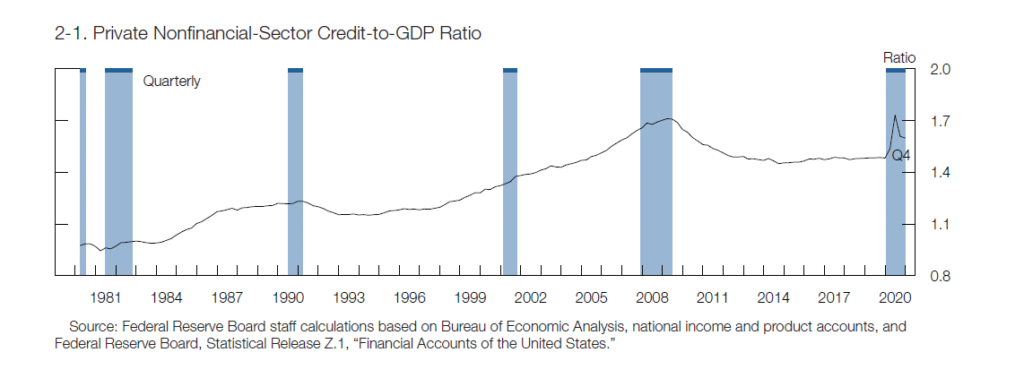

Risks from debt owned by businesses remain elevated even after declining since mid-2020, the Federal Reserve said in its latest Financial Stability Report.

- Businesses remain under “considerable strain” as debt remained at a high level relative to the gross domestic product (GDP), even if this was little changed versus the second half of 2020.

- There were less bond issuances, which offset the increase in debt recorded in the last three months of 2020, particularly on riskier forms of borrowing such as high-yield bonds and institutional leveraged loans which were solid during the period.

- Firms continued to hold liquid assets as they had to spend more with slow share repurchases, while profits recovered and more funds were raised through bond offerings.

- With interest rates at record lows, investor concerns on defaulting due to high leverage were eased.

- The Fed said risks from household debt are modest as borrowing mainly came from those with high credit scores.

- Households have also increased holdings of liquid assets as government support provided a buffer for their balance sheets.

Leave a Reply