- US Dollar powers to 16-month highs.

- EURUSD slides to 16-month lows.

- GBPUSD bottoms out after UK CPI.

The US dollar steadied at 16-month highs against the major currencies on Wednesday morning as retail data for October raised bets of the Federal Reserve hiking interest rates much earlier. The dollar index has already powered through the 96.04 level affirming the dollar strength across the board.

Data released on Tuesday showed that retail sales grew by 1.7% in October, topping consensus estimates of 1.4%. Following the release, St Louis Fed President James Bullard, who is also a voter in 2022, reiterated that the FED should tack in a more hawkish stance. The remarks sparked rate hikes talk, sending the dollar higher.

EURUSD technical analysis

In return, the EURUSD fell to levels not seen in 16-months as the common currency remained under pressure. EURUSD remains under pressure after initially tanking below the 1.1300 level to lows of 1.1261. The pair is currently battling for support near the 1.1300 level.

While technical indicators signal that the pair is oversold, the prospects of it printing lower lows remain in play. Consequently, a daily close below the 1.1300 level could pave the way for bears to fuel another slide lower. However, a quick bounce-back could come into play on the pair finding support above the 1.1300 level.

EURUSD fundamental analysis

The EURUSD pair has come under immense selling pressure in recent days on the US dollar powering to 16-month highs. The US dollar has continued to strengthen, supported by a number of factors. Chatter that the US could hike interest rates even as the European central bank stays clear of rate hike talks has all but continued to fuel the sell-off wave.

Additionally, traders have resorted to shunning the euro in favor of the dollar as a safe haven amid the unending Evergrande debacle. Reports that the real estate group has closed some of its online units fuel default concerns forcing traders to run away from riskier currencies such as the euro.

A plethora of solid economic data out of the US has also helped affirm the strength of the US economy at a time when Europe appears to be faltering. The result has been traders betting on the dollar at the expense of the euro, all but sending the EURUSD pair lower.

Looking ahead, the focus is on the release of Eurozone inflation data, waiting to see if the print will be strong enough to sway the ECB to start thinking of easing accommodative monetary policy. As long as there is a divergent monetary policy outlook between the FED and the ECB, the euro looks set to remain under pressure, which could see the EURUSD edging lower.

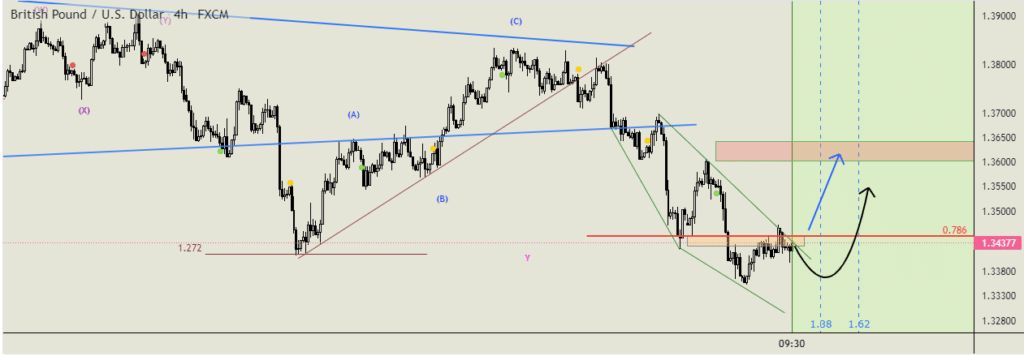

GBPUSD bounce back

Meanwhile, the GBPUSD appears to have reached a bottom after coming under immense selling pressure in recent days. A bounce back from one-year lows of 1.3364 continues to gather steam supported by a string of positive economic data.

The pair has since bounced back and appears to have found support above the 1.3400 level while staring at short-term resistance near the 1.3470 level. A rally followed by a close above the 1.3470 should pave the way for the cable to make a run for the 1.3500 handle.

The latest catalyst fuelling the upward momentum on GBPUSD is data showing that inflation rose at a stronger pace than expected in October. CPI and the Core CPI increased 4.2% and 3.4%, respectively, all but affirming inflation is no longer transitory. The data is likely to fuel calls for the Bank of England to hike interest rates in a bid to curtail runaway inflation.

However, price gains on the GBPUSD pair could be curtailed by the unending Brexit saga. The British-European negotiators are engaged in talks over the rewriting of the Northern Ireland protocol. Any negative news from the ongoing talks could put pressure on the pound.

Leave a Reply