Federal Reserve Chair Jerome Powell is likely to maintain his dovish stance during the policy meeting this week, according to Bloomberg.

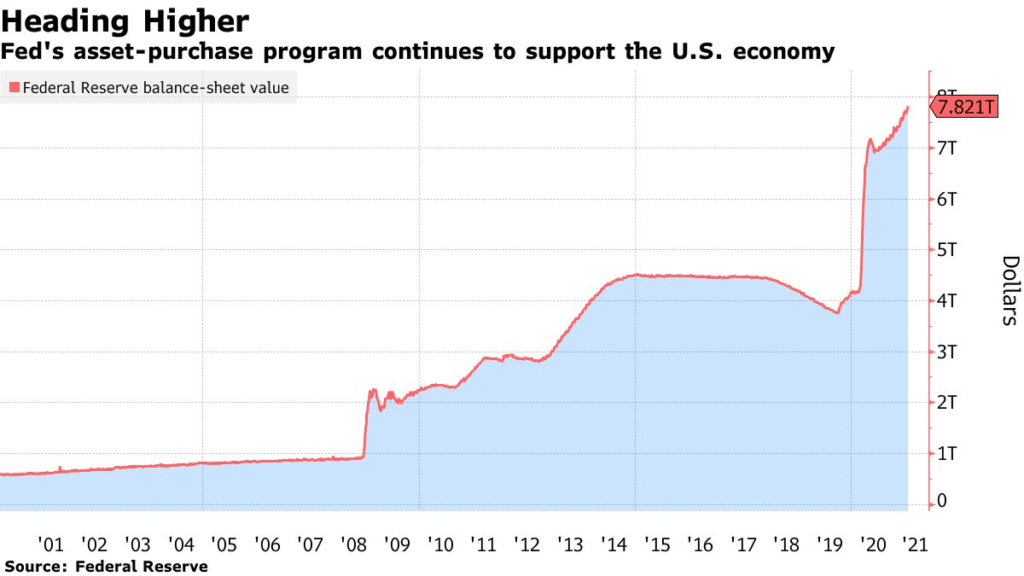

- The Federal Open Market Committee (FOMC) is widely expected to maintain its bond buying program at $120 billion monthly.

- An economist said the Fed is pushing to maintain economic support as there is not enough evidence of a recovery, and the United States is not out of the woods yet.

- The FOMC is also likely to to maintain plans to slow asset purchase once significant strides are made in terms of employment and inflation.

- The panel is scheduled to release a statement at 2 p.m., but no quarterly forecasts will be published at the meeting. Powell will talk to the media at 2:30.

- The market will await guidance on why the Fed is not poised to respond to strengthening data, as there are still 8 million jobs lower than pre-COVID-19.

- Powell last week said the Fed is prepared to do everything it can to support the economy for ‘as long as it takes” to recover completely.

Leave a Reply