Euro Hedge is an expert advisor that has been around for quite a while, having been introduced to the Forex community on March 29, 2021. Since then, it has been activated 20 times. Also, hundreds of traders have downloaded the demo version. We evaluate it to see if it has potential to benefit traders.

Detailed Forex robot review

Euro Hedge is being marketed on the mql5 website. Here, you can find the price of the robot, its features, parameters, publication details, vendor’s profile, and some client feedback.

The specific features of the robot are:

- Trades with EURUSD, GBPUSD and XAUUSD currency symbols

- The suggested leverage is 500

- A minimum balance of $5,000 with a start lot of 0.01 is needed

- Traders are advised to use hedging accounts

The person responsible for developing this product is known as Sugianto and is situated in Indonesia. He has also developed other products like Dunia Maya, South East EA, and Trendline Trader etc. No other useful details are given though. His second name, experience, contact details, and competencies are unknown. This is a red flag that we cannot ignore. Sugianto is probably an amateur trader hiding behind a decorated sales pitch.

Euro Hedge strategy tests

Euro Hedge applies a variety of strategies. They include hedging, averaging, pyramiding, lot martingale and anti-martingale strategies coupled with the ability to close partial losing positions. The main goal is to get in and out of the market as fast as possible so as not to be trapped by sudden market changes.

However, the developer should have taken the time to explain each approach in detail especially for the sake of novice traders. It is easy for new traders to become confused by these approaches.

There are no backtest results to show us how the robot performed in the past. We are thus forced to question the workability of the strategies on board. The provision of tangible proof is one of the most effective ways to convince traders to purchase a product. Since such evidence is lacking, traders may have second thoughts about investing in this tool.

Live account trading results

The vendor has provided links to the EA’s live trading results. Unfortunately, they are unverified by trusted third-party sites like FXBlue, FXStat, or Myfxbook.com. Anyways, we have decided to have a look at them just to have a clue about its performance in the real market.

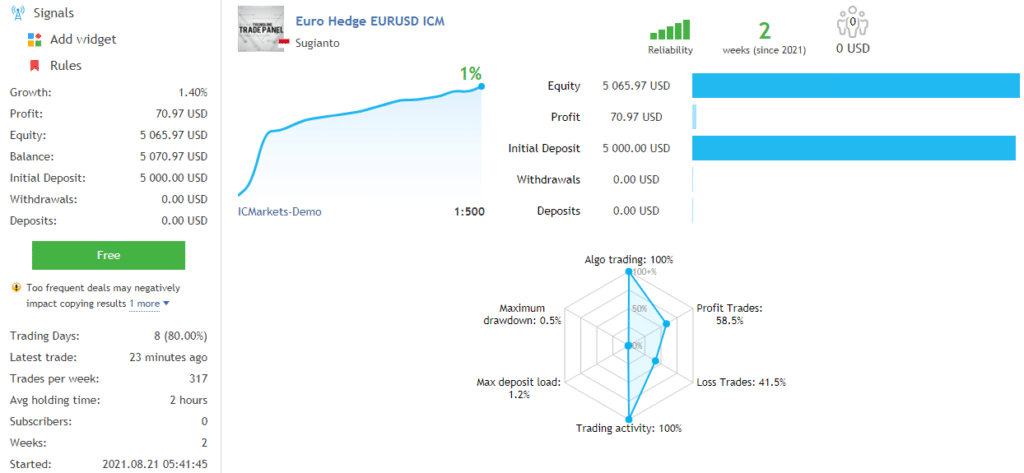

This is a real USD account that has attained a growth of 1.40% since its inception. The profit amount which is $70.97 has caused the balance to increase from $5,000 to $5,070.97. The drawdown is small as it currently stands at 0.5%. To date, the profit trades are 58.5% and the loss trades are 41.5%. The EA has traded for 8 days and the average holding time for a trade is 2 hours.

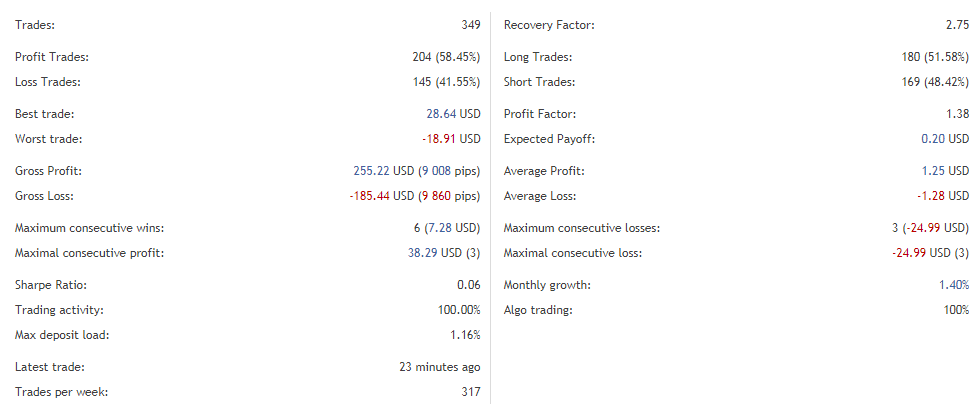

The number of trades conducted is 349. The win rates for long trades and short trades are 51.58% and 48.42% respectively. These outcomes are very poor as they point to an account struggling to make profits. The profit factor of 1.38 also shows us the dire situation of the account. The average loss (-$1.28) is slightly higher than the average profit ($1.25).

Pricing

Euro Hedge is priced at $349. There are also 2 renting packages. You can either rent it for a month at $99 or for 3 months at $199. We could not help but notice that these pricing plans are too high especially when compared to other EAs in the market. Worse still, a money-back guarantee is not offered. So, traders may ignore this product due to its cost-restrictive nature.

Customer reviews

There are only two client testimonials on mql5. Both are positive. But there is a problem. The customers may have been influenced by the vendor to leave positive comments. It is also possible that the reviews are made up. The many ifs are enough to make us doubt the reliability of the feedback.

Our evaluation of Euro Hedge has led us to conclude that it is not worth your money. The vendor fails to provide crucial information such as verified trading results, backtest report, his credentials and detailed explanations of strategies used.

Such info would have enabled the trader to make an informed decision on whether to buy the product or not. The lack of reliable customer feedback even makes it harder to know if the system is benefiting traders.

Leave a Reply