- Euro fell to five-month lows against the dollar as increasing COVID-19 cases in the block aroused economic recovery cases.

- The New Zealand dollar sell-off persisted as the Canadian dollar held firm against the dollar strength, with USD/CAD emerging as an ideal pair for fading dollar strength.

- Oil also remains under pressure amid dollar strength, and surging COVID-19 cases in Europe continue to arouse supply concerns.

The euro tanked to five months lows against the dollar as traders reacted to a vicious third wave COVID-19 crisis in Europe. Exacerbating euro woes was the dollar strengthening to five-month highs against the majors. Oil also came under pressure amid the Suez Canal stand-off, a situation made worse by demand concerns in Europe.

Euro COVID-19 crisis

The Eurozone markets remaining on edge amid a third wave of the virus continues to arouse concerns about economic recovery. Germany, the block’s biggest economy, has already extended lockdown curbs until April 18.

The disappointing Eurozone economic data is another tailwind that continues to weigh heavily on the common currency, fuelling a sell-off wave. Germany’s consumer confidence for April has dropped to -6.2 as the block’s biggest economy faces uncertainty amid pandemic-induced lockdowns.

The EUR/USD pair has since dropped to the 1.17 handle and risks of plunging to the 1.16 level, the next support level. A dampened mood on the Eurozone’s economic ability to recover amid the third wave crisis should continue to weigh heavily on the common currency.

The EUR/GBP pair has also felt the full force of euro weakness plunging to one-week lows. After touching highs of 0.8644 early in the week on sterling weakness, the pair has tumbled and is currently trading at the lower end of 0.856 levels.

Dollar rally

On the other hand, the US dollar continues to show strength despite treasury yields pulling lower from 14-month highs. FED speakers reiterating that the economic recovery is on course amid the aggressive COVID-19 vaccination campaign continues to offer support to the greenback.

The FED has made it clear that it will be as accommodative as needed in the near term with no plans to remove the massive support that has helped cushion the economy amid the pandemic. FED chair Jerome Powell is reiterating that inflationary pressure transitionary has also helped fuel dollar strength.

Despite yields, the dollar has continued to strengthen against the majors, which have been the main catalysts in recent weeks, edging lower. Likewise, it is expected to continue strengthening, receiving additional push on euro and GBP weakness.

NZD sell-off

NZD/USD is one of the pairs that have felt the full weight of dollars strength. The pair is down to five-month lows. The pair faces an uphill task to take back the 0.700 handle after the recent slide to the 0.696 level.

NZD’s weakness stems from the government announcing it will be introducing an NZD3.8 billion fund as it seeks to boost the housing supply and curb housing prices from rising further. The absence of significant fundamental drivers should continue to weigh NZD sentiments against the dollar.

CAD resilience

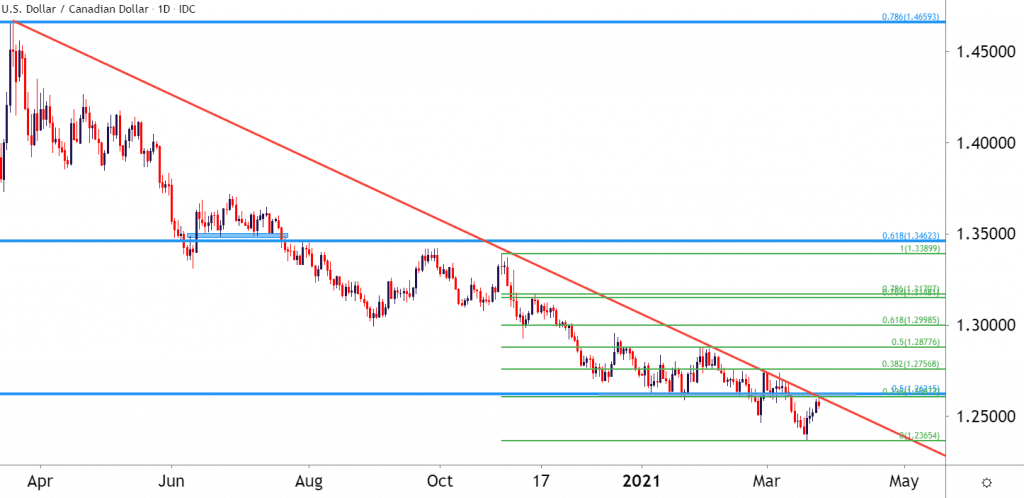

The Canadian dollar has been the most resilient against the dollar. USD/CAD has struggled to edge higher amid the broader US strength. Amid the CAD strength, the pair has remained subdued near three-year lows.

The USD/CAD pair has emerged as a preferred option for traders looking to fade the recent US dollar strength.

Oil tanks

The oil roller-coaster ride persisted on Thursday as it fell 5% amid growing demand concerns. The volatility is not expected to fade any time soon as the risk of a third wave of infections continues to pile pressure. Oil has shed more than 8% in value over the past week amid supply and demand concerns.

US West Texas Intermediate oil was down by $3.17 to $58.01 as a slide away from the $60 a barrel level continued to gather pace. London traded Brent is also struggling to hold on above the $60 a barrel level after a 4.4% slide to the $60.99 level.

Leave a Reply