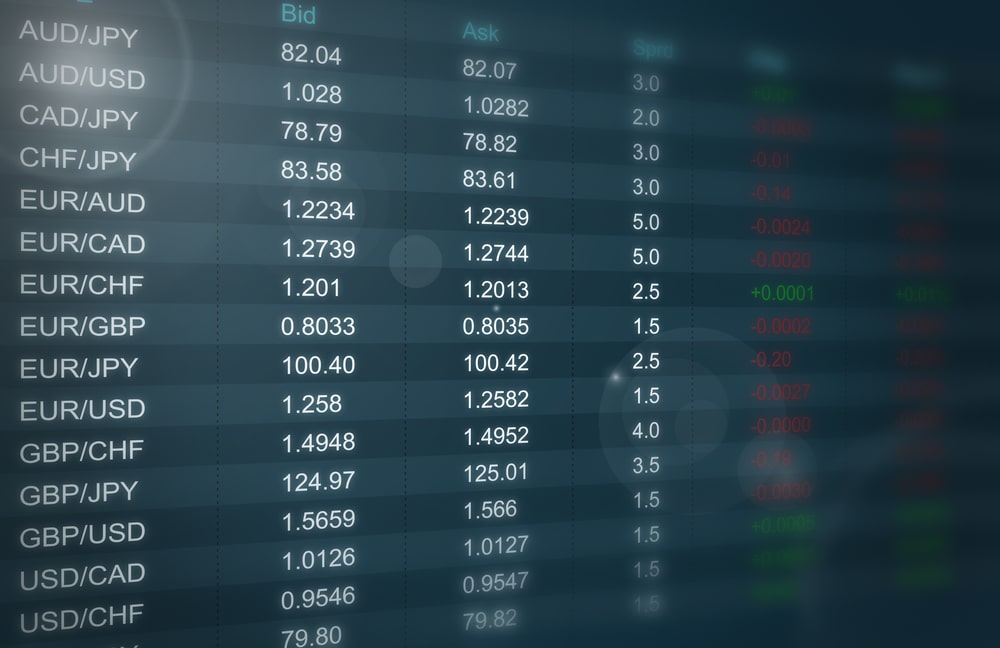

A floating exchange rate is a free-market exchange rate whereby the market price for a country’s currency is determined by the demand and supply forces. In this case, there are no third-party influences such as government interference or trade restrictions that can interfere with the rate.

In contrast, a fixed exchange rate is an FX rate determined by a country’s monetary authority. In this case, the authority defines the periodic going rate for the country’s currency against a specific foreign currency or group of other currencies.

Fixed rates

For countries that adopt fixed rates, one of the biggest reasons given in support of is that it decreases economic costs associated with exchange rate uncertainty. Therefore, this may attract many foreign investors to that country because of reduced FX risk.

In addition, some countries use it as a tool for regulating inflation risk. Central banks are required to intervene in FX markets to maintain the official exchange rate level, which means that autonomous monetary policy has been lost in this system.

In contrast, a floating rate provides monetary policy autonomy, which is also a significant advantage. An independent central bank can use autonomous monetary policy to promote demand for local goods in the international market. The bank can also use such freehand to cushion the economy against recession in a more sustainable way.

The benefits of fixed rates

Stability is the main benefit of a fixed interest rate. Countries that fix their currencies to more stable ones like JPY, EUR, or the US dollar cushion their economies against fluctuations in international commodity prices and income from foreign investments F. In order to promote international trade and economic growth, some countries prefer to take the fixed route.

Stabilization of currency, as cited above, may also attract foreign investment in the domestic market. This is because it minimizes the risks associated with FX fluctuations substantially. Nonetheless, it may not produce as much commerce and investment.

Fixed exchange rates have long been thought to be advantageous because they provide governments the ability to manipulate currency values so that they will encourage exports while limiting the amount of money spent on imports. This is a common accusation against China, for example.

The downside to fixed rates

There is a negative to maintaining a fixed rate because it requires a lot of time and work to maintain. There will be a continuing need for central bank intervention to prevent economic changes from adversely affecting markets. However, this can be extremely costly and open a country to economic crises if not properly controlled.

Secondly, such a monetary strategy does nothing to restrain policymakers from reverting to disastrous macroeconomic policies. As long as the political will is lacking, the exchange rate system will have to be abandoned in order to help the government of the day to achieve its goals. Because of this, some investors may lose their trust in the government’s ability to maintain macroeconomic stability. This can make fixed rate regimes lose their credibility.

Floating exchange rate

With a floating exchange rate, the price is determined by market speculations and the forces of demand and supply. This means that changes in the strength of an economy is reflected in the currency’s performance. In addition, factors such as interest rate fluctuations, geopolitical dynamics and speculation also play a part in influencing the currency’s strength.

Inflation, international trade, interest rates, and foreign investment all have an impact on the supply and demand of currency. For example, when a country is receiving a lot of foreign investment, the demand for its currency will increase and this will lead to an increase in its value and the exchange rate in international markets.

The benefits of floating rates

Depending on supply and demand, the floating rate can rise and fall on its own accord, unlike the fixed rate option. This eliminates the need for ongoing monitoring and management, freeing up resources, allowing for greater internal policy freedom, and, most importantly, removing restrictions on cash flow and reserves imposed by cumbersome regulations.

The downside to floating rates

Floating rates create a greater degree of FX risk. As a result, foreign investors and traders may be deterred from entering the country and the economy may become more vulnerable to growing international vulnerabilities and turbulent markets.

In summary

Fixed exchange rates are under the purview of monetary authorities set in place by governments. They are designed to cushion the economy against uncertainty and adverse effects of FX fluctuations. In contrast, floating FX rates are based on market forces and are a reflection of the strength of a country’s economy. They are linked to both domestic and export markets and are also affected by interest rates and speculation.

Exchange rate systems are less important for international payments stability than the domestic measures implemented by individual countries. Fiscal and monetary prudence are the cornerstones to long-term prosperity.

Leave a Reply