Detailed Forex Robot Review:

For many years of experience, experts have long confirmed the hypothesis that universal automatic Forex robots don’t exist. We had to study in depth the principle of the work of the relatively new forex robot Flex EA, which is declared as a universal robot. The developers describe that it works according to an innovative model, in which so-called virtual transactions are opened. If a virtual order is predicted for profit and the scenario coincides with the real price movement, then the real deal is opened according to the algorithm of the adviser to get profit.

In fact, such phrases about the use of artificial intelligence and so on – this is just a publicity stunt. On thematic portals have already gathered quite a lot of screenshots of real test results. And these data do not always coincide with what the developers are trying to show on their websites selling those same advisers.

Flex EA Description:

The principle of operation of the described robot is plug and play. This means that it is enough to install it in the trading terminal and run it in the system with predetermined parameters. You don`t need anything to optimize or change.

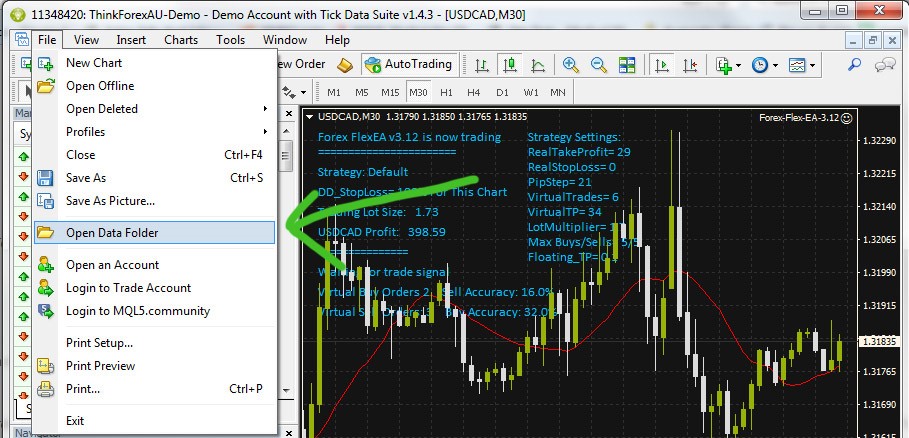

Forex robot Flex EA, as stated above, is universal. It is more rational to use it on volatile currency pairs: GBPUSD, USDJPY, USDCAD, USDCHF, EURUSD.

- Advisor type – automatic, indicator-free

- Timeframe – M15

- Trading terminal – MetaTrader 4

It is noteworthy that the developers have added an automatic update feature to this advisor. You will receive a notification that the robot will be updated (this will require access to the Internet).

The system works as follows: always the adviser keeps open 5-6 virtual transactions. These orders are not fixed by the program; they don`t affect the result of trading. With their help, the vector of price movement is determined and the behavior of the chart of an asset is modeled. According to the simulation results, entry and exit points are determined.

This principle of forecasting is considered to be fairly new and not proven. The advisor does not use indicators or technical tools for analysis. Therefore, all definitions of trends, trends, price pullbacks can be false. It is impossible to build a successful trading model based solely on the behavior of patterns (figures from candlesticks on the chart).

Flex EA Advantages:

- Compatible with all Metatrader 4 updates;

- ECN supported;

- Versatility (any currency pairs, any time trading);

- No pre-setting required – all parameters have already been set.

Flex EA Disadvantages:

- Lack of a clear and well-developed trading model;

- Advisor algorithms are not based on indicators;

- The adviser is not able to screen out the fundamental factors affecting short-term price adjustments (because of this, many losing trades are opened);

- Gambling principle of opening deals.

Flex EA Trading Strategy

According to numerous observations, it becomes clear that the basis of the adviser is the principle of scalping. Transactions are opened almost immediately after the activation of the robot on the chart. And the closing of orders occurs upon receipt of even a small profit. Losses are usually fixed at the Stop Loss level. Take Profit is also set, but on a slight deviation from the initial level of entry into the transaction.

During the monitoring and testing of the robot, it was not possible to confirm the presence of the embedded Martingale methodology. The robot trades without doubling the lot, but an increase in the lot is observed. This technique makes the adviser similar to gambling. When orders are opened “blindly”, without a clear understanding of the market. Of course, no artificial intelligence is built into the trading model.

Which trading results does Flex EA show?

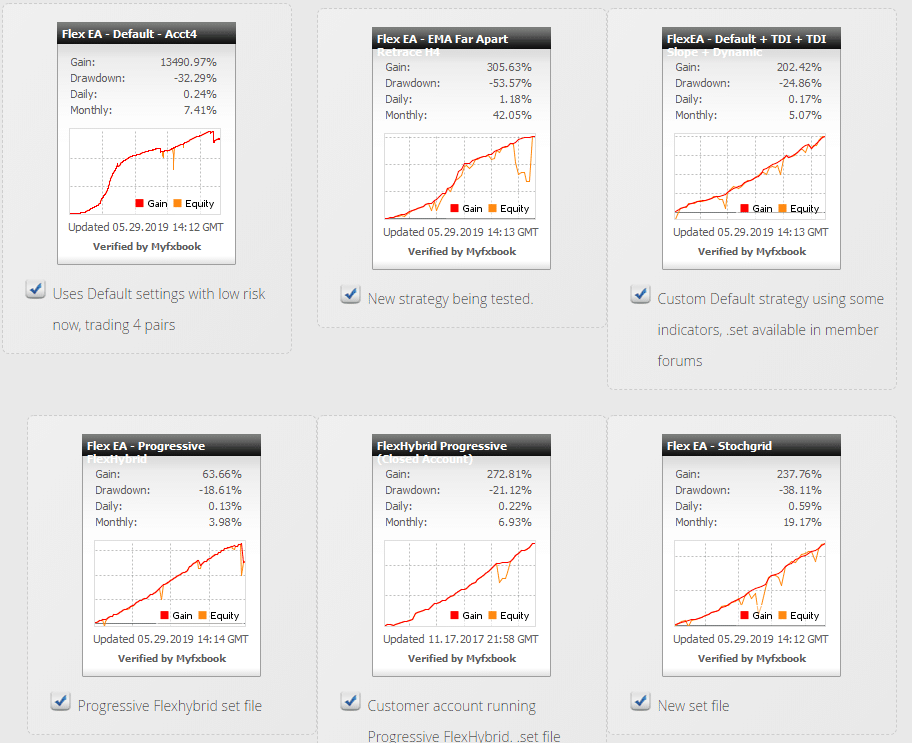

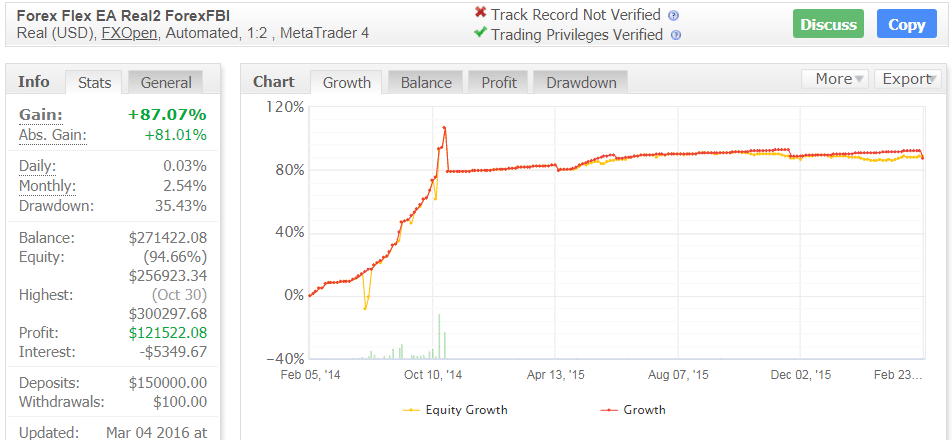

This fx robot can be interesting for those who study the results of the Flex EA trading. The developers have tried to ensure that the yield picture was as high as possible. We can see one of the examples in the screenshot below.

The bill was absolutely real. Testing was conducted in 2016. Over the entire testing period, the deposit was increased by 87% with a maximum drawdown of 35%. If you are interested in this trading result, then we recommend testing it first on a virtual account in order to test the strategy and understand the features of the Flex EA trading model.

This robot has more disadvantages than advantages. It can definitely be recommended to those who are willing to test it on a demo account or on cent accounts with small amounts. Some trading results have a positive trend, however, it does not last long-term period and is characterized by significant volatility.

Overall assessment: 5/10

Leave a Reply