EuropeFX operates under the legal entity Maxiflex Global Investments Corp. Limited leadership, which is registered in Cyprus. Also, this is an offshore zone the company is regulated by the independent organization CySEC. In Europe, the company is also regulated by some organizations, including FSA, FCA, and AFM.

The official website at https://europefx.com is translated only into five languages: English, German, Italian, Swiss and Dutch. For users from other regions of Europe, as well as from the CIS and Asia, it will be difficult to perceive some information. The company does not open accounts for US citizens but is focused mainly on European traders.

The company is registered in Cyprus. But the forex broker has two central offices – one in Berlin at Franklinstraße 28-29, 10587, and one in Cyprus.

Trading accounts and trading conditions with a EuropeFX broker

The broker offers to open one of the following types of accounts:

• Bronze (from 1000 euros);

• Silver (from 2500 euros);

• Gold (from 10,000 euros);

• Premium (from 25,000 euros);

• Platinum (from 50,000 euros).

What is more, you have an opportunity to open an account with a deposit of 200 euros (it will not have any status). The difference between accounts in trading conditions is insignificant.

General trading conditions:

• Minimum transaction volume – 0.01 lot;

• Spreads size – from 0.1 pips;

• Account categories – STP / No Dealing Desk;

• Leverage – up to 1: 200.

Trading conditions from the forex broker are not inferior to those offered by numerous competitors. Therefore, EuropeFX can be considered as a full-fledged financial partner.

With Gold status, the user gets the opportunity to connect SMS-notifications with trading signals. At the same time, a personal manager is available only to those clients who replenish a deposit of 50 thousand euros. Such conditions cannot be called loyal. The company is focused on a solvent target audience with certain trading experience.

Trading terminals

EuropeFX provides access to several trading terminals to choose from:

- Metatrader 4;

- Metatrader 4 Web;

- Metatrader Mobile;

- Euro Trader Web.

If practically nobody has any questions about classic MT4, Euro Trader Web is worth a few words about it. This is the company’s development. The program allows you to open orders on the computer and mobile devices with one click. True, the list of available tools for analysis and forecasting is limited. In terms of functionality, the Euro Trader is less versatile than Metatrader. It is suitable for those who use third-party signals and who need a convenient platform for quick trading, without extra windows, partitions, and details.

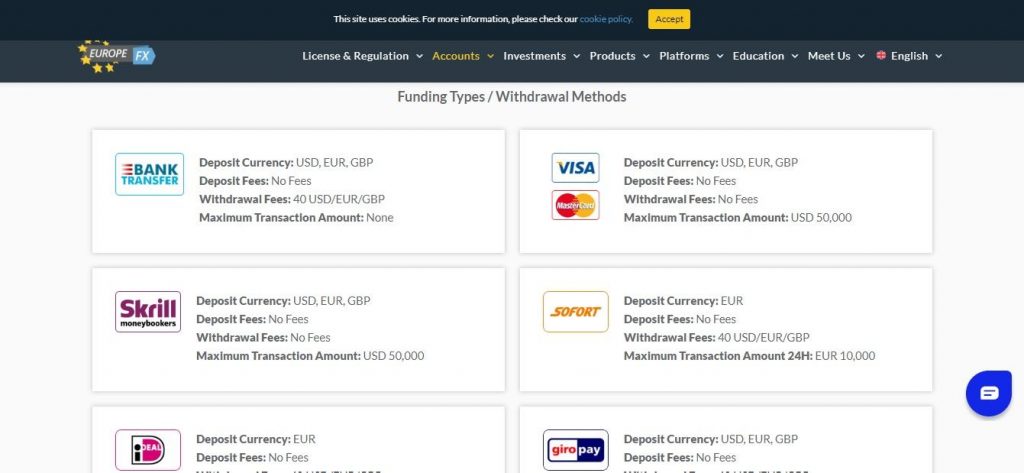

Deposit replenishment and withdrawal

The company does not limit the possibility of depositing and withdrawing funds. Details are available: VISA, Master Card, Paypal, Skrill, SOFORT, Safe Pay, as well as direct bank transfer (for corporate entities). The company does not set any fees for depositing or withdrawing funds. A small commission can be charged only by the payment system at the established tariffs. Processing of requests for withdrawal of funds is carried out around the clock, and funds are entered into the account within 1-5 minutes after depositing.

Auxiliary services

The company has opened access for clients to trade Forex, CFD, indices, bonds, cryptocurrency, and futures. One of the largest lists of financial instruments is offered (the number of assets exceeds 150 units). In addition to traditional trading, the client can use the Mirror Trading service. This is a classic format for copying trades with automatic execution.

On the special section page, it is enough to select a managing trader from the extended list. Estimate potential profitability, average trader’s drawdown. Next, connect the signals to your account, fully automating the trading.

Also on the site separately available educational and analytical section. You can use the news service, watch webinar recordings from financial market experts. Economic calendar, forecasts, technical analysis – everything is available for free to users in an expanded format.

EuropeFX Company deserves the attention of a potential trader. True, the site is not translated into some of European and Slavic languages. Therefore, the range of potential customers is limited.

The rest can be distinguished benefits. This and the lack of bureaucratic delays in opening an account, and many financial instruments, and the lack of fees for withdrawal of funds.

With a minimum deposit of 200 euros, the EuropeFX broker is available to many traders. The target audience includes both beginners and experienced participants in financial markets.

Leave a Reply