The US dollar is experiencing mixed fortunes. What trajectory is the greenback likely to take ahead of the Fed’s Jackson Hole symposium? We evaluate the possibilities.

- The Jackson Hole Fed meeting is the most awaited news and could shape up USD action.

- The Covid-19 pandemic has slowed down investor confidence, but FDA vaccine approvals have given the economy a boost.

- Germany’s macroeconomic data is the most significant one from the Eurozone this week.

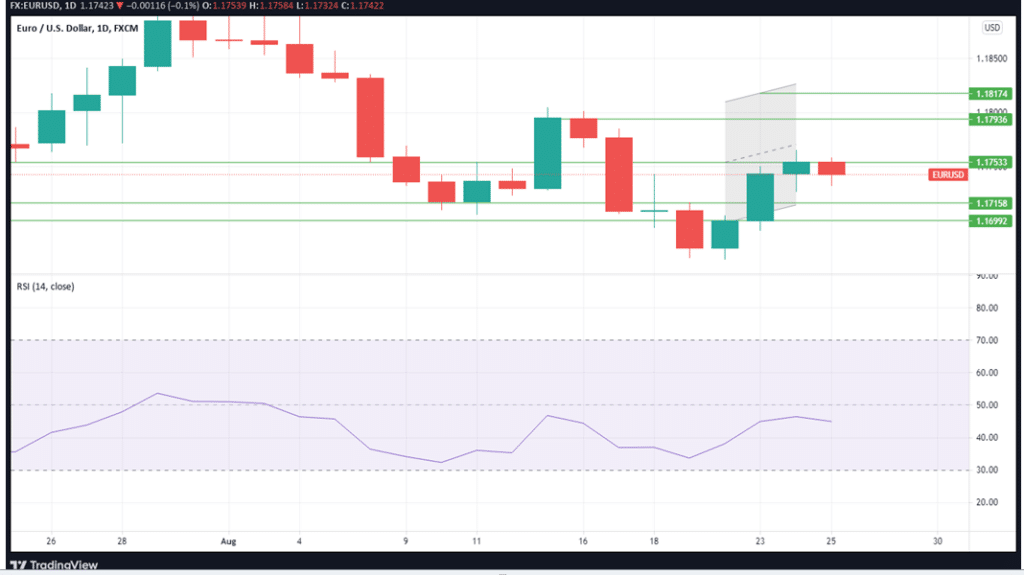

EURUSD was down by 0.1% compared to its position 24 hours earlier to trade at 1.8174 at 0323 EDT on Wednesday. At the time of writing, the dollar index, which measures the currency’s performance versus six rivals, rose by 0.09% to register 92.979.

Worries of a global economic recovery being derailed due to the highly contagious strain of the Delta variant faded as the dollar rose from one of its lowest levels in the past week against its peers. Investor worries over the prospects for the economic recovery abated, possibly causing them to turn away from the “safe-haven” asset.

Since the US Food and Drug Administration has given full approval to the COVID-19 vaccine, a drug created by Pfizer and BioNTech, as a result, risk appetite in global markets has increased because of the confidence that more vaccines will be brought to the US.

Dr. Anthony Fauci, the US’s leading infectious disease expert, has estimated that the United States might get a handle on COVID-19 by early next year.

The USD rally hits turbulence

In the past few weeks, the USD has gained strength and even reached its highest point in about nine and a half months. Signs that the Federal Reserve would cut back on asset purchases (quantitative easing) in 2021 have encouraged this surge. However, the US economy still has to grapple with fears that the virulent COVID-19 pandemic, and especially the Delta variant, is spreading.

As 10-year Treasury yields rose, the EURUSD exchange rate found it difficult to rise, with this coming after the FDA’s full clearance of Pfizer’s vaccine in the US. The speculation regarding interest rates in the United States is part of the reason why the tapering of the US quantitative easing policy is being delayed, even though the weak economic data is keeping the cost of borrowing rates from moving higher.

The fact that there is a lot of uncertainty (due to Delta) about the Fed’s ability to properly communicate policy decisions has led the market to doubt the likelihood of Chair Jerome Powell announcing any sort of time-frame at the Fed’s annual economic symposium at Jackson Hole on Friday.

Could Jackson Hole change things?

Jackson Hole is seen as a significant test by some analysts, but given the current uncertainty, it’s more likely that the Fed will need to see one or two outstanding employment numbers before beginning to taper in 2021.

Due to the ongoing spread of the Covid-19 pandemic across the country, the Fed’s economic symposium this year will be held virtually on Friday rather than at Jackson Hole, as is usual.

When it comes to signals about when the Federal Reserve might start winding down its asset purchases, one thing is certain: If there are any revelations in the words of Fed Chair Jerome Powell at the event, markets will react.

Other relevant data

The market will be looking at the US Durable Goods Orders report for July, which is expected to fall by 0.3 percent after rising by 0.9 percent previously, to see if this gives more impetus to calls for looser monetary policy.

In addition, the German IFO Survey (where August Business Climate is now estimated at 100.4) will be heavily scrutinized. The data will assist traders in understanding the market’s mood. Second-quarter GDP growth estimates in Germany have been raised to 1.6 percent, which is beyond analyst estimates. The figure rose from a preliminary 1.5 percent estimate.

Technical outlook

EURUSD is currently trading at 1.1744; its RSI is at 44 and looks headed down. If the market bulls lose momentum, the EURUSD pair is likely to find the first support at 1.1715, and a further slip may be supported by a slightly lower price at 1.1699.

If the bulls take charge, they may push the price to the first resistance at 1.7936. A further upward push can encounter a second resistance at 1.8174.

Leave a Reply