A Moving Average crossover occurs when the shorter-term or fast Moving Average crosses above or below the longer-term or slow Moving Average on a chart.

MA crossover may assist traders in detecting trend patterns, including where the next possible entry point could be if a trend is likely to continue or reverse and whether the trend has changed.

Future prices are not predicted by the Moving Average cross. This MA crossing merely signifies a market structure or a potential trend shift.

Support and resistance

Every MA has the ability to serve as a zone of support or resistance. Because MAs are a reflection of price movement, they include a psychological component that may serve as a chart turning point.

The MA may serve as a support if the price interacts with a movement from above on average. We may get resistance if the price approaches the Moving Average from below.

Crossovers of Moving Averages are a dependable trading tactic, but only in trending markets. When the market is trading sideways, they have little value. Because of the short duration of the Exponential Moving Averages, their crossovers perform well during big breakouts and overall strong movements.

A major drawback is that their signals and, as a result, their value are often skewed in trading ranges and since MAs are a lagging indicator. As a result, the trader must continuously monitor their open positions and react as market circumstances change.

Trading MA crossovers

Most traders’ strategies for trading MA crossovers begin and end with timing entries and exits. This simple system has given rise to names such as the ‘Golden Cross,’ which occurs when a shorter-term MA crosses above a longer-term one, and the ‘Death Cross,’ which occurs when a shorter-term MA crosses below a longer-term one.

Markets tend to fluctuate and trade within a narrow range or trend rather than straying too far from it. MA crossovers are a crucial element of traders’ understanding that following trends have the ability to provide the greatest return for the least amount of effort. The shorter and more dynamic average typically predicts the market’s direction better.

It’s also worth noting that currencies and tradable assets have different degrees of trending. When you discover a currency pair that has a history of trending and notice a Moving Average crossing, you may make a trade with a well-defined risk by placing your stop above or below the crossover.

Entry and exit strategy with fast Moving Averages

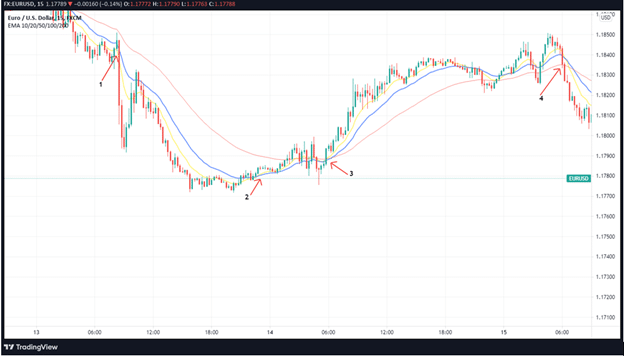

We’ll utilize a 15-minute time frame and three EMAs — a 10-, a 20-, and a 50-period one – for this approach. The regulations for entering and exiting are straightforward.

Once the 10-period EMA has penetrated the 20-period EMA and has crossed through the 50-period EMA, trade in the direction of the 10-period EMAs, however, you must wait for confirmation before executing the trade, which occurs when a bar closes on the opposite side of the 50-day EMA.

You maintain your position until one of two things happens: the 10-period EMA crosses back above the 20-period EMA, or the retracement continues all the way to the 50-period EMA.

The second exit strategy has a higher probability of producing positive outcomes since the market may reverse and return to the intended direction before passing the 50-day EMA. If this does not happen, your reward would be less than if you used a 50 period EMA. An exit out of the trade should be made in both instances.

On the 15-minute chart above, the 10-period EMA (yellow) crossed the 20-period and 50-period EMAs on many occasions.

First, at (1), the EUR/USD cross saw a significant drop on the heels of an economic data release (US June 2021 CPI), resulting in a rapid Moving Average crossing. Traders waiting for confirmation (a bar closing below the 50-period EMA) would join at the close of the large bear trend bar, while others would look for closure on a smaller time frame (10 or 5 minutes).

At this point, one of two things would have happened: either the 10-period EMA passed the 20-period EMA at breakeven at the bar (2) or a loss. This demonstrates how poor this trading method is in sideways trading.

Our example, on the other hand, had an EMA crossover in both trending and non-trending circumstances. Shortly after a bullish trend bar broke out of the tight trading area, the 10-period EMA crossed above both slower EMAs at (3).

In conclusion

Moving Average crossovers give traders the opportunity to enter trends with a higher degree of certainty while mitigating the risk of price whipsaws, which may harm other traders who trade too quickly.

Because there may be a lot of emotion involved in trading and risking money, an objective and straightforward approach have a natural advantage. If you’re a beginner trader, this may be an excellent place to start to get a feel for the market.

Leave a Reply