Source: Bloomberg

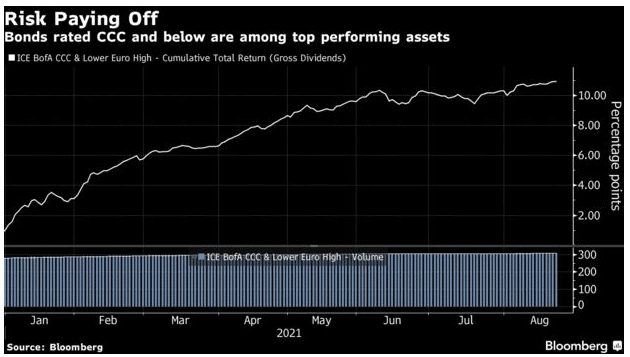

European investors are gaining 16.3% annualized returns from the bonds at CCC rating and below, compared to an annualized return of 11.7% last year.

- Bank of America analysts now rank the bonds among the highest performing asset classes this year despite concerns about whether the returns will weather the tough U.S. high-yield market.

- The equity volatility gauge VIX surged the highest since May, with subscription in bonds from McLaren Finance PLC rallying at the highest.

- The Bank of America is anticipating 60 billion euros or $70 billion in high-yield upgrades this year as corporate defaults levels at 2% from March.

- More firms like Raffinerie Heide are joining the market, with the increasing demand for junk bonds.

- Investors in the subordinated bank bonds are also reaping big, with the likes of Piraeus Financial Holdings’ 500-million-euro bond gaining 50% to around 97 cents on the euro.

Leave a Reply