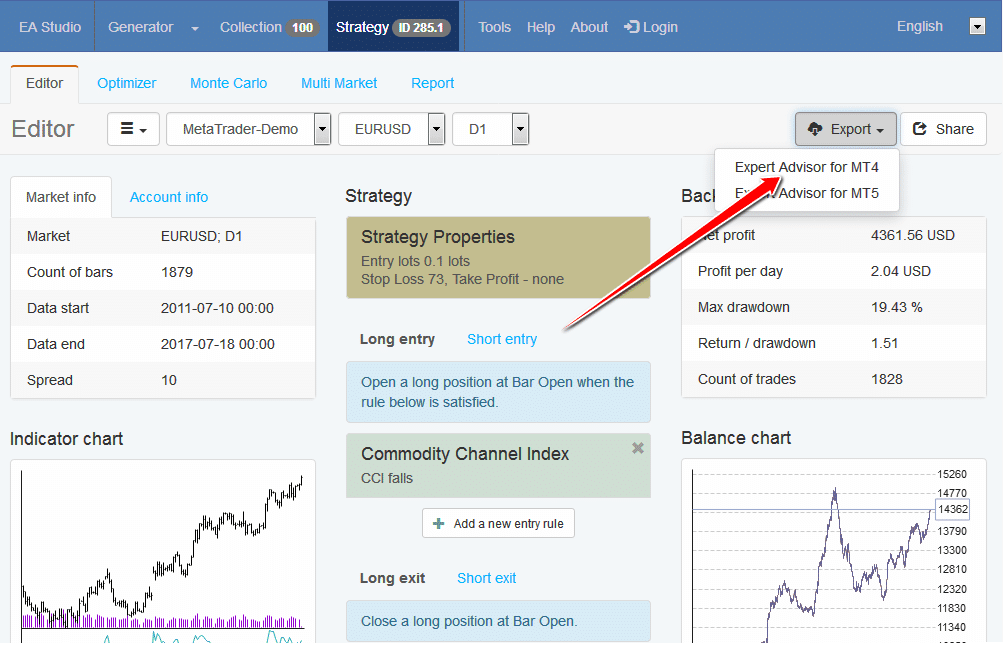

Backtesting: Before paying for such a service, it is important first to backtest the robot to ensure it does what it is marketed to do. The forex robot should be tested on a range of market conditions to ensure it generates desired outcomes.

Live trading: While selecting an option, it is important to settle on one based on results generated during live trading. This way, one is able to settle on an effective expert advisor that is not purely based on simulations.

Order size: Some robots come pre-set with particular order sizes. It is important to settle on one that allows one to tweak the order sizes as part of risk management.

Credibility: Online reviews would come in handy in ascertaining whether a marketed robot is effective and works as implied.

Developing a forex robot

While automated trading systems are readily available for purchase online, it is always smart to develop one from scratch. The MetaTrader trading platform has made it possible to come up with a robot based on the rules that one would wish to integrate into trading.

The MQL scripts on the trading platform allow one to integrate trading strategies while leveraging chart patterns and technical indicators. The system can then be backtested using historical data to get a feel of how it is likely to perform in live markets.

Coming up with a forex robot can entail setting the rules of detecting and trading breakouts on any currency pair. In this case, one can leverage Moving Averages to ascertain when to open a position as soon as the price breaks above or below a given level. In return, one can also determine the ideal points to set stop loss and profit take orders.

Why forex robots?

Automated trading systems stand out partly because they can carry out speedy analysis of an array of securities that normal humans would often struggle with. In this case, they allow people to detect opportunities once they crop out and profit from them.

The fact that they eliminate the psychological anguish that comes with trading manually makes them ideal for gaining an edge in the business. In this case, they can open and close positions based on pre-set rules. By averting emotional trading, they increase the prospects of one generating profits.

In addition, forex robots are ideal for backtesting strategies before deploying them in actual or live trading. By backtesting, one is able to get a feel risk-free of whether a strategy would work and the potential returns. It also becomes pretty easy to polish a strategy for better results.

The downside

While Forex robots have enhanced the art of trading significantly, they are not always 100% accurate. Due to fluctuations of fundamentals on currency pairs, constantly changing market conditions present a unique challenge.

The fact that market behavior is constantly changing makes it extremely difficult for robots to respond adequately and generate accurate signals most of the time. The fact that they come with pre-wired thinking makes it difficult for them to respond adequately to changing market conditions.

Additionally, there is always the concern that such automated tools can only generate profits over a short period. Their performance over the long term tends to subside owing to the ever-changing market conditions.

Leave a Reply