The US dollar is a free-float currency as its value fluctuates in response to supply and demand forces. In contrast, some governments try to fix the value of their native currency. The Chinese yuan is one such alternative whose exchange rate is usually under the mercy of regulators.

The greenback appreciates and depreciates in response to market forces and zero government intervention. Even though it is a dominant force in the global financial system, the dollar is not immune to depreciation.

Depreciation occurs whenever a legal tender loses value against other currencies. Dollar depreciation often comes into play as traders react to various aspects of the US economy and policies imposed by regulators.

Monetary Policies

Monetary policies imposed by the Federal Reserve influence dollar strength from time to time. Whenever the central bank cuts interest rates, the same is interpreted as weakness in the US economy. The cutting of interest rates often comes into play when the US economy is struggling.

By cutting interest rates, the FED makes it easy for people to borrow money, given the reduced cost of borrowing. While such policies take effect to help stimulate the US economy, the same tends to trigger greenback depreciation.

Depreciation comes into play as investors shun the USD in favor of high-yielding investments benefiting from low interest rates. During periods of low interest, investors and traders turn to equities as they tend to outperform other investments.

Whenever the FED cuts interest rates, market participants are often forced to pull their money from treasuries and invest in currencies of countries with high interest rates. The net effect is usually depreciation on the USD.

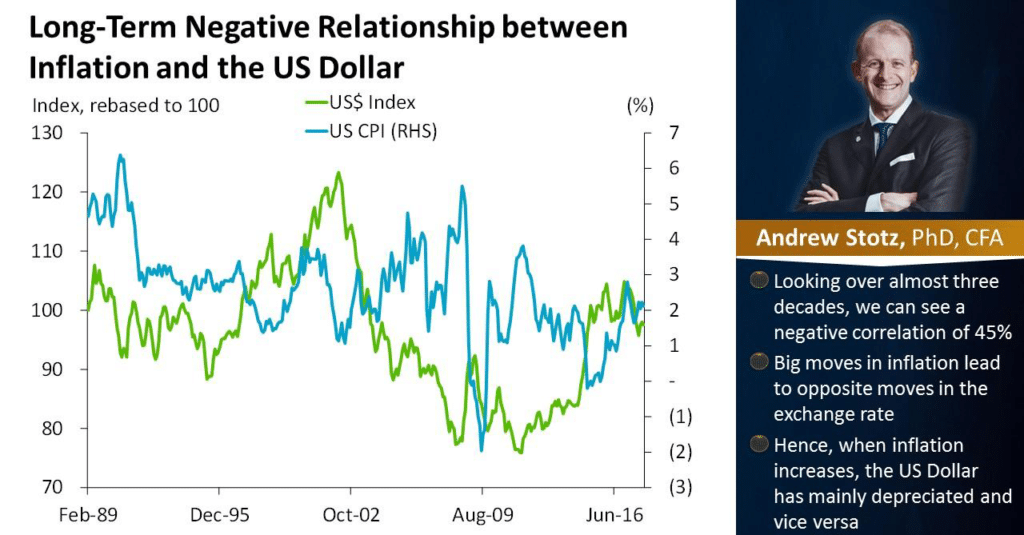

Inflation

Inflation and the US dollar share an inverse relationship. Rising inflation causes prices of goods and services to increase. Similarly, during this period, US exports lose their competitive edge on becoming expensive. Importers would often turn to other cheaper alternatives produced by other countries.

A significant decline in the number of goods that the US is exporting due to increased inflation often triggers lower dollar demand. The low demand amid high supply can trigger dollar depreciation.

In addition, higher inflation in the US presents a unique opportunity for importers to import cheaper items from abroad. As importers resort to other currencies to finance items they are buying abroad, the US dollar demand declines significantly. The net effect is usually depreciation in the exchange rate.

Demand

Demand is an important aspect that influences dollar strength. Whenever there is strong demand, the greenback value tends to increase due to its limited supply. However, when demand is low, the currency tends to weaken against its peers.

US dollar demand drops whenever the US is importing more than it is exporting. In most cases, the US does not ship more than it imports. However, dollar strength is always assured given the artificial demand created by it being the de-facto global currency.

Whenever other countries want to purchase goods on the international markets, they turn to the buck as the mode of payment. This often results in artificial demand. Likewise, whenever the artificial demand is low, the US dollar comes under pressure losing some strength against the majors.

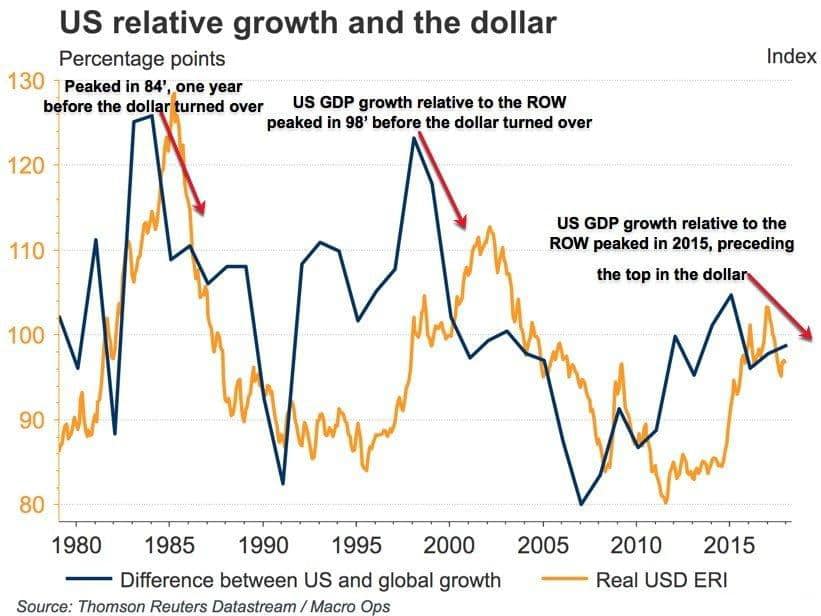

US Economy Health

The strength of any currency is dependent on the health of the underlying economy. Whenever the US economy is doing well depicted by growing GDP, high unemployment levels, and increased manufacturing activity, the dollar tends to strengthen across the board.

However, in times of economic turmoil depicted by increased unemployment, reduced manufacturing, and declining GDP growth, the dollar tends to lose its value. Slow economic growth or recession forces investors to take their money out of the US and bring the reserve currency into countries where there are high prospects of generating higher returns.

Economic turmoil results in reduced and dampened investor interest in the US dollar as focus shifts to currencies of countries whose economies are growing. Speculators often use this opportunity to bet against the USD leading to further weakness and depreciation.

Falling export Price

While the US is not highly dependent on exports, a significant reduction in some food, beverages, and feed prices in the international market often takes a considerable toll on the dollar sentiments and strength against the majors. Therefore, whenever the prices of some of the products decline, the net effect is usually weakness and depreciation of the greenback.

A decline in export prices results in a significant reduction in the amount of money that the economy generates from the business, leading to trade deficits and dollar weakness.

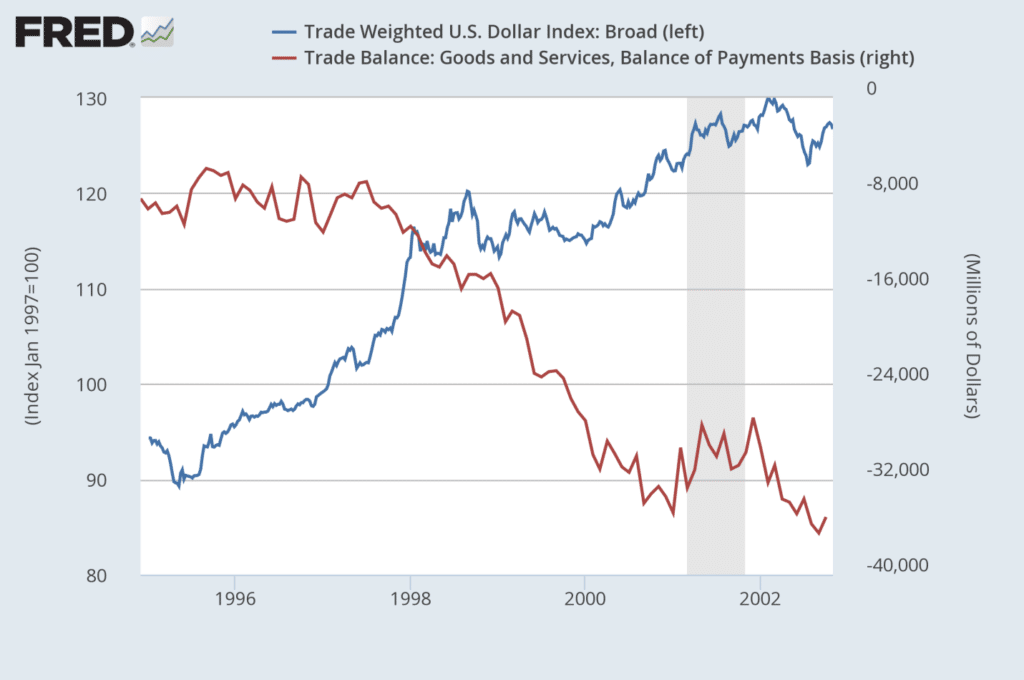

Trade Balances

Normally a currency tends to appreciate whenever a country is selling more than it is buying. However, when a nation is importing more than it is selling, trade deficit often affects the legal tender strength in question.

The US is a net importer. However, its fiat does not weaken given that it issues more debt, which is used to finance the deficit that comes into play. Being the US biggest trading partners, China and Japan have helped offer support to the greenback by buying trillions of dollars of US debt. In exchange, the US pays the two countries interest on the amount loaned out.

The USD could depreciate if the lenders believe the debt is unsustainable and start pushing to have the amount loaned paid back. However, given the healthy demand for the US treasuries, it is highly unlikely that such a scenario will come into play anytime soon.

Bottom Line

The dollar as a free-float currency depreciates in response to several factors devoid of government intervention.

Monetary policies, inflation levels, and the health of the US economy influence dollar strength a great deal. The reserve currency status also offers support to the greenback, therefore, adding a layer of stability.

Leave a Reply