The forex market is subject to several adverse events that often affect trader’s sentiments, conversely fuelling wild swings. Traders deploy some strategies to protect themselves against adverse events. The ‘Sure Fire’ hedging has found increased use as a risk mitigation play in times of adverse events in the trillion-dollar market.

What Is Hedging?

Forex hedging entails traders opening additional positions to protect open positions against adverse events that might affect portfolio performance. Additional positions allow traders to offset or balance current positions, therefore reducing the risk of exposure.

Traders engage in hedging whenever an upcoming event or news is likely to trigger extreme volatility, resulting in significant losses. By hedging, a trader can mitigate a loss or limit it to a known level. Hedging sees traders opening positions that are opposite of underlying positions.

For instance, if a trader is long EUR/USD, they could enter a short position if they feel an upcoming news event would trigger wild swings resulting in the price moving lower. By opening a short position, the net profit from the two positions, long and short on the same currency pair, would be zero as the two trades cancel out.

The opening of an opposite position on the same currency pair allows traders to keep the original positions on the market. Likewise, opening a second position will enable traders to open a second trade and make money with the new position as the market moves against the first position.

It is important to note that some forex brokers don’t allow traders to engage in hedging in trading platforms. In most cases, the opening of new positions on the same currency pay often results in a net of the two positions.

How Sure Fire Strategy Works

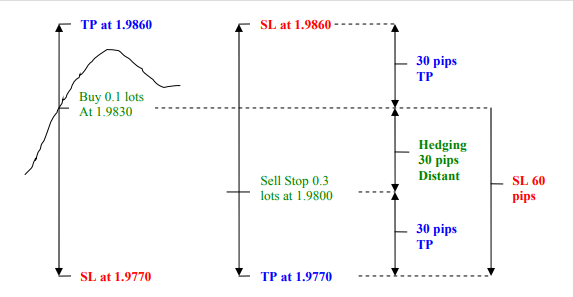

Consider a currency pair trading at about 1.9830. A trader can enter a long position sized at 0.1 lots at 1.9830, and the take profit would be set at 1.9860, setting the stage for a 30 pip profit on price rallying. Likewise, the stop-loss order would be set at 1.9770 60 pips away from the buy entry point.

Concerned by the potential impact of an upcoming adverse event, one could enter a sell stop order at 1.9800 sized at 0.3 lots twice the previous long position for hedging purposes. The short position would protect the initial long position against the adverse event, causing the price to move lower significantly.

The take profit order for the short position entered would be set at a 1.9770, setting the stage for a 30 pips profit on price moving lower. The short position’s stop loss would be set at 1.9860 for 30 pip loss on price reversing and moving higher. The second short position, which acts as a hedge, is placed 30 pips away from the initial long position.

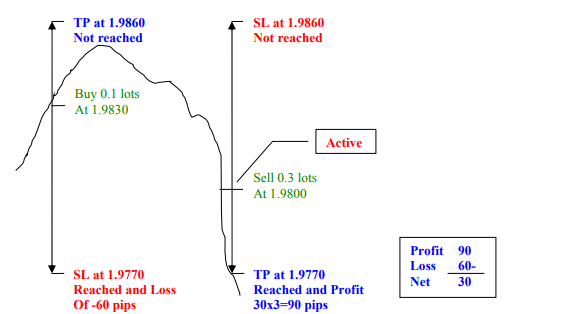

In case the market reverses from the initial long position and edges lower, the sell order would be filled at 1.9800. Similarly, the trader would stand a chance of generating 30 pips, in profit, on the market edging lower to the take profit point at 1.9770.

While the first buy position would end up closing at a net loss of 60 pips, the second sell stop order would close at a profit of 90 pips given the 0.3 lot size entered compared to 0.1 lots for the long position. Similarly, a trader would end up with a net profit of 30 pips upon the market edging lower.

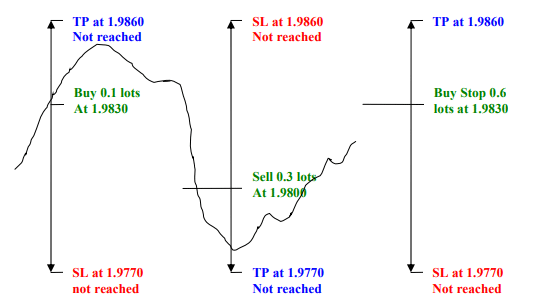

Price Reversal

The price edging lower and triggering the 1.9800 level might reverse before hitting the TP at 1.9700, resulting in two orders: the buy order at 1.9830 and sell stop order at 1.9800. If the price were to reverse and start moving higher, a trader would have to enter a buy stop at 1.9830 in anticipation of price edging higher. The new buy stop order would have to be sized at 0.6 lots, twice the short position, as shown below.

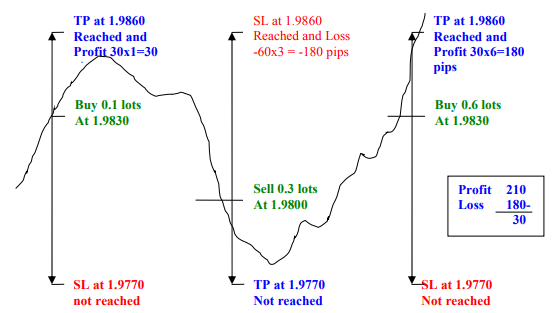

As price moves up, the new 0.6 lot buy order would hedge against the second 0.3 sell stop order. The trade would be left to run until the 1.9860 take profit level is filled. Given the 0.6 lot size entered in the second buy stop order, a trader would end up making a profit of 180 pip profits, adding the initial buy order 30 pips profit, the net profit on the two buy positions would be 210 pips. Subtracting a net loss of 180 pip loss on the sell stop order, a trader would end up with a cool 30 pips profit.

SureFire hedging Trading requirements

The SureFire is most effective when

- There is no spread on the currency pair under consideration

- An opposite position is taken to hedge against the previous position

- The lot size of each new position opened is twice the previous position. For instance, the first order could be sized at 0.1, the first hedge at 0.3, and the third hedge at 0.6.

Bottom Line

The SureFire Hedging strategy is an ideal way of protecting an open position against an upcoming adverse event. The hedging strategy entails taking a position in the opposite direction twice the previous position’s size.

While an effective strategy of protecting oneself against an adverse event, the strategy should only be deployed by people who have in-depth knowledge of the financial market. The taking of additional risk that is twice the previous market odder’s size could pose significant challenges should the market remain erratic. While anybody can engage in hedging, it is essential to take into consideration the risks involved

Leave a Reply