- US dollar on the front foot ahead of GDP.

- GBPUSD retreats from one-month highs.

- USDJPY upward momentum gathers steam.

The US dollar remains on the front foot after two days of gains against the majors. The dollar strength remains well supported by rising treasury yields ahead of the release of key economic data and next week’s pivotal Federal Reserve meeting.

The dollar index, which measures the greenback strength against the majors, has already bounced off one month’s lows to highs of 93.882. A rally past the 94.00 would affirm the dollar strength after it came under pressure last week on Federal Reserve chairman Jerome Powell reiterating it is not yet time to start raising interest rates.

In the absence of a charter from the central bank, the focus this week is on economic releases with Q3 GDP data on Thursday crucial to ascertain the health of the US economy.

BOE rate hike talks

A resilient British pound amid positive headlines surrounding the coronavirus situation in the UK has helped curtail losses on the GBPUSD pair. Infection rates have dropped significantly, raising hopes of the UK easing restrictions and fully opening the economy.

Additionally, the market has started pricing in the prospects of the Bank of England hiking interest rates before the end of the year in a bid to control runaway inflation. The charter has helped fuel pound strength pushing the GBPUSD above the 1.3800 level.

Pound weakness triggers

However, the pound has been unable to fend off a resurgent dollar as a spike in inflation in the US continues to prop the greenback amid expectation that the FED will embark on asset tapering at its next meeting scheduled for next month.

Additionally, the pound strength has been weighed heavily in recent days by the unending BREXIT stalemate. Reports that Britain could take unilateral action if a solution is not achieved soon have all but triggered weakness in the pound, sending the GBPUSD lower.

The prospects of deteriorating relations between the EU and the UK intensifying in the next few weeks should continue to weigh heavily on the pound, thus curtailing any upswing on the GBPUSD pair.

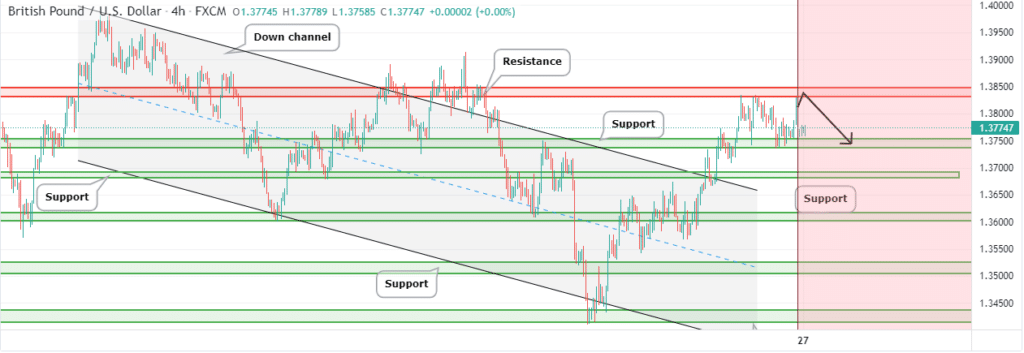

GBPUSD technical analysis

Amid the renewed dollar strength, the British pound has emerged as one of the biggest casualties among the majors, its impressive run in recent days having stalled. GBPUSD has since pulled back from one-month highs of 1.3836, tanking below the 1.3800 amid the surging bearish pressure.

The pair has been oscillating between 1.3737 and 1.3809, which has emerged as a crucial resistance level. With bulls under immense pressure, a sell-off followed by a close below the 1.3730 could trigger an increased sell-off that could see the pair tanking even further.

On the flip side, bulls fuelling rally past the 1.3809 should reignite the upward momentum that could see the pair bouncing back to two-month highs above the 1.3836 level.

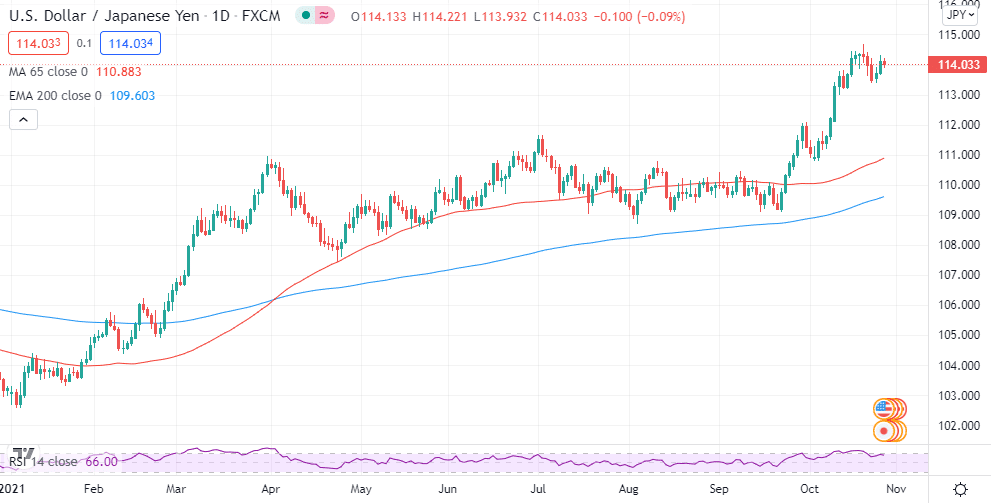

USDJPY at 114.00

Meanwhile, the Japanese yen remains under pressure against the US dollar amid rising yield and concerns about Japan’s economy. USDJPY is closing in on three-year highs on the pair powering to above the 114.00 level.

The rally in the USDJPY has come at the backdrop of US treasury yields rising to four-month highs, consequently fuelling dollar strength. The Japanese yen has continued to lose ground against the greenback on the Bank of Japan, indicating it will maintain its masses stimulus program.

In contrast, the Federal Reserve is on course to start asset tapering with plans to begin interest rate hikes starting next year. With BOJ lagging behind on asset tapering and interest rate hikes, the yen looks set to remain under pressure against the majors, which could see the USDJPY continuing to edge higher.

Leave a Reply