Pros and cons of technical analysis

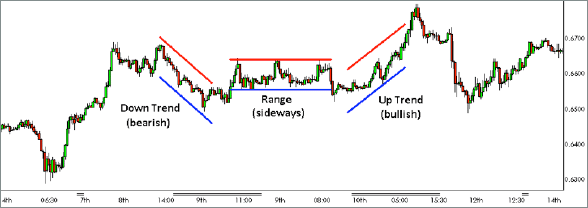

One of the biggest arguments to illustrate the cons of technical analysis is the widely-held belief of being a lagging indicator. The information traders get from this form of studying the markets is thought to be ‘after the fact.’ Technical analysis uses the premise that markets repeatedly move in a wide plethora of patterns. Because said patterns have happened in the past, they will happen again in the future.

The majority of technical enthusiasts, especially more short-term traders, do not need to understand why price moved a particular manner. Indeed, technical analysis is an excellent visual reflection of market participants and what they’re likely to do next. Technical analysis is only ineffective where the trader feels they need a deeper understanding of why certain movements happened. However, technical analysis is still critical because traders need it to enter a position at the right moment. In most cases, there can never be one definitive reason why a market moved a certain way. Thus, any type of analysis has very little to no objectivity to it.

Pros and cons of fundamental analysis

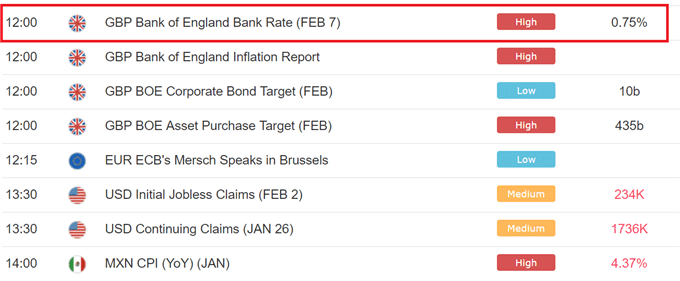

The main thing that fundamental analysis helps traders with is creating a long-term bias about a particular market and increasing global market knowledge. Some fundamentals, such as interest rates, are thought to be leading indicators due to the acceptance that they are catalysts for price. Some argue that fundamentals are better predictors of the future than technical analysis, though this has never been undoubtedly proven because it’s still a subjective thought process. Fundamentals can also help with just knowing the day-to-day news releases that usually affect the markets, which is the point of an economic calendar.

The limitations of fundamental analysis lie in the number of available fundamentals, all of which have some significance in the markets. Studying fundamentals is just as complicated and time-consuming, if not more, as technical analysis. Indicators such as interest rates, employment figures, GDP, retail sales, industrial production, CPI, PPI, and inflation can all influence the forex market. Though traders can get boggled with information overload, making it difficult to formulate a trade idea confidently. The challenge is in identifying which of these fundamentals is most crucial for a trader and sticking with that.

What’s also rarely talked about is that fundamental analysis is better suited for really long-term traders such as swing and position size traders. The reason is simply that to see the real impact of a specific fundamental indicator takes weeks or even months. The nature of the markets is prolonged – big moves don’t happen quickly. Many a time, some of these indicators do not immediately affect the markets upon release. Only these types of traders can have the mental fortitude to see that far ahead into the future despite the fundamentals not exhibiting any real influence in the now.

For other traders with shorter outlooks, fundamentals offer little benefit, unless for news traders. Though again, even with traders that trade news also run into problems, leading to the reason why they have to exercise extreme caution. There is a phenomenon in Wall Street known as “buy the rumor, sell the fact.” This adage implies that markets can sometimes move based on their participants’ expectations rather than current news events and economic data.

Many news traders look for noticeable differences between the previous and the actual figures of a particular news release. For example, if the US’s expected NFP figure was forecasted at 200K when it was previously at 220K, but it turns out to be 180K, the US markets may move counter to the negative news. In this case, the markets would have moved based on the expected figure rather than the one which came out. Of course, it’s not always the case, though fundamental analysis is not truly objective.

Alternative forex trading approaches

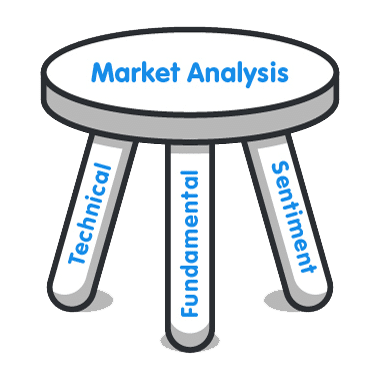

Technical and fundamental analysis are the primary schools of thought in the forex market. A few other lesser-known methodologies are used by a minority of traders, such as sentiment and quantitative analysis, which can provide an edge not found in the primary methods. Like fundamental analysis, these strands of study are more beneficial for position size traders who typically hold positions for a very long time.

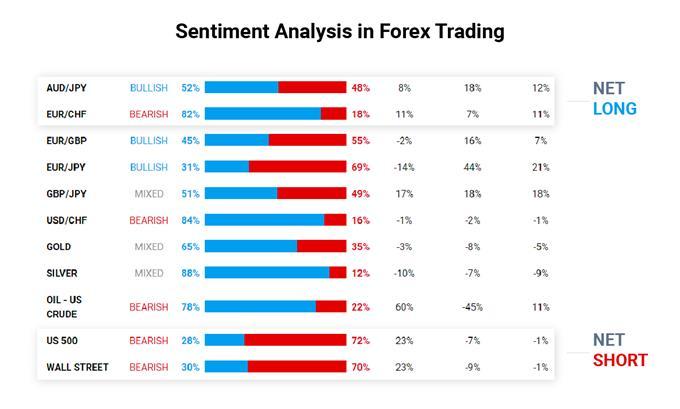

Sentiment analysis is a trading style that seeks to identify the number of traders’ positions that are long or short in a market. This study is referred to as market sentiment as it relates to gauging the sentiment of the most prominent players in the markets. Fortunately, this information is available in one way through what is known as the Commitment of Traders report.

The Commodity Futures Trading Commission (CFTC) provides this report, which gives insights into the net short and net long positions of futures traders across the spectrum. These participants mainly consist of commercial and non-commercial traders. Sentiment supporters believe that this report does have a considerable impact that filters through to the forex markets.

Quantitative analysis is a lot more complex than any other type of analysis because it requires very mathematical and statistical examinations. With this framework, analysts attempt to predict the markets through techniques ranging from statistical modeling to numerical variables related to a currency. One could say this type of analysis has some similarities with fundamental analysis since it touches on economics (and economics involves mathematics). However, the difference is that this type of analysis is more advanced and, again, more beneficial for long-term traders.

Conclusion

No analysis strategy is necessarily more superior than the other because all are subjective to a large extent. What works for one isn’t always going to work for someone else. Each type of analysis should complement a trader’s style and goals in the markets, and each type should be robust and straightforward to execute.

Leave a Reply