The Basics of Forex Correlation

One of the distinguishing traits of the forex market is that instruments are expressed as pairs instead of single entities. When you’re buying a currency, you are also indirectly selling another currency in the pair – and vice versa. In buying a currency, it has the potential to gain strength, while the opposite currency can potentially lose strength. Essentially, this is where correlations come in.

The dictionary definition of correlation, which is “a mutual relationship or connection between two or more things.”, very similarly applies to the world of forex. A currency correlation is the extent to which the movement of price within one instrument or pair influences another instrument or pair.

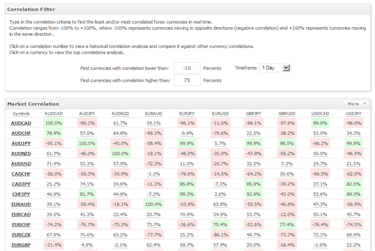

This relationship can either be a positive correlation (pairs moving in the same direction) or a negative correlation (pairs moving in the opposite direction). These values are reflected as percentages or coefficients, ranging from -1 to +1. If we assume that two pairs, like EUR/CAD and GBP/CAD, are positively correlated, we can indicate this value as +1. Alternatively, using a percentage will indicate this value more specifically. From then on, we can compare these percentages against other pairs across different time-frames by utilizing a forex correlation table like this one below:

How Forex Correlations Knowledge improves your technical analysis

Observing the strength or weakness of one particular currency through correlations can help with the following:

- To gauge potential price movements: If we understand, for example, that EUR/AUD and EUR/NZD (as they are paired with currencies from Australia) have a strong positive correlation, we can anticipate where either could go by observing what is happening on one of the pairs. We could look at specific patterns, market structure, fundamental data, among other things. These factors could either increase or decrease confidence over a trade idea as time goes when we continually mirror the two.

- Help to minimize risk or hedge: As an example, if we were to go long on AUD/USD, a method of potentially hedging the risk of this trade would be to go short on a pair such as GBP/USD. The logic here would be that should the AUD/USD idea become invalid, that may instead signal USD strength. By selling GBP/USD, we would be capitalizing on this strength. However, this idea only scratches the surface because it wouldn’t necessarily mean that GBP/USD would fall enough to cover up the risk depending on the market conditions and the correlations affecting GBP/USD. However, a more in-depth study of the strongest correlations can make hedging possible if performed strategically. Investors can even extend this hedge across another instrument that shares some relationship with the pair/s they’d be trading.

The two main important things about correlation are direction and time. This viewpoint is critical because pairs that share even the strongest correlation can be uncorrelated at certain periods. Technically speaking, no pairs can be 100% correlated, and correlations can quickly change across time-frames. Thus, with correlations, it is more effective to understand them over bigger time-frames instead of intra-day due to the latter’s price fluctuations and general market noise.

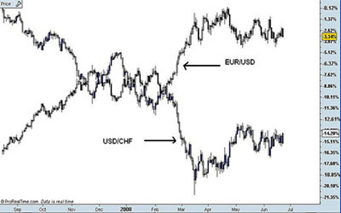

In terms of direction and time, you may find pairs that could be positively correlated, but the time at which they move may not be the same to the second. For example, USD/CHF and EUR/USD generally travel in opposite directions. However, at any given instance, one may fall 50 pips in 5 minutes, yet one may not rise at all, but perhaps rise a certain amount at a later stage.

Traders can look to exploit correlations mainly by observing another forex market and other markets such as indices and commodities. With traditional correlations such as the negative correlation between the EUR/USD and USD/CHF, we can quickly notice the resemblance in the chart below.

Forex Correlation Hidden Gems

Interestingly, other uncommon correlations exist within indices and commodities. Traders can look for an edge here since these instruments typically endure extended, long-lasting trends that profoundly affect multiple markets, especially forex. The greenback is one of the most influential currencies in the world and enjoys several weightings against it outside of the forex market. Much of the dollar’s strength lies in the dollar index representing a weighted average of a basket of six dominant currencies, which has a massive correlation with dollar pairs.

Another intriguing correlation exists between the DAX and the euro. The GER30 index, also commonly referred to as the DAX (Deutscher Aktien Index), is a German stock index made up of the top 30 German companies. From a fundamental perspective, much of the ECB’s (European Central Bank) policies affect the DAX. Therefore, since Germany uses the euro as its primary currency, this effect filters through to the euro and any of its associated pairs.

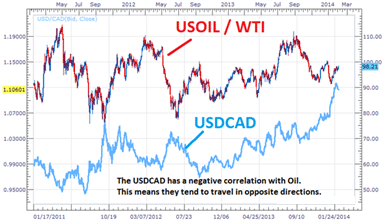

Traders can research various correlated markets sentimentally, technically, fundamentally, and quantitatively. Certain currencies have strong correlations against different non-forex markets that have remained this way for decades. This knowledge can form part of the framework for complex analysis. If we know that Canada historically and is still currently one of the world’s largest oil exporters, then we’d know that oil prices tend to have a significant effect on all CAD pairs.

Fundamental traders also like to compare different economic data such as interest rates against currencies, which is another form of correlation. The interest rate of any country for these traders is considered one of the essential factors to observe. These traders consider any change in the rate at any particular time to have the same effect on that country’s currency in the long run.

Summary

To summarise, correlations provide part of the framework of practical technical analysis. Unlike trading an individual stock, in forex, you have to employ a two-tiered approach to a pair. When we understand correlations, we realize that we cannot trade multiple markets concurrently as we may be increasing risk. Even if we looked at 30 pairs, generally speaking, all would be moving in two directions. Though there are numerous markets one can trade, it does not equate to as many trading opportunities because of the correlations. Quality matters far more than quantity.

Leave a Reply