Source: Bloomberg

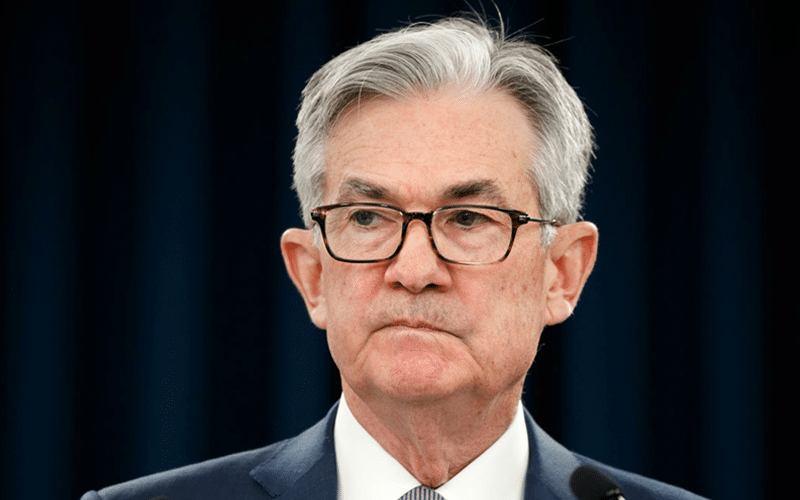

Fed’s chair Jerome Powell said inflation has accelerated but expects it will return to the 2% target as supply stabilizes.

SPY is up 1.43%, EURUSD is down 0.20%.

- The remarks came from Powell’s written testimony to the House Select Subcommittee on the pandemic crisis quoting increased oil prices and spending as the economy reopens.

- Investors will have a chance to ask questions and have more insight on Powell’s judgement on economic recovery and the central bank’s track on maintaining an emergency hold on its monetary policy.

- Fed’s projections indicated they accelerated their expected time and pace of rise in interests from the almost-zero level sparking a debate on when to lessen asset purchases from the present $120 billion monthly rate.

- The quarterly forecasts highlighted officials’ heightened sense of risk and uncertainty over their inflation projections.

- Fed’s gesture on inflation surveillance had an impact on financial markets, short-term rates went up as long-term gains leveled up, limiting the spread between 5-year and 30-year Treasury yields.

Leave a Reply