What is the FOMC?

The Federal Reserve (Fed) is the most important central bank in the world because of the size of the American economy and the US dollar. The bank is responsible for setting the monetary policy in the US, supervising financial companies like banks, and ensuring the financial stability of the financial system.

The Federal Open Market Commission (FOMC) is a special committee of the Fed that is responsible for implementing the monetary policy role of the bank. It is made up of 12 members who are headed by the bank’s chairman. Other members are the seven members of the board of governors and board presidents.

These members meet every six weeks to deliberate on the state of the economy and make the necessary adjustments. In most cases, they decide on whether to lower or raise interest rates or whether to implement additional tools at their disposal to support the economy.

FOMC releases are among the most followed events by traders because of their impacts. In the past, key assets like currencies, stocks, and bonds have had significant single-day gains after the FOMC releases.

Why are FOMC releases important to traders?

A monetary policy meeting is important to traders for several reasons. Most importantly, it tends to set the tone for various assets in the financial market. Some of the assets that are mostly affected by the FOMC releases are:

US dollar

As the currency of the United States, the dollar tends to react strongly whenever the FOMC releases its statement. In an ideal situation, the dollar tends to rise when the central bank lowers interest rates and vice versa. This happens because higher rates lead to more demand for America’s fixed-income assets like bonds.

The chart below shows that the US dollar index (DXY) started falling in March 2020 when the Federal Reserve lowered interest rates to zero. The dollar index is a benchmark that measures the performance of the dollar against other currencies like the euro, yen, and pound.

US dollar fell when the Fed brought rates to zero

Similarly, the chart below shows that the US dollar rose sharply in 2018 when the bank made four interest rate hikes.

The US dollar rose in 2018

Stocks

Stocks are also affected by FOMC releases. Ideally, companies benefit when interest rates are low. That is because low rates influence more spending by households and businesses. They also reduce the interest expense, which is the interest they pay to their lenders. However, shares of banks tend to fall in a low-interest-rate environment because they make part of their money from interest they charge their customers.

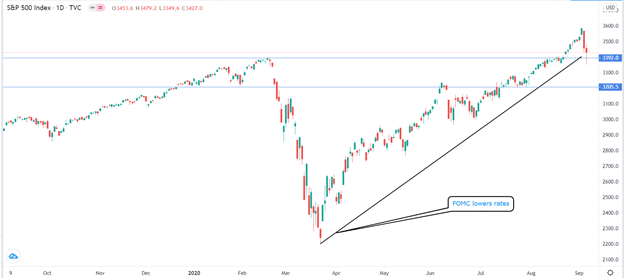

The chart below shows that the S&P 500 rose sharply in March when the Fed lowered interest rates.

S&P 500 rose after the Fed lowered rates

Precious metals

Precious metals like gold and silver are also impacted by the actions of the FOMC. In most cases, gold and silver prices tend to rise in a low-interest-rate environment. This is because of the inverse relationship they have with the US dollar. It is also because these metals are usually viewed as hedges against inflation. And inflation tends to rise in a low-rate environment.

Other assets that are impacted by interest rates are cryptocurrencies, fixed income assets like bonds, and exchange-traded funds.

Tools used by the FOMC

Interest rates are the most popular tools used by the Fed and other central banks. Basically, the bank will lower interest rates when the economy is suffering and hike rates when the economy is doing well. When the economy is suffering, the bank cuts rates to lower the cost of borrowing by individuals and companies. It also does this to incentivise people and companies to spend money. For example, the Fed slashed interest rates to zero during the dot com bubble, Global Financial Crisis, and during the coronavirus pandemic.

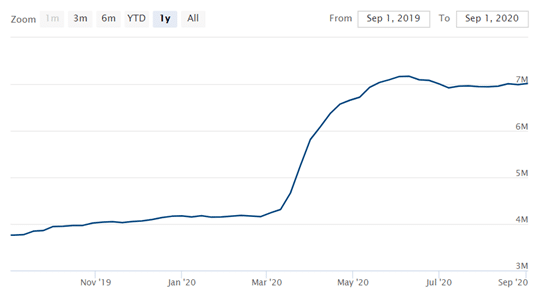

Quantitative easing is another tool the FOMC uses. This is basically a situation where the bank prints money and buys financial assets like bonds and exchange traded funds. The goal of doing this is to lower long-term interest rates and increase liquidity in the market. The chart below shows how the Fed has expanded its balance sheet during the coronavirus pandemic.

Fed balance sheet

The Fed has other tools at its disposal. For example, it can use yield-curve control and even buy corporate and municipal debt.

How to trade FOMC releases

In recent years, FOMC releases have had minimal impacts to the financial market. That is because since the 2008/9 financial crisis, the central bank has adapted a forward-guidance approach. This simply means that the bank provide hints to what it will do in the future. For example, during the pandemic, the bank hinted that rates will be unchanged even after inflation moves above 2%.

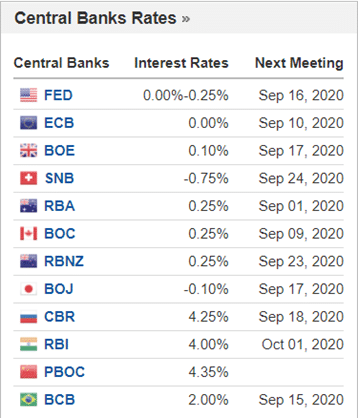

First, you need to know when the FOMC will hold its meeting. To do this, you can use one of the several economic calendars that are available in the internet. You can find calendars at various sources. The image below shows when the Fed and other main central banks will release their decisions.

Central bank calendar

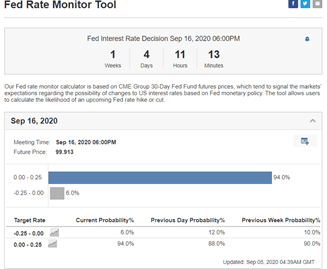

Second, you need to know what to expect during the meeting. To do this, you should use a tool known as the Fed Rate Monitor tool to see what analysts are expecting. The image below shows that 94% of all analysts expect that the bank will leave rates unchanged in its September 2016 meeting. Only 6% of the analysts expect the bank to lower the rates.

Third, I recommend reading pre-FOMC reviews by credible economists. I prefer using analysis from websites like Bloomberg, Financial Times, and The Wall Street Journal.

Fed rate monitor tool

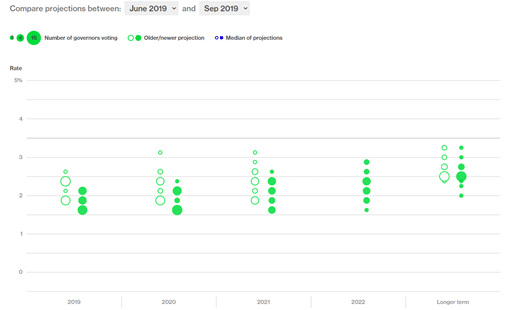

You should have this information during the FOMC release day. When the bank releases the decision, it is important for you to look at the statement that they publish on their website. This statement will help you come up with an opinion about what the bank will do in the future. Also, in this statement, you will find a dot plot, which is simply what the committee members predict about the future. The image below shows how this dot plot usually looks like.

FOMC dot plot

You should listen to the bank’s press conference that comes shortly after the release. Finally, you should read the minutes of the meeting that comes three weeks after the meeting.

Final thoughts

FOMC releases are important for forex and CFD traders because they set the tone for what to expect in the future. As a trader, knowing when the FOMC is meeting, what to expect from the meeting, and the key assets to track will help you make good decisions.

Leave a Reply