We’ve got a middle of March 2021, but the presentation still has a number of gained pips in 2019, not in 2020. It’s not okay. The forward statement is that we can “Discover the possibilities of auto-trading on Forex.” The presentation informs us that there are (where?) backtest reports on the past 10-year tick data.

Detailed Forex Robot Review

The presentation lacks information about the strategies behind the system. Only trading results allow us to know that the system is a mix of Scalping, Grid, and Martingale strategies. It’s suspicious that the developer covers the risky strategies providing no info.

The presentation includes little lines about the system or explanations:

- Forex Ninja works on the terminal fully automatically for us.

- We can run it on the MetaTrader 4 platform.

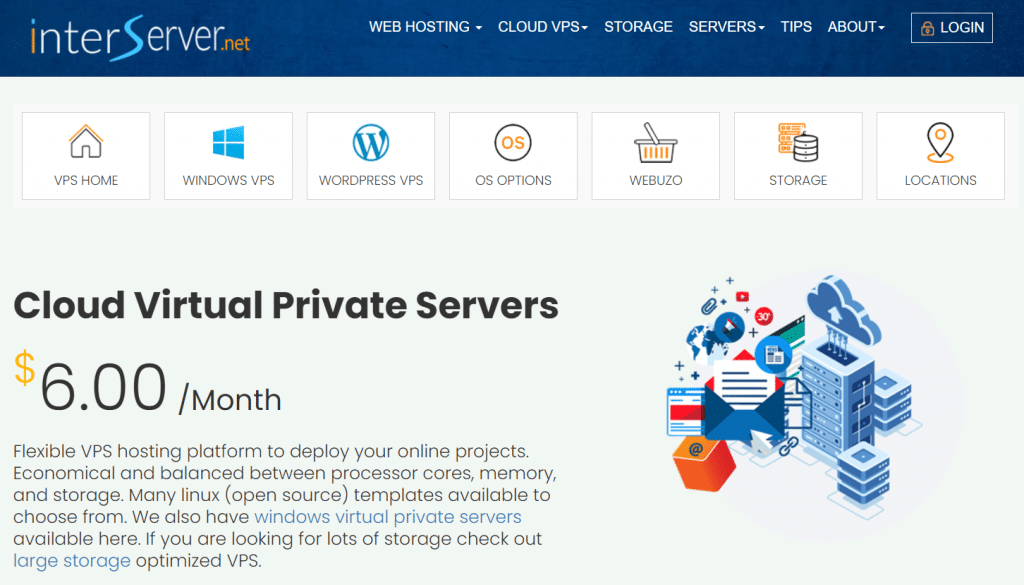

- The robot needs to be run on a VPS service to execute orders much quicker.

- ECN account is a fundamental requirement to be profitable.

- The robot runs Scalping, Grid, and Martingale strategies.

- We have no info from the presentation about them. Only trading results make it clear.

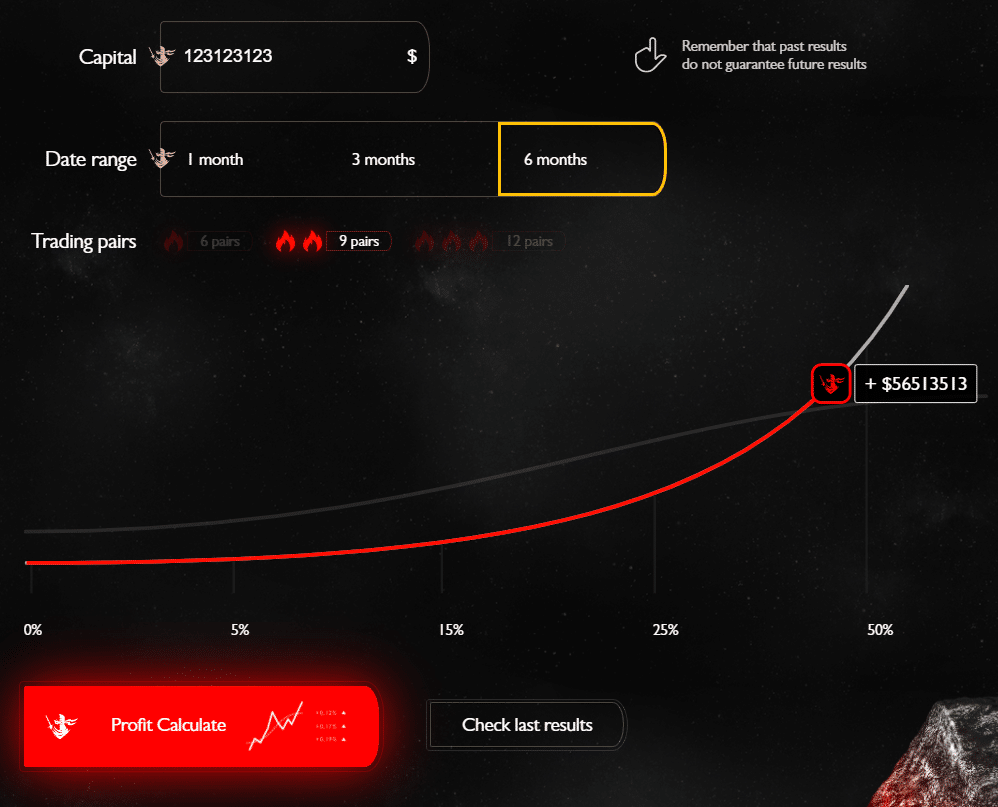

- There’s a profit calculator of the effectiveness of the trading capital with the default risks.

- We can customize Capital, Date Range, and trading pairs (6, 9, or 12).

- From the PDF user guide, we know that InterServer can be a good VPS provider.

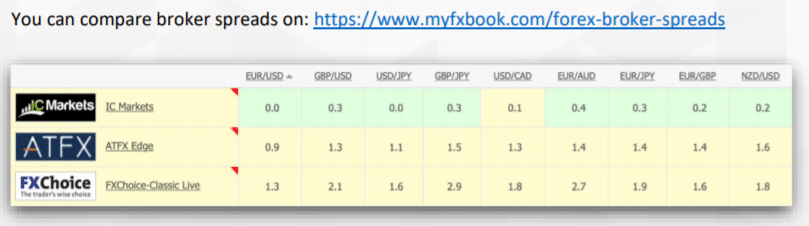

- The same intel we have about brokers and their spreads. We use IC Markets, FXOpen, and others for scalping, and high-execution requires trading.

Forex Ninja Strategy Tests

The presentation has no backtest reports. It’s a solid con because we can check how the robot surfed the past data: what win-rates we have to expect, what trade frequency, and so on.

Real Account Trading Results

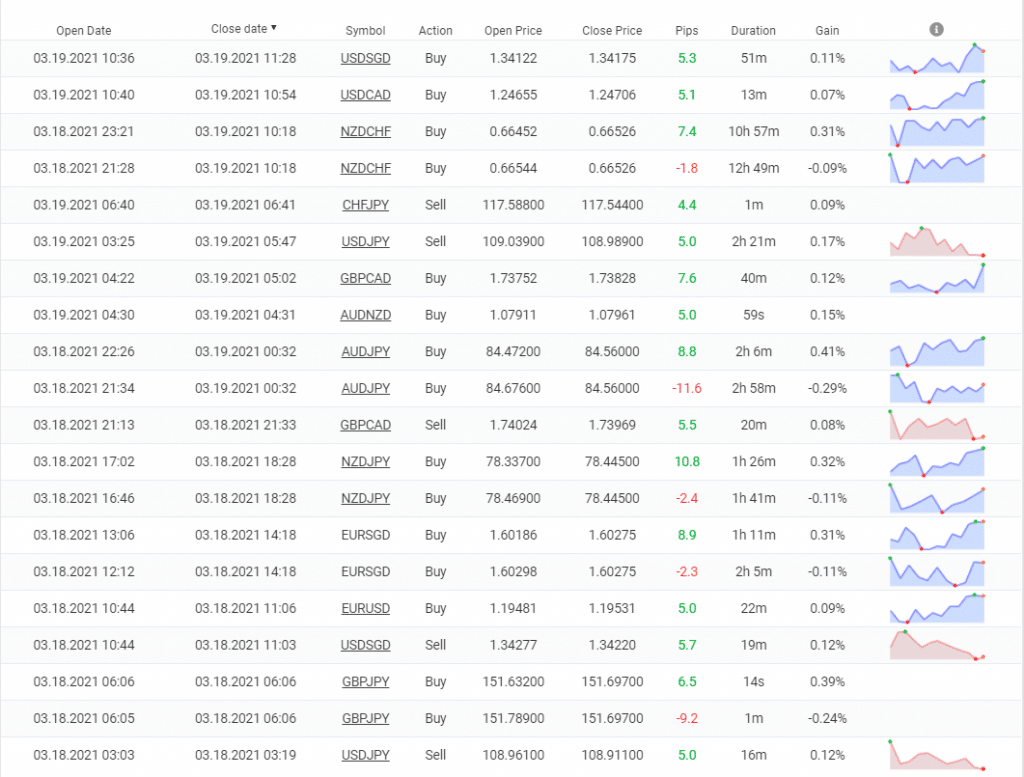

Forex Ninja works on the real EUR account on IC Markets automatically. The platform was chosen – MetaTrader 4. The leverage is 1:500. The account has a verified track record and verified trading privileges. The account was created on March 25, 2020. Since then, the absolute gain has become +211.06%. An average monthly gain is 9.93%. The maximum drawdown is 29.80%. Twenty-four traders track the account.

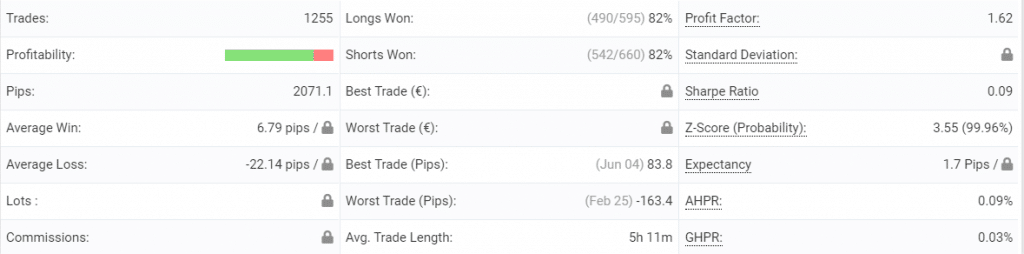

Forex Ninja has closed 1255 deals with 2071.1 pips. An average win is 6.79 pips when an average loss is -22.14 pips. The win-rate is 82% for Longs and Shorts. An average trade length is over five hours. The Profit Factor 1.62.

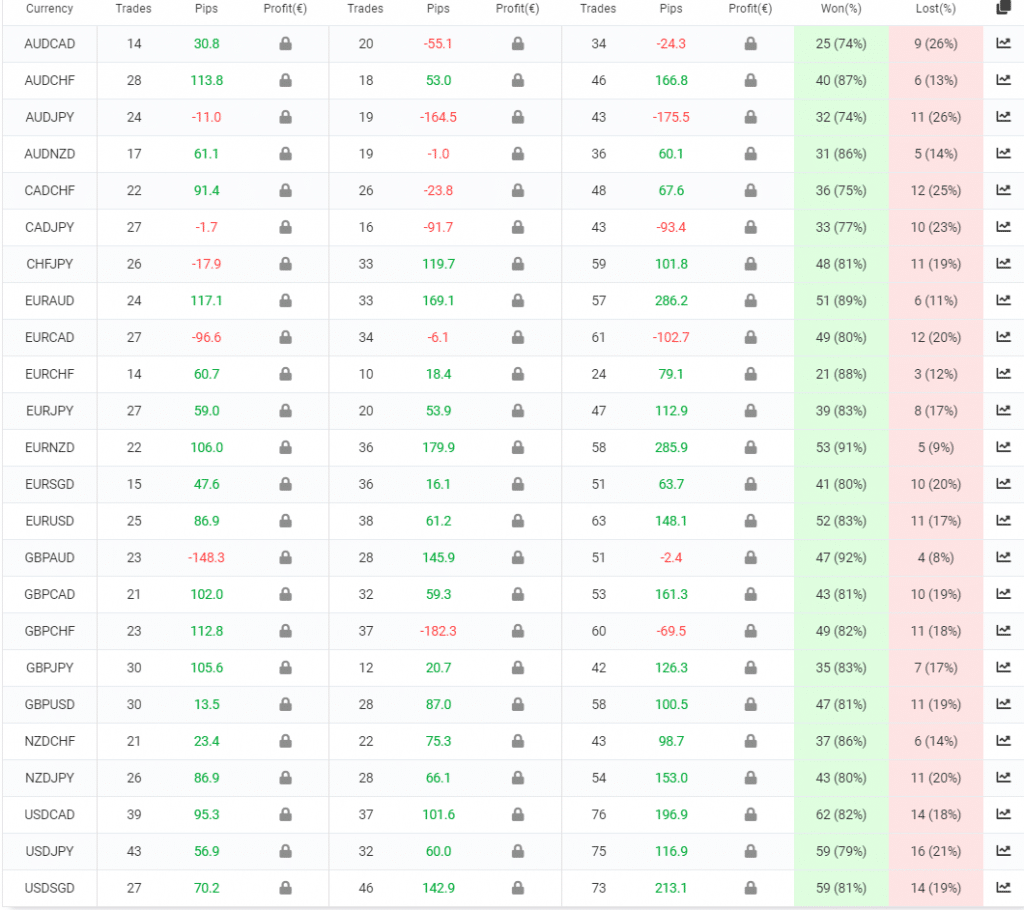

The system works with many symbols that are available on the terminal. EUR/AUD is the most profitable symbol – 286.2 pips.

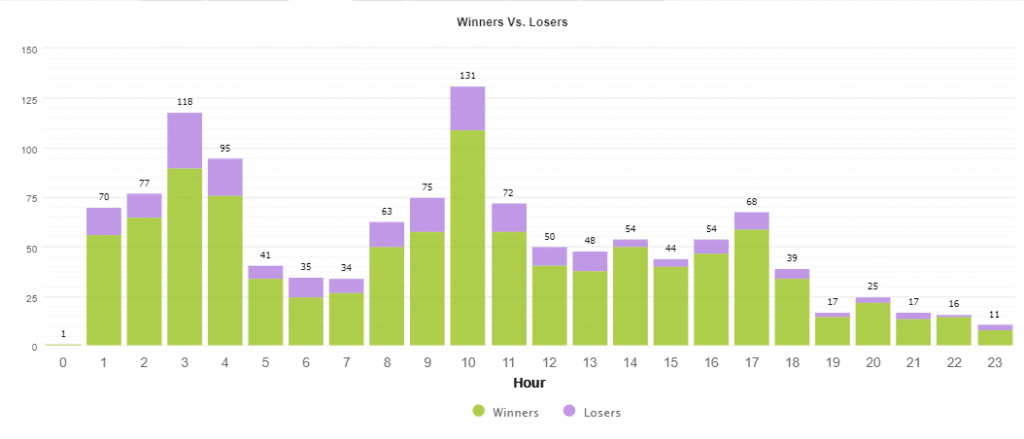

The robot works all day, focusing on trading during Australian, Asian, and European trading sessions.

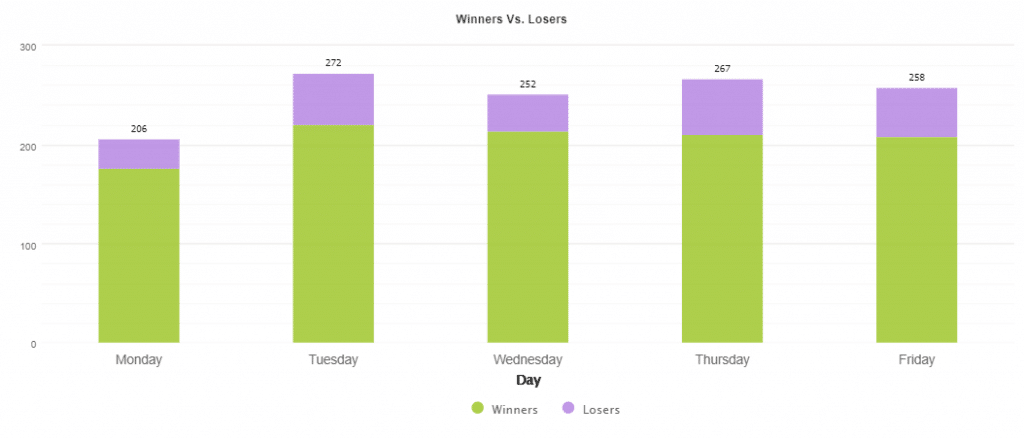

The most-traded days are Tuesday (272 deals) and Thursday (267 deals).

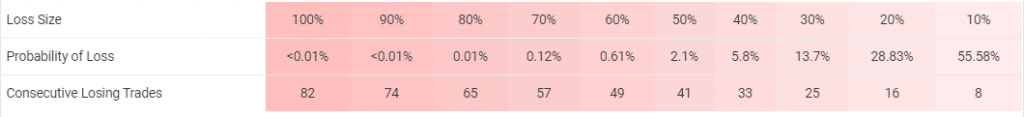

The robot works with medium risks to the account balance.

The robot uses a Grid of two orders. There were Lot Sizes, but this info was removed because people could see Martingale on the board.

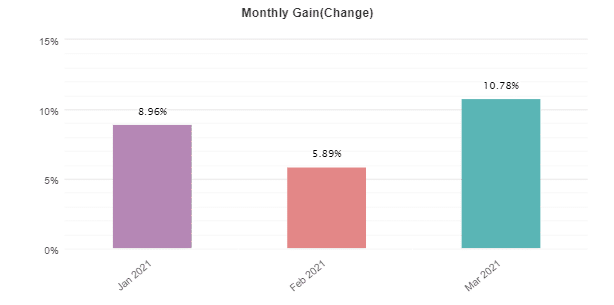

Several weeks of March are twice more profitable than the trading results of February 2021.

Pricing

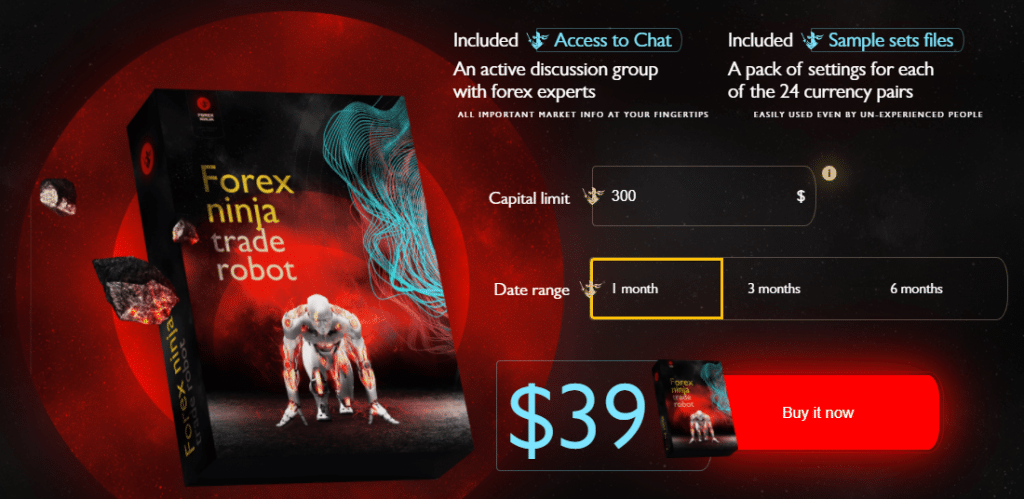

The offer is flexible and starts from $39 monthly for small accounts.

The accounts with significant capital have to pay $4050 for six months, $2138 for three months, $750 for a month.

Customer Reviews

The company has created a page on Forex Peace Army. There’s a single review on the board.

This positive review was received from a faceless person.

The Forex Ninja has a poor presentation without information that provides no clear vision about what we are looking at.

Trading results showed that there are many risky strategies on the board like scalping, grid, and Martingale.

The developer hides this intel from clients. The pricing starts from a few, but for a big account paying $4050 for half a year is overkill.

Leave a Reply