The United States Federal Reserve flagged the vulnerability of asset prices to significant declines, following the steady increase in several markets since November.

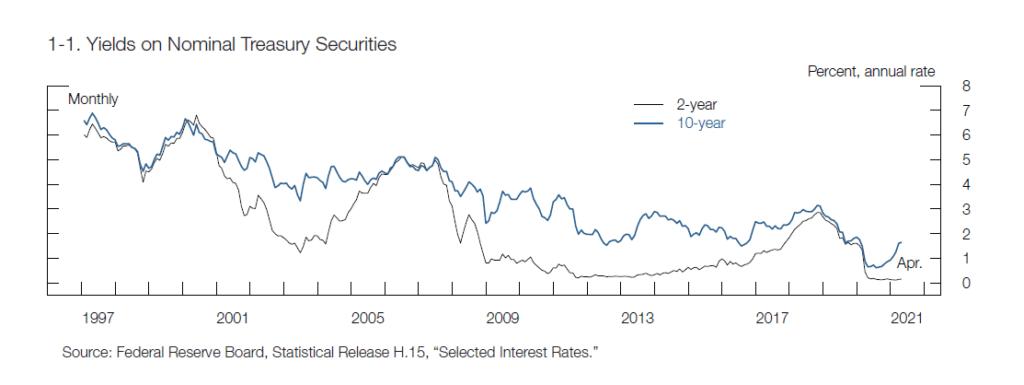

- Long-term Treasury security yields have climbed to pre-pandemic levels in recent months, but remain low compared with historical ranges as risk compensation measures were implemented.

- In its latest Financial Stability Report, the Fed said asset valuations may be vulnerable to lower risk appetite, failure to contain the COVID-19 pandemic, or a stall in recovery.

- Economic segments such as energy, travel, and hospitality are more sensitive to developments related to the pandemic.

- Bond equity market indexes hit record highs in the recent months, while corporate bond and leveraged loan yields have remained at low levels on historical standards.

- The interest rates have been kept at record lows, but the Fed said downside risks remain such as the record growth in mortgage loans, and uncertainties on repayment.

- Farmland prices continue to be on an uptrend versus rents and incomes, on the back of cheaper mortgage rates.

Leave a Reply