Imagine that you can know what experts, forex brokers, and big banks think about the possible directions of pairs in the currency markets? Interesting right? Today we in the Forex Traders Guide are going to talk about the Forex forecast poll, a sentiment tool that can show you what the market’s feelings are.

The forecast poll is one of the most interesting trading tools to identify market sentiments across almost all the forex pairs in the markets. Also, it can show you how pairs act regarding what people think about them.

Let’s explore the world of the sentiment market and learn about how to use the Forecast Currency Poll to improve your trading performance.

What is the Forecast Currency Poll

The Forex Forecast Poll is a kind of sentiment index created in 2010 by Mauricio Carrillo, a financial analyst and journali. It was originally published in FXStreet, and currently, it can be found in different fx brokers and platforms as an associated service provided by FXStreet.

The sentiment tool highlights near- and medium-term price expectations from forex market leaders, including independent analysts, brokers, and big banks. The concept behind the tool says that those selected experts are leaders who influence many people in the market. So, the tool will provide a direction of what the overall market sentiment is.

As parallelism, it could be identified as a kind of Reuters-University of Michigan consumer sentiment index but for Forex. However, the poll involves, theoretically, way more people than the consumer sentiment indicator to get the sentiment.

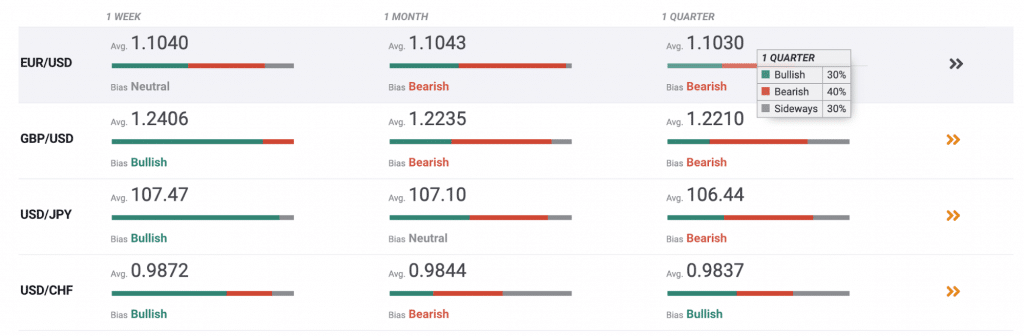

Currently, the forecast poll covers ten currency pairs including EURUSD, GBPUSD, USDJPY, USDCHF, AUDUSD, NZDUSD, USDCAD, GBPJPY, EURJPY, EURGBP, and a cryptocurrency, BTC/USD, a metal, XAU/USD and energy, the WTI. It is presented in 1-week, 1-month, and 1-quarter horizons.

The Forex forecast poll is collected every Friday and published at 15:00 GMT on the FXStreet website.

How the Forex Forecast Poll works

As mentioned before, the Forecast Currency Poll collects data on Friday and it is published almost immediately, so there is no lag or delay in the data.

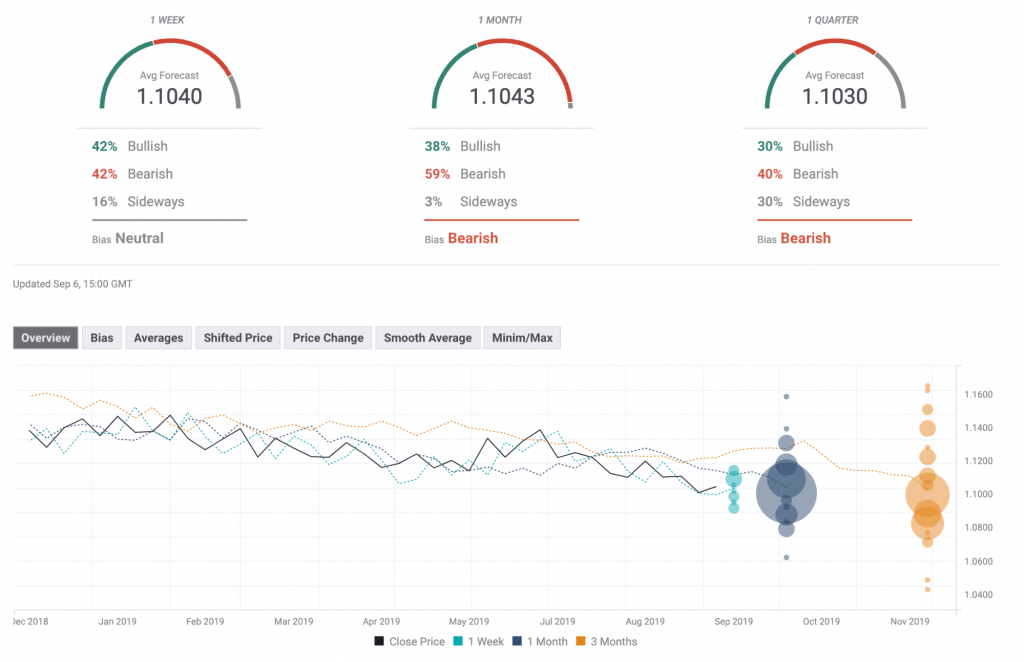

The tables show bullish, bearish, or sideways lines that identify the percentage of experts who believe in that option. The tool adds all forecast and makes it averages, but you can also watch the individual estimates.

Then, the forecast poll plots values in a chart where shows how the forecasted prices are located regarding the current rate, and also what is the dispersion of price anticipations.

It also provides different interpretations of the dispersion, accuracy, or inaccuracy, which is very important in terms of value for this indicator as it gives contrarian thinking too.

What the currency poll sentiment tool tells us

The currency poll tells about market sentiment and what is the bias of each currency pair covered. It can be used as a sentiment indicator which provides actionable prices levels.

The tool tells us about the unanimity among the expected direction of the pair, or if there is a divergence of opinions. Also, if there is the case of excessive speculator sentiment in the market.

According to the author, the tool provides price targets to trade when the sentiment is not at extreme levels, “when there is deviation between actual market rate and value reflected in forecasted rate, there is usually an opportunity to enter the market,” as the website says.

Contrarians in the Forex forecast poll

The Forecast Poll is also a contrarian tool. As many other sentiment indicators, the Poll also provides information about the possible contrarian movements. According to the author, when the indicator is at extremes, it can be a signal for a sharp change of the price direction as it happens when a pair is overbought or oversold.

How to use the Currency Poll

The forecast poll is a useful tool to identify trends and market sentiment. It is not recommended to be used alone as a signal provider, but with the right combination, it could be a great help for your trading performance.

The Forecast Poll can be used with the MACD to identify extreme speculation sentiment and possibly change directions. Plus, moving averages can be used to determine accurate price targets.

The dispersion in the forecasts can also give you hints about profit targets or stop losses if you identify minimums and maximums forecasts, but again, you should use it with another technical indicator.

The poll can also be used as a statistical measure of the impact of fundamental data in forex pairs and the difference between expected and real prices. Just check the nine years of forecasts and how the price moved to create discrepancies between predictions and actual rates were after a significant economic release.

Leave a Reply