- The EUR/USD is up 0.28% on Wednesday, solidifying a positive trend that started in late March 2020. Over the past year, the pair has gained 10.98% and 0.91% year to date. Also, the pair has shown considerable volatility, with the 52-week range being 1.0636 to 1.2346.

- Coronavirus remains a significant influence on market sentiment. The Presidential elections, together with this week’s Georgia runoff, have dented market sentiment significantly for the US. This scenario continues to support the ascendancy of the EUR/USD.

Georgia runoffs weighing on risk appetite, market sentiment is mixed

Results from Tuesday’s Georgia runoffs are streaming in, and exit polls show Democrats coming on top. Early projections show Raphael Warnock, a Democrat, will win against Kelly Loeffler, the incumbent and Republican. If Jon Ossoff (Democrat) clinches the remaining Georgia senate seat, the US Senate will see a Democrat majority for the first time since 2009.

The Georgia elections will bring to a close one of the most nail-biting elections in the US. The election has been a significant US dollar pressure point. Market sentiment on the greenback has also taken a beating as US politicians wrangled over the second relief fund.

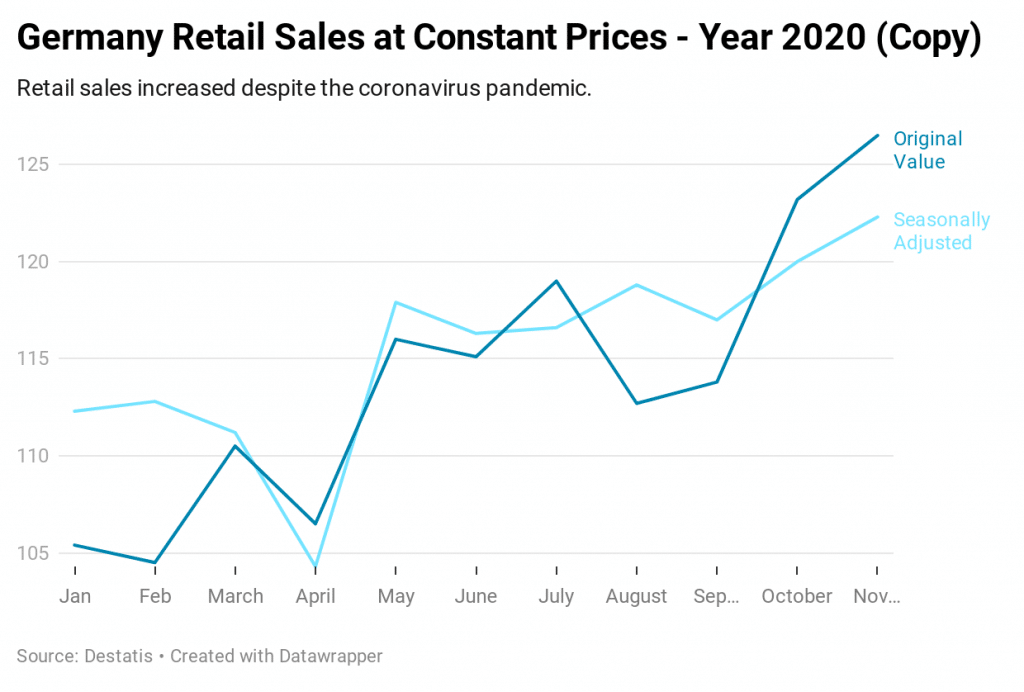

A weakening dollar coincided with a strengthening Euro. Many things have lent support to the EUR, but Germany’s November Retail Sales take more credit. The Retail Sales prevailed against a 2% drop consensus by registering a 1.9% growth. One can argue that Germany has held steady support for the Euro by registering positive retail sales figures for most of 2020, as shown in the figure below (data retrieved from Destatis – German Federal Office of Statistics).

Figure 1

Further, Germany’s unemployment rate was unchanged in December at 6.1%; the December ISM manufacturing PMI for the US beat estimates at 60.7, but the data could not shift the market sentiment in the greenback’s favor. Therefore, it seems that the political situation in the US has a greater influence on market sentiment.

Apart from Germany’s positive economic data, the political situation in Europe has shown more stability than expected. Early this year, the Brexit talks parties reached a final agreement bringing a close to a four-year soap opera. Brexit was a huge Euro pressure point, and its conclusion implies more growth potential for the common currency.

Do the technicals agree?

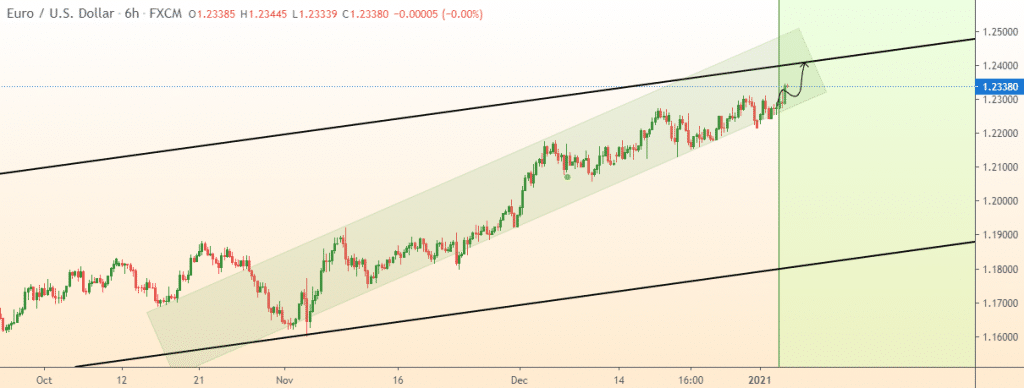

EUR/USD long is still in play, according to our analysis. The strong channel in the figure below binds the 6-hour EUR/USD price chart since October. There was an attempt in November to break below the 1.16049 support but the level held on. Now, more bullish price action is pushing for the upper band of the strong channel.

Figure 2: EUR/USD 6-hour price chart

The smaller channel provides strong support by predicting the pair to breeze past 1.24 in a matter of hours. Recently, the EUR/USD pair broke above 1.2312, a 32-month high, and the price has remained at a strong support level. In mid-February 2018, the pair tested the 1.25452 price level, which has remained important to date.

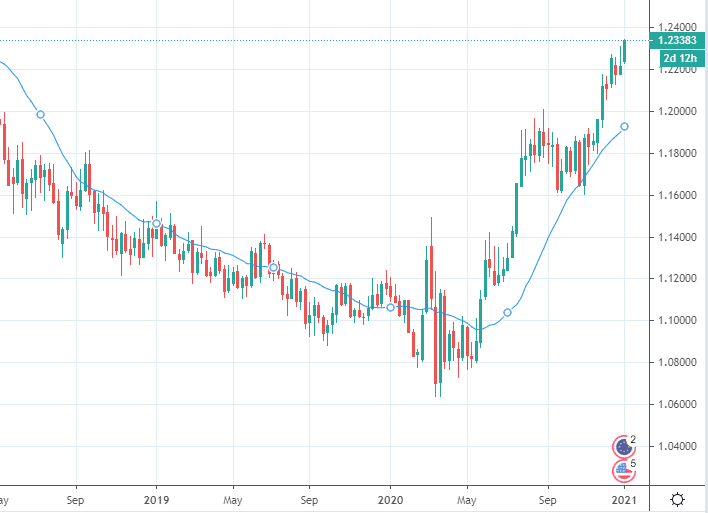

Further support for the pair comes from the 20-day simple moving average. If the current momentum holds, the EUR/USD pair is in play to test a multi-year high within days you can count on one hand.

Figure 3: 20-day SMA offers strong support

Conclusion

The EUR/USD technical view might seem lofty, especially since the pair has been climbing for almost ten months nonstop. Perhaps, market sentiment might start to flip. However, the fundamentals are still on the Euro’s side, though the USD has significant potential to mount a comeback.

Leave a Reply