- US dollar softness as treasury yields retreat.

- EURUSD bulls eye 1.1300 supports on dollar softness.

- AUDUSD is on a bounce-back mode.

After a volatile Tuesday trading session, the US dollar was on the defensive mode Wednesday morning. The dollar index raced to two-week highs of 96.45 before coming under pressure as ISM Manufacturing PMI data disappointed.

With treasury yields under immense pressure, the dollar is struggling to hold on to gains near the two-week highs. Amid the dollar softness across the board, focus now shifts to the US Federal Reserve expected to release minutes for its December meeting later in the day. The minutes should provide hints on when the central bank plans to hike interest rates.

Additionally, investors will also pay close watch to US jobs reports, including the non-farm payroll report due on Friday.

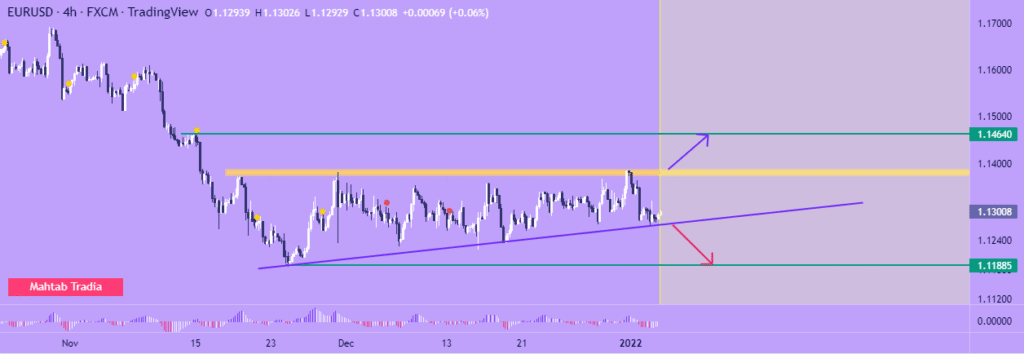

EURUSD technical analysis

The dollar softness might as well explain why the EURUSD is trying to find support above the 1.1300 psychological levels. While the EURUSD Is trading at the 1.1297 level, a close above the 1.1305 should help affirm the renewed bounce back.

The pair needs to find support above this critical level to avert further sell-offs after the recent pullback. On the flip side, failure to find support above the 1.1305 could leave the pair susceptible to further sell-offs. A drop to 1.1275 could be in the cards, having emerged as a crucial support level as part of a rising trend line.

EURUSD price action drivers

The mixed sentiment on the EURUSD pair stems from the disparity between the US and German Treasury bond yields. While US yields have been powering high in recent days, the same has not been the case with German bonds, all but fuelling EUR weakness.

In addition, EUR sentiments against the dollar have taken a significant hit owing to growing concerns about the spread of the Omicron variant and its potential impact on the block’s economy. The dollar has continued to attract bids amid the Omicron fears going by its safe-haven credentials.

Nevertheless, improving economic data out of Germany has continued to offer support to the EUR averting a significant sell-off of the EURUSD. German Retail Sales for December coming at +0.6% against an expected -0.5% has averted concerns about the German economy.

In addition, the dollar came under pressure on Tuesday as the ISM Manufacturing PMI dropped to the lowest level in 11-months of 58.7 against an expected 60.0. Looking ahead, EURUSD price action will depend on economic data out of the US and the December minutes of the Federal Open Market Committee.

AUDUSD bounce back

Meanwhile, the AUDUSD was also on the bounce-back mode on Wednesday morning, trying to take advantage of the dollar’s softness. The pair appears to have hit strong support near the 0.72230 level, from where bulls are trying to steer another leg high after a recent bounce back from one-week lows of 0.7182.

The AUDUSD is attracting bids Wednesday morning amid dollar softness on US treasury yield edging lower. However, expectations of a faster policy tightening by the FED should affirm dollar strength, something that could curtail strong upside action on the pair.

However, with the Reserve Bank of Australia also expected to become increasingly hawkish as inflation rises, solid sentiments on AUD could fend off dollar strength due to FED actions. China’s economic growth gaining momentum in the first half of the year is another factor that could offer support to the AUD against the dollar, given that it is Australia’s biggest trading partner.

Looking ahead, trading opportunities on the AUDUSD will depend on the outcome of the ADP report, building Permits, and services PMI in the US. US bond yields and broader market sentiments are also expected to influence the pair’s price action.

Leave a Reply