Although the trend is your friend in Forex, some traders like to go against the tendency and try to make money from specific and short term conditions when the market gets tired of a movement. It is called Fading strategy.

Fade trading is well known as the art of the contrarian trade and the anticipation of the profit taking, in both long and short term. But, how does a trader know when to go inside of a prevailing trend to make money against it?

Keep reading and you will discover one of the riskiest but highly rewarding forex strategies. In the case you are a day trader, a short term investor or a casual Forex lover you may want to know how to trade fading and how to make pips in Forex with it.

Table of Contents

What is Fading

Fade, or fading trading, is a contrarian Forex strategy which is not only used in Forex but it also shows up in other markets. Fading works as taking the opposite direction of a movement with strong momentum.

The fading strategy is built on the idea that market price will recover some of its lost ground almost immediately after a strong movement. The primary reason for that is because some seasonal or short term traders will book profits right after a strong move. They don’t want to trade the trend, but just take benefit of the breakout.

So, fade traders take advantage of that retracements from highs.

Long story short, the fading strategy is based on placing trades against the prevailing trend and take profit of short-term reversals.

Fading strategy always looks for four topics:

- Overbought or oversold prices

- Early sellers or buyers are ready to take profits after a breakout

- Current positions may be at risk

- Traders watch major economic news to trade fading movements

When does a fade show up

As fade traders go against the trend, they will look for strong movements that show possible turnarounds. So, timing is critical at the moment of opening the position.

If you want to find the right time to open a position, you should take care of several variables. Usually, it comes with a temporal exhaustion of the trend, such as a break after a critical level when the price action faces profit taking or right after another significant level.

It also shows up after an economic release or a technical event that moves the market. That being said, keep in mind that some times a breaking level can be followed by a stop loss trigger that will exacerbate the move. In that case, you need to wait more time for the dust to settle.

How to use fade trading in Forex

The fading strategy has three steps for a successful position. It includes identifying the opportunity, opening the position at the right time, and closing it with profits.

First, you should identify overbought or oversold conditions in a pair. You can use technical indicators explained here in the Forex Traders Guide, such as Stochastics or the RSI, the Relative Strength Index.

Second, watch for early signs of exhaustion or capitulation. Use technical indicators such as Momentum, Volume, MACD, or chart patterns in the picture. It will show you the specific time when extreme conditions are about the change, and it will produce the position signal.

Third, open the position and set the appropriate stop loss and profit taking levels. In Forex Traders Guide, we always recommend opening positions using limit orders.

Fading Breakouts

One of the Fade trading techniques is fading breakouts. But what it is? It is merely trading the opposite direction of the breakout. In other words, identify false breakouts and taking profit of it.

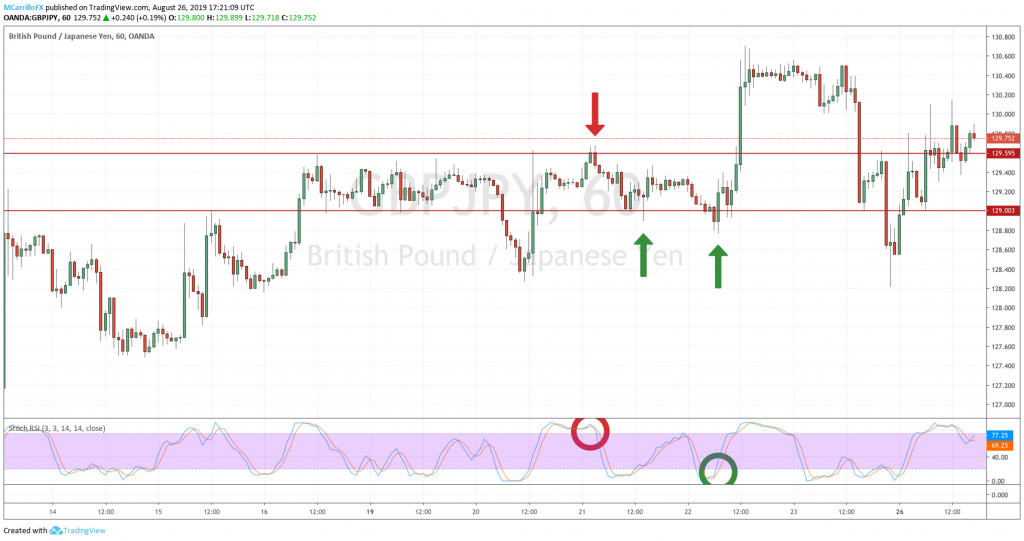

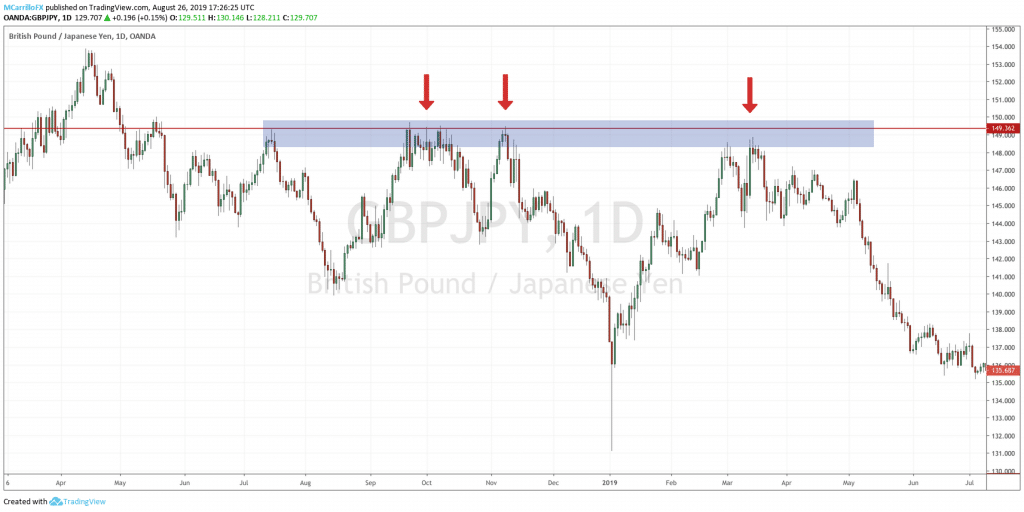

As you can see in the image, traders wait for a false breakout of a significant level, and then they bet on contrarian positions. The idea behind it is that you don’t believe the price will sustain the movement that motivated the break.

Also, remember that false breakouts are an excellent short term trading strategy, but eventually, the break will have success if the level is hit other times. Why? Because the defenses of that level will be fewer every time the price come back with another attack.

Fading the trend after a significant level is reached

When it comes to talking about Fading strategy, the necessary condition of every fade trade is that we do believe the trend will reverse its movement. In that case, the most obvious reason for a tendency to fade is to find a strong level that doesn’t allow it to pass.

It could happen in an uptrend when it hits a critical resistance. Or in a downtrend, when the price action reached significant support.

As you can see from the chart, traders may want to identify levels that acted as a barrier in the past and are willing to perform in the same way again. Look for double tops and bottoms, for congested areas, pivot points, psychological prices, etc.

Fading Economic News

Fade trading in economic data releases is a popular Forex Strategy. If you are interested in how to trade economic releases and how is its impact on Forex, please see the Forex Traders Guide’s article about the trading of Fundamental events and Economic publications.

Back to fading economic news, traders place positions in the opposite direction of the number released after the dust settles.

Experienced traders don’t go inside the market right away after an economic report is published. They want to wait for all the noise to end and then watch clearly what the real direction of the market is. Also, they want to take advantage of the hype created by people who misunderstood the data.

Also, the theory says that a movement motivated by an economic released will return to its pre-release level after few minutes post-data. Then, the real trend is developed. The fading strategy looks for that kind of movements.

Leave a Reply