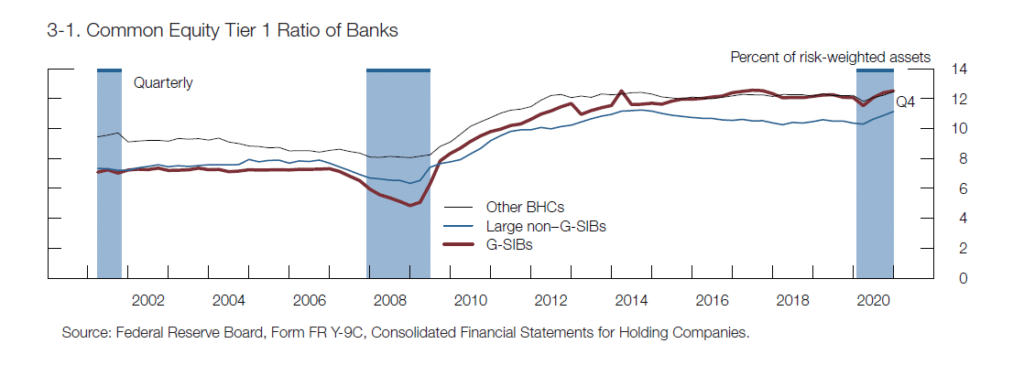

Banks in the United States remain well capitalized as leverage remains low, the Federal Reserve said in its latest Financial Stability Report.

- The Tier 1 ratio, which measures the equity capital versus risk-weighted assets, increased on net for the majority of American banks over the past year.

- The Fed said banks have weathered the pandemic “well,” as profitability recovered and credit quality performed better than market expectations.

- The largest banks reduced capital distributions, as caps on dividends were implemented, along with restrictions on share repurchases.

- Growth was recorded in low-risk assets such as central bank reserves, Treasury securities, and government-guaranteed public-private partnership (PPP) loans which pushed total assets significantly higher.

- Large banks ended 2020 with the ratio of tangible capital to total assets remaining below pre-pandemic levels.

- Meanwhile, leverage at hedge funds and life insurance companies continues to be high, as insurance firms invest heavily in corporate bonds and hold collateralized loan obligations (CLOs).

Leave a Reply