- Germany’s inflation slowed in June 2021 (MoM) to +2.3%, from a high of +2.5% realized in May 2021.

- In France, food prices dropped 0.7% in June 2021 (MoM).

- US core CPI rose in June 2021 (MoM) to 0.9%, beating consensus estimates for the fourth consecutive month.

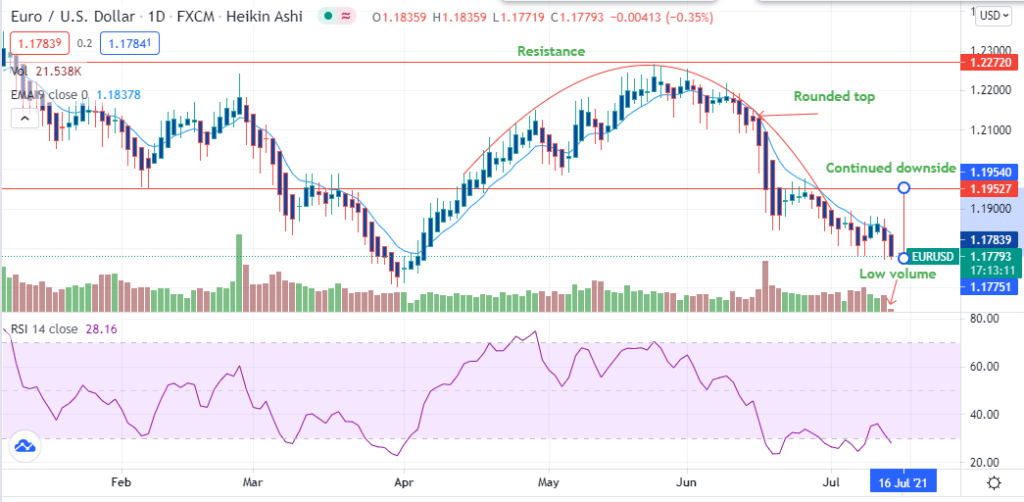

The EURUSD pair declined 0.51% as of 1:10 pm GMT on July 13, 2021, from the previous day’s close. It touched the low of 1.1792 after hitting a high of 1.1876 and was trading at 1.1799 as of this writing.

Germany’s rate of inflation (marked by the CPI) slowed in June 2021 (MoM) to +2.3% from a high of +2.5% realized in May 2021. This rate met the projection with consumer prices in May 2021, recording an increase of 0.4%. An increase above 2.3% would have positively affected the euro against the dollar.

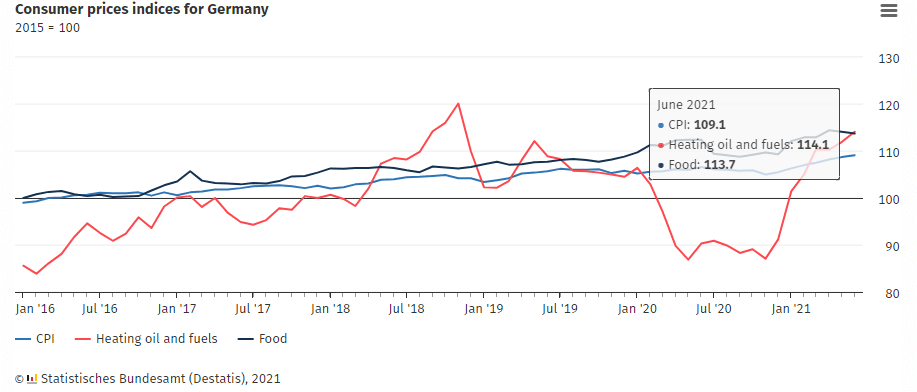

Germany’s CPI

June 2021 saw the overall CPI hit 109.1, with the price index for heating oil and fuels at 114.1 and food prices at 113.7. Energy prices added 9.4% (YoY), boosted by the carbon dioxide charge introduced in Q1 2021.

However, at an index of 113.7, food prices in June 2021 were still 1.2% below the average recorded at +1.5% in May 2021. Vegetable prices fell 2.3% (YoY) to stand at 113.4 while the price of mobile phones also fell 5.8%.

French CPI

France also released its CPI data, indicating an inflation rise of 0.1% for June 2021 (MoM), a slight decrease from +0.3% recorded in May 2021. Service prices inched lower to +0.1% from 0.3% in May 2021, adversely affecting the euro.

Further, food prices dropped 0.7% in June 2021 and also fell 0.2% on the annual assessment. Covid-19 restrictions and the stay-home requirement decreased the transport price by 0.3% (MoM) and -0.8% (YoY).

While the French Harmonized Index of Consumer Prices (HICP) rose 1.9% in June 2021 (YoY), it recorded a lower increase at 0.2% in the monthly assessment from 0.3% in May 2021.

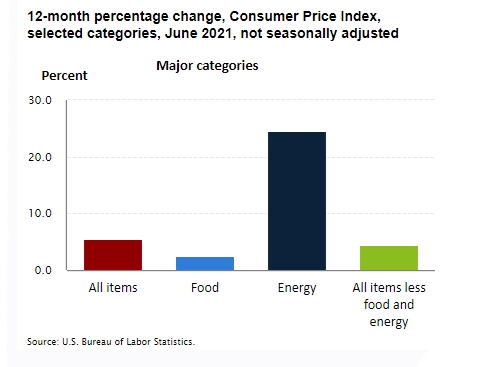

US CPI data

US core CPI rose in June 2021 (MoM) to 0.9%, beating consensus estimates for the fourth consecutive month.

US CPI

The inflation rate for all items excluding food and energy surged 4.5%, while energy prices rose 24.5%. Other than the constant rise in the price of crude oil, energy prices were also boosted by the decrease in crude oil inventories. However, demand for crude oil is yet to reach pre-pandemic levels as the inventory demand fell 48.90% from 7.983 million barrels to 4.079 million barrels.

For urban consumers, the CPI rose 5.4% to an index of 271.7 (in the 12 months leading to June 2021) from a previous index level of 269.20. The CPI was up 5% in May 2021, indicating an increase of 0.4% in the month. The price of all items in exclusion of food prices rose to an index level of 270.985 in June 2021 (MoM).

The high cost of used (second-hand) cars also contributed to the surge in inflation that clocked a 13-year high in June 2021. A shortage in the supply of semiconductors used in manufacturing new cars has fueled this price surge. This inflation jump is expected to propel the Fed’s tightening of the US monetary policy much sooner. It was expected to raise rates in Q4 2022 or Q1 2023.

Technical analysis

The EURUSD pair hit resistance at 1.2272, where it proceeded to establish a rounded top. The pattern indicates a possible downtrend aiming at 1.1775.

The pair is declining on the low trading volume, and the 14-day RSI is trending in the oversold region at 28.17. We may see a price reversal if the buyers overtake sellers pushing the pair towards 1.1954.

Leave a Reply