Taking a look at the participants and understanding the microstructure of forex markets is very important for investors and traders. Having an idea about the different counterparts in the forex market is as important as learning about the similarities and differences between different fiat currencies. The various players include entities such as banks, hedge funds, corporations and hedgers, retail traders, and others.

Table of Contents

The Banks

The majority of trades taking place in the foreign exchange market are either initiated or facilitated by a bank, making bank trading floors, the epicenter of the foreign exchange. Besides, commercial banks that dominate the market, investment banks play an essential role as well. Price discovery happens in the interbank market, where different banks can trade with each other. Traders become market makers at banks and take a substantial amount of directional risk when they anticipate client flow.

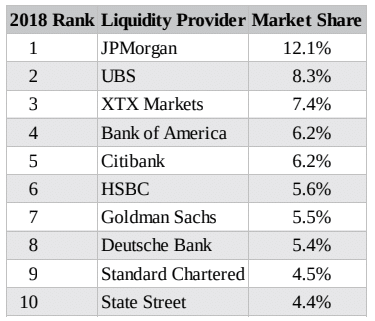

The top 10 liquidity providers in the FX market by market share as of 2018 include:

Central Banks

Central Banks are vital players in the foreign exchange market. Their forex operations are mainly through four separate reasons.

Forex intervention: This is an uncommon scenario in which the central bank directly intervenes in the FX market, buying and selling currency aggressively. When they believe that the particular currency is misaligned, the FX moves conflict with the country’s monetary policies, or when volatility is high.

Moral suasion: Central banks can intimate their preferences to the market and attempt to influence currency rates. Their ability to influence the market depends on the strength of the central bank as well as its credibility and independence. They often achieve their goals by only “talking up or down” its currency, without modifying its existing monetary policy or touching the forex market.

Central bank policy: The monetary policy of the central bank is one of the major drivers of FX rates. A country’s currency can appreciate when interest rates are high and rising, which attracts more capital. On the other hand, low and falling interest rates have the opposite effect, which decreases a currency’s value.

Diversification: Many countries possess massive foreign currency reserves as a tool for protecting against any future economic crisis, or maintain their owаn currency level. In order to diversify risk and capitalize on future interest rates and currency moves, countries can buy and sell various currencies on the open market.

Hedge Funds

Hedge funds refer to pools of investor capital that are formed for trading various asset classes in the hope of speculative profits. Hedge funds are important participants in the foreign exchange market because of their size, with some hedge funds managing over $10 Billion worth of capital. They value the abundance of transparency and liquidity in the forex market. The different types of hedge funds that participate in the FX market are as follows.

Commodity Trading Advisors(CTAs), model, and systematic funds:

These groups of hedge funds base their trading and capital allocation on pattern recognition, computer programs, algorithms, or by following correlation trends. Trend following models was popular from the 1980s up until the late 1990s. However, more sophisticated models have emerged, gradually replacing them.

Discretionary/macro funds:

These funds try forecasting trends and movements in the FX market with the help of various macros variables and analysis. Despite the name “macro”, macro funds have different time horizons with many funds trading on a very short time horizon. Those short-term hedge funds possessing a macro approach are referred to as “fast money”.

Corporations and Hedgers

This group sells and buys currencies daily. Corporations have many reasons to transact in foreign exchange. One of the simplest examples would be to compare them with exporters who sell goods to foreign buyers.

For instance, when a Japanese car-maker sells cars worth $ 6 Billion to America, they would receive a big chunk of dollars as revenue. However, it runs a balance sheet, paying many of its shareholders and employees in JPY. As a result, it would need to sell dollars and purchase JPY at some point. They would then call banks regularly to sell the USD as its USD balance grows. There are various types of corporate transactions happening in the FX market daily due to the FX conversion needs of global corporations.

Retail traders:

Retail traders include both speculators and day traders who mainly trade from their smartphones or home. In the last ten years, foreign exchange day trading has become increasingly popular with the growth of retail FX platforms, overtaking equity day trading in the process.

In Japan, retail trading is especially prevalent, with over 1,000,000 active trading accounts. The US has far less, with just over 150,000. A high percentage of Japanese retail traders are women, who use it to enhance the yield on their pool of savings.

Real Money:

Real Money refers to groups of investors who trade foreign exchange against any underlying asset. For instance, a US-based bond fund decides to purchase Greek bonds worth EUR 2 Billion. They need Euros to pay for the bonds but have their cash balances in USD. The real money client can then call a bank and purchase 2 Billion Euros to sell it in USD. Real money groups include pension funds, mutual funds, equity hedgers, insurance companies, and bond funds.

Being aware of all the different groups of players in the foreign exchange market is extremely useful for traders, investors, and analysts alike.

Leave a Reply