Source: WSJ

The European Central Bank is giving its banks incentives in the firm of liquidity pools to boost lending to cash-strapped businesses. DAX is up +0.11%, EURUSD is up +0.09%.

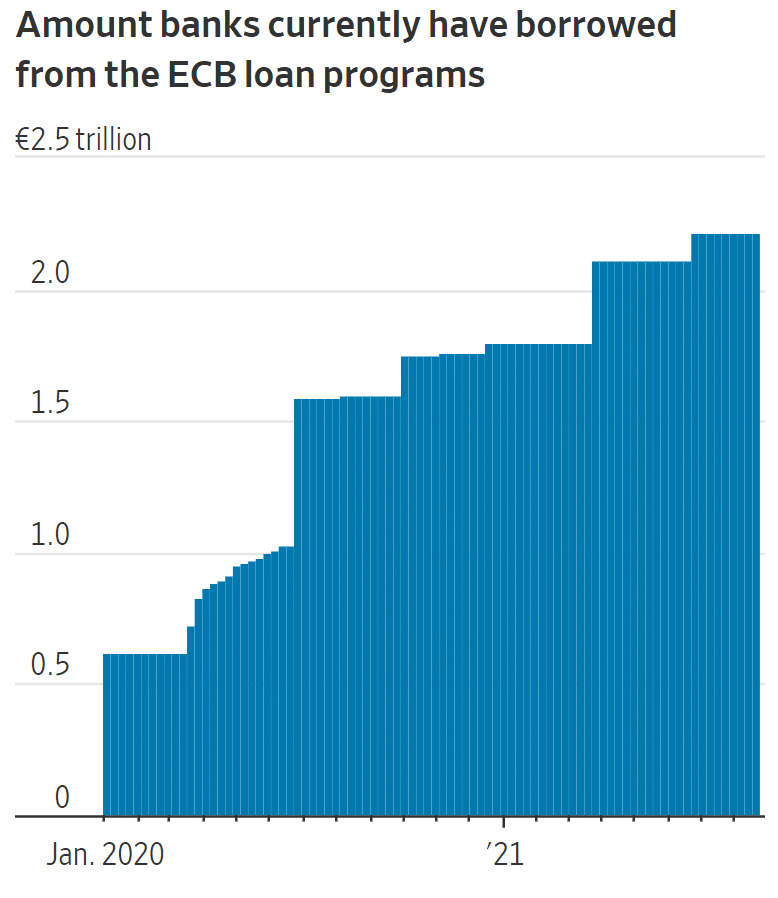

Fig: Borrowings by ECB Banks

- Through the 2014 liquidity boosts known as targeted longer-term refinancing operations or TLTROs, ECB aims to boost lending to tackle a credit crunch created by the coronavirus pandemic.

- The ECB has further lowered the interest on its loans to a minus 1% rate, implying that banks are getting paid by the central bank to borrow.

- An ECB spokesman says the TLTROs have minimized the need for lenders coming to the market to seek funding, reducing costs.

- Analysts have welcomed the borrowing relief from the ECB but say it only offers limited relief amid losses of income in a sustained negative rate economy.

- The analysts add that banks continue to experience margin squeezes on what they charge on loans versus the earnings on deposits.

- In June, ECB banks borrowed about 110 billion euros or $129 billion from the ECB as they took advantage of TLTROs. The borrowing brought the total outstanding amount under the program to at least 2 trillion euros, up from 1 trillion euros before the rate cut.

Leave a Reply