- The EU aims to increase its vaccination program to cover 70% of the EU population by July 2021.

- The US proposed lifting the tax rate of US-based companies globally from 21% to 28% and the global minimum rate to 15%.

- Most EU countries are reeling from increased debt burdens and risk insolvency.

The EUR/USD closed at +0.46% on May 20, 2021, from the previous day. The pair traded from a low of 1.2223 to a high of 1.2239 after the European Parliament announced on May 20, 2021, that it had agreed to introduce a Covid-19 pass in the Eurozone. The pass dubbed “EU Digital Covid certificate” would help EU citizens travel across the 27-member states to work and tour. It will contain vaccination data, tests conducted, and cases of disease recoveries.

Vaccination campaign

The EU aims to have vaccinated at least 70% of its adult population by the end of July 2021. This target is similar to that of the US, with the EU having exported up to 220 million vaccine doses globally.

Germany’s PPI for April 2021 year-on-year increased from 3.7% to 5.2%, beating forecasts at 5.1%. Europe is set to reshape the retail payment system by introducing instant payment through digitization. EU customers will benefit from non-excessive prices that will further improve the PPI into 2022.

US Employment and tax concerns

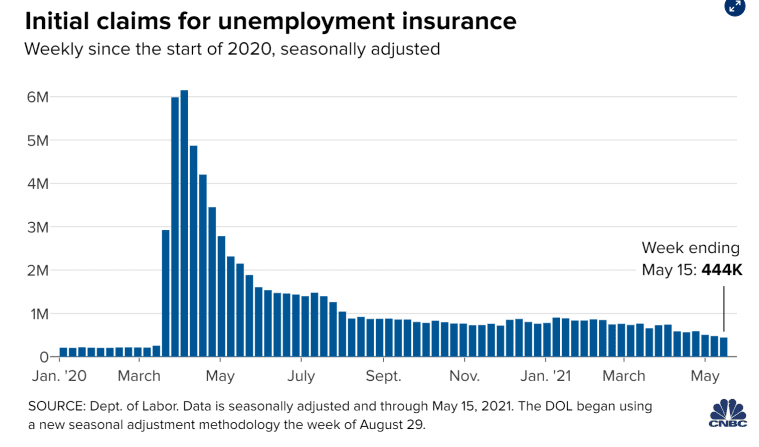

Initial unemployment claims in the US dropped to 444,000 from 478,000 in the week that ended on May 15, 2021. However, continuing jobless claims increased to 3.751 million from 3.640 million.

Seasonally Adjusted unemployment insurance data

According to the US labor department the week ending May 8, 2021, saw a 0.1%-point increase in the insured unemployment rate to 2.7%. Further, tax increases under the Biden Administration could see a continued reduction in the employment rate.

President Biden proposed lifting the tax rate of US-based companies globally from 21% to 28%. Under the previous Trump Administration, the tax rate had been reduced from 35% to 21%.

Further, expansion of this bracket under the proposal could see the world incorporate a 15% minimum tax rate. This move is being touted as the solution to stop companies from relocating or shifting to other countries to lower their tax burdens.

Technology-based companies in G20 are avoiding the payment of $32 billion in taxes annually. The reform would make companies increase their tax rates in their domicile countries. US companies may start paying this minimum tax rate before other companies since President Biden has advocated for it. Other countries in the G20 such as Germany have welcomed the idea of a corporate minimum tax rate with others expected to discuss it before the end of May 2021.

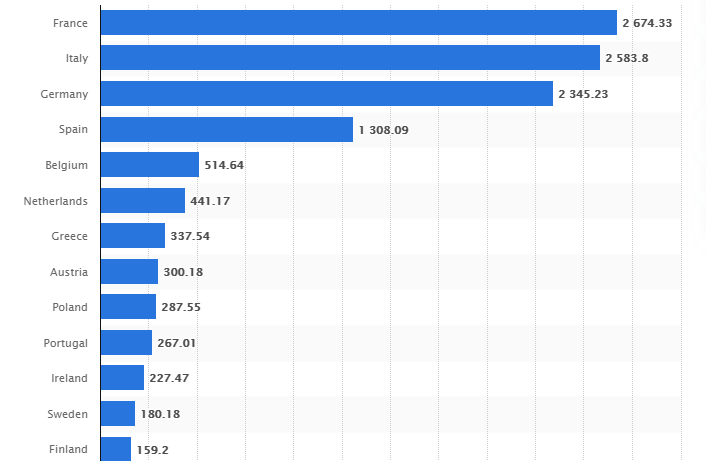

Insolvency concerns

The European Central Bank (ECB) has warned of impending financial risks in the eurozone even as Europe prepares to digitize instant payment services ahead of lifting restrictions. The high debt burden in countries driven by the services sector could plunge the states into insolvency once government support measures such as furlough programs are lifted.

National Debt in EU-member states as of 2020

France leads the national debt figure among EU member states with its ratio of public debt in 2021 predicted to remain at 117.8%. In 2022, it may fall slightly to 116.3%.

Technical analysis

The EUR/USD moved above the 20-day EMA at 1.21126 as it settled at 1.2225. There was increased buying activity as the 14-day RSI at 70.00 angled towards the overbought zone.

EUR/USD Technical Analysis

There was limited liquidity shown by decreasing volume at 58.23K while prices increased from 1.2218 to 1.2225. The pair is looking to break this barrier and continue rising.

Leave a Reply