- The US dollar gained against the euro on improved employment rates in the US.

- Inflation rates in Europe are likely to breach the 2% ECB target.

- US crude oil inventories stand at 479.3 million barrels after a decline of 5.080 million barrels.

The EUR/USD traded at -0.63% on June 3, 2021, hitting a low of 1.2132 from the previous day, where it had closed at 1.2209.

The dollar gained against the euro after nonfarm employment in the US increased 49.54% to 978,000 from a low of 654,000 in May 2021 (month-on-month). Weekly initial jobless claims in the week ending June 3, 2021, also declined to 385,000 from a high of 405,000. The jobless claims beat estimates by 1.28%, indicating an improvement in US employment rates.

Investors are watching the eurozone, especially the French government that is set to allow workers to return to offices on June 9, 2021.

Service PMI and inflation concerns

May 2021 saw Spain’s service PMI increase to 59.4 from a previous reading of 54.6. The service PMI for Italy also increased to 53.1 from a low of 47.3, indicating expansion from a contractionary phase. In the same month, Markit composite PMI (for the eurozone) also rose to 57.1 from 53.8 while services PMI increased to 55.2 from 50.5.

Despite the positive PMI data for the eurozone, the euro still performed dismally against the dollar ahead of the monetary policy meeting of the ECB on June 10, 2021.

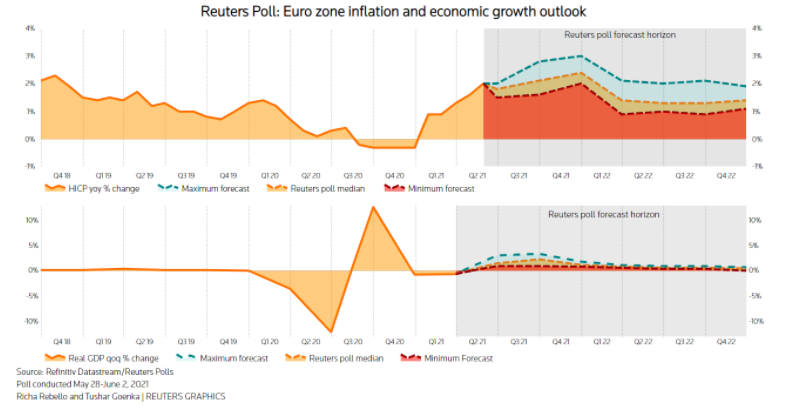

Inflation concerns are likely to hit Europe as the ECB’s target of 2% could be breached into Q3 2021. According to consensus estimates, inflation could hit 2.5%, driven by a 13% increase in energy prices.

Other consumer prices (excluding energy) may fall short of the ECB’s target at 0.9%. The high energy prices are a result of an increase in travel demand and a revived hospitality industry. Consumers in the region will also bear the burden of increasing prices caused by disruptions to the supply chain in the manufacturing industry.

Emergency purchases

Investors will be watching to see whether the ECB will begin tapering its emergency purchase program (PEPP) or leave it unchanged on June 10, 2021. Under the initiative, the ECB is set to purchase assets worth €1.85 trillion. While the ECB may view the inflation concerns as transitory and not permanent, the increase in consumer prices will affect the rollout of the PEPP.

Quarterly inflation estimates indicate that figures may rise from 1.8% in Q2 2021 to 2.4% by Q4 2021.

Growth of inflation in the eurozone

While the ECB may not consider tightening the PEPP until March 2022, it will be vital to manage debt levels so that GDP growth rates exceed interest rates.

The launch of the Next Generation EU (NGEU) funding plan for its €800 billion is set to take place in June 2021. This bond-buying program is a step towards tightening the PEPP to counter inflation.

Falling oil inventories

Inventories of crude oil in the US fell by -5.080 million on June 3, 2021, from -1.662 million against a consensus estimate of -2.443 million.

The decline meant that stockpiles of crude oil now sit at 479.3 million in the US (-3%) below the 5-year average. The weekly utilization rates of oil refineries also increased by 1.7% from 0.7% in the week leading to May 28, 2021, indicating heightened economic recovery.

Technical analysis

The EUR/USD pair moves below the 9-day EMA, which is at 1.2179, indicating a weakened euro against the dollar.

The 14-day RSI shows an increase in selling pressure at 47.19. The pair is expected to consolidate at 1.1989. The price may rise to the key level of 1.2119 afterward.

Leave a Reply