Source: ECB

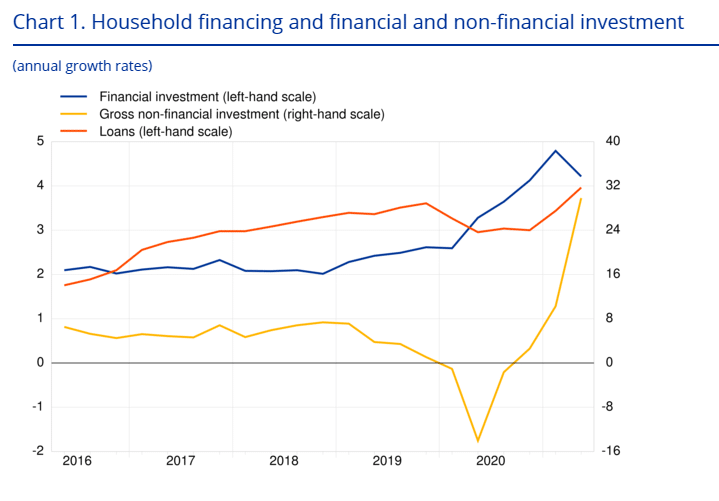

Households in the euro area posted a 4.2% annual increase in financial investment in the second quarter of 2021, a decline from 4.8% registered in the first quarter. DAX is down 0.28%, EURUSD is up 0.36%.

- Gross disposable income rose by an annual rate of 4.9%, a higher increase compared to 1.0% in the first quarter. The gross savings rate by households fell slightly to 19.1% from 20.6% in the first quarter.

- Households’ net worth grew by a lower 6.5% annual rate, compared to 7.4% in the first quarter. Housing wealth rose at 5.0%, compared to 4.7% in the first quarter, as the debt-to-income ratio hit 96.7% from 94.9% in the second quarter of 2020.

- Investments by non-financial corporations’ financing were unchanged at 2.2%. Gross operating surplus by non-financial corporations rose by 30.0%, up from only 8.5% in the first quarter.

- Net value contributed by non-financial corporations rose at an annual rate of 24.9%, a higher uptick compared to 0.6% in the first quarter.

- The debt-to-GDP ratio by non-financial corporations fell to 81.7%, from 82.1% in the second quarter of 2020. The non-consolidated debt measure widened to 144.9%, up from 142.9% from the prior year.

Leave a Reply