Countless brokers and third-party services offer various rebate programs, but are they worthwhile for traders? Receiving cashback from every position regardless of whether it wins or loses is a great incentive, and over time, little savings can accumulate into larger amounts over time. However, there are some key considerations to make before joining any rebate service.

Overview

Who wouldn’t want to receive cashback from each of their forex traders? A forex rebate program aims to achieve this purpose either directly from a broker or a third-party provider working with one. While the saving aspect is commendable, there are some things to consider over the worthwhileness of such programs in forex.

What is a forex rebate program?

Rebates in forex are like loyalty or cashback programs. Traders receive a small portion of the trades they execute through a broker as spendable funds. The more they trade, the greater the accumulation of the rebates.

Regardless of the trade outcome (whether win or loss), assuming they have met a few Ts & Cs, a trader is guaranteed to receive the rebate. Over the long haul, rebates can be a beneficial method to save tens to hundreds of dollars without changing any trading conditions.

How do traders sign up for a rebate program?

Ordinarily, IBs (introducing brokers) or affiliates earn commissions from the clients they’ve signed onto a broker. However, these IBs and affiliates are effectively third-party providers who will transfer most of those rebates to the traders.

There are plenty of forex rebate providers currently that traders can sign up to, such as PaybackFX, Cashback Forex, RebateKingFX, PipsbackFX, and so on. Usually, these providers may either require a new account linked through their affiliate link or an existing one.

Alternatively, traders could go straight to the source as some brokers provide rebates to their clients, although these may be lower than those from the providers. Therefore, one would need to confirm where they’re getting the most ‘bang for their buck.’

How much can traders save with rebates?

The earning potential varies greatly depending mainly on the frequency of trading and the rates which the brokers offer for every instrument. This part is the ‘meat’ of this article in discovering whether these programs are meaningful.

The trading frequency is the real determining factor, which varies widely from trader to trader. It’s a no-brainer an intraday trader naturally trades more often than a swing trader. Something else to consider is the account size.

Someone with a bigger account can accumulate the same number of rebates with fewer positions than a trader with a smaller account who executes frequently. The two hypothetical examples below aim to demonstrate how earnings can vary based on some of these factors.

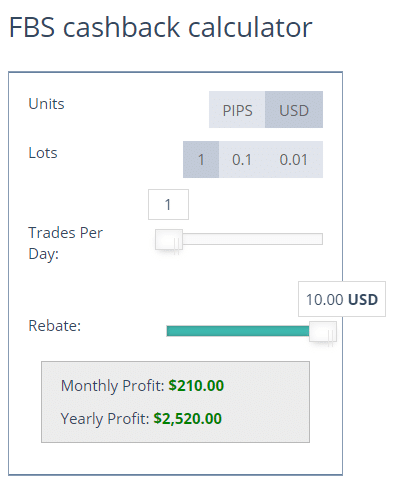

For consistency and ease of calculation, we will use the same rate of $10 per lot on EUR/USD from FBS through PaybackFX.

Example 1

In this scenario, if a trader opened one standard lot on EUR/USD every day, their monthly savings would be $210. One lot size on EUR/USD requires a 20-pip stop, equating to a risk of $200.

Let’s assume the trader is trading with a $10 000 account, meaning the $200 is a reasonable 2% of their total equity.

Let’s also assume they have a 50% winning rate. If opening one trade a day, that is 20 trades in a month. At $200 risk per position, losing half of these ($200 X 10) is $2,000. If their monthly savings are $210, this represents just over 10% of their losses, which is a noticeable difference by most people’s standards.

They can use these earnings as a re-investment into their account or use them for something else. This trade frequency is typical of the average intraday trader, and on many occasions, some may trade even more.

Example 2

Using another scenario of a lower-frequency trader, they may open one standard lot (also worth $200) a week on the same pair, which is four trades in a month. Assuming they have the same win rate of 50w in 30 days, they would have lost $400 ($200 X 2).

Though we cannot use the calculator like in the first example (we simply divide the $210 by five as the positions in this situation are five times less than 20), the total saving is $42, also representing about a 10% saving of their losses.

What not to do with rebates?

These examples above are purely hypothetical and do not represent typical scenarios. However, they demonstrate that a few aspects, mainly the actual rebate rate, the trade frequency, and the trade volume, affect the worthwhileness of joining a rebate program.

Another consideration is the pairs traded. Generally, providers will offer higher rebates for less-traded markets such as exotic pairs and precious metals like silver. Although there aren’t methods that can drastically improve earnings (aside from trading frequently), there are other things traders should keep in mind.

Churning

One approach traders shouldn’t attempt and which is generally prohibited is ‘churning.’ ‘Churning’ refers to purposefully opening and closing multiple positions for the accumulation of rebates. Besides, this technique wouldn’t be sustainable because there will almost always be a spread or commission associated with each position.

Not deviating from the trading plan

Traders shouldn’t deviate from their trading plans for the sake of earning rebates because, in truth, they are still minuscule and only count as small savings.

Spreads

While spreads and other trading conditions do not change whatsoever through a rebate program, it is something to consider if the rebate provider offers different rates on different accounts.

For example, if the broker offered three accounts and each had a rebate of $5, $10, and $15, respectively, the natural inclination for many would be to go for the $15 offer. However, in most cases, the $15 rebate may be on an account with higher spreads as the broker generally incentivizes this.

So a trader may be able to open a 0.1 position on the account offering $5 and $10 but can only do 0.07 on the $15 one to account for the higher spreads. While this difference seems minor, the profit potential between a 0.07 and 0.1 position is undoubtedly noticeable.

Conclusion

To conclude, rebate programs are beneficial for high-frequency traders or those who trade higher-than-average volumes as the accumulation of rebates is quicker and more noticeable. Ultimately, traders should not change their trading plan for the sake of rebates as they are only there to act as cashback rather than free profit.

Leave a Reply