- Germany’s current account had declined 29% to €21.30 billion in April 2021 from €30 billion (a decrease of €8.7 billion).

- The ECB is expected to release the policy statement on July 8, 2021.

- Homeowners in New Zealand have been warned of an increase in mortgage rates, with the OCR expected to be reviewed upwards in November 2021.

The EURNZD pair added 0.37% as of 8:54 pm GMT on July 7, 2021, from the previous day’s close. It opened trading at 1.6818 and made a high of 1.6878.

The pair rose ahead of Germany’s current account data scheduled for release on July 8, 2021. Germany’s current account balance in April 2021 stood at €21.3 billion, with expectations rife of an increase in payments.

In the last financial record by the Deutsche Bundesbank, the current account had declined 29% from €30 billion (a decrease of €8.7 billion). Lower services and a shrinking surplus on invisible transactions (current) drove the decrease that also affected the surplus of the goods account.

The ECB announced a decrease in the indicator of the composite borrowing cost to 1.46% (-10 basis points). Households seeking new loans to purchase houses also had their interest rates unmoved at 1.32%. While Germany’s industrial production rate for May 2021 (MoM) decreased -0.3%, it had increased 17.3% Year-on-year (adjusted by price).

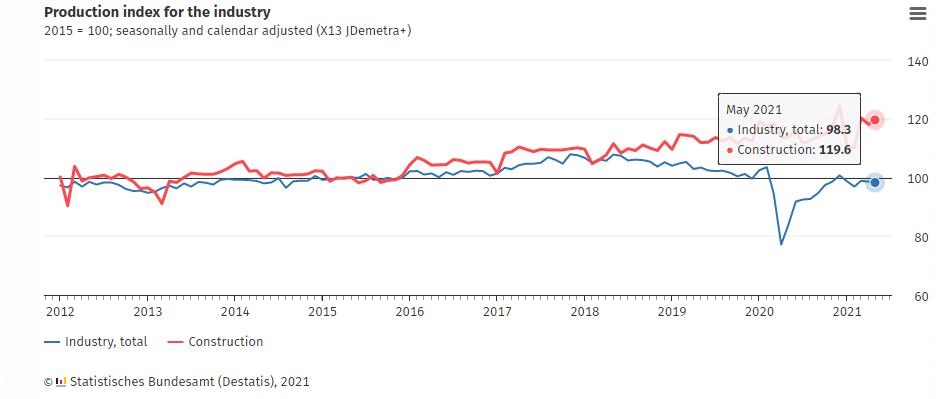

Germany’s Production Index

May 2021 saw the production of consumer products rise 4.1%, with the construction index at 119.6 (+1.3%). Capital goods lowered by 3.4%, together with energy production at -2.1%.

Germany is slated to release exports data on July 8, 2021, for May 2021 (MoM), with consensus estimates at 0.6% from a low of 0.3%. Imports are also expected to surge to 0.4% from the previous deficit of -1.7%. An increase of the trade balance from the forecast at €15.4 billion from €15.9 billion will positively impact the euro.

Monetary Policy Statement

The ECB is expected to release the policy statement on July 8, 2021, to underscore the economic conditions governing the bank’s purchase of assets in the wake of the pandemic. In its last meeting, the ECB retained refinancing interest rates at 0.00% (on main operations), 0.25% (rates on marginal lending), and -0.50% (rates on deposits). The bank’s governing council admitted that it would consider raising the rates after inflation rose to a level close to the marginal target of 2%.

March 2022 remains the target date for terminating the asset purchase program based on the pandemic emergency purchase program (PEPP), costing the ECB €1.850 trillion. Monthly asset purchases were set at €20 billion to help accommodate the policy rates until the bank decides to raise the rates.

Higher rates in New Zealand

New Zealand’s ASB (bank) has indicated that mortgage rates in the country will be hiked, preparing the way for higher repayment terms.

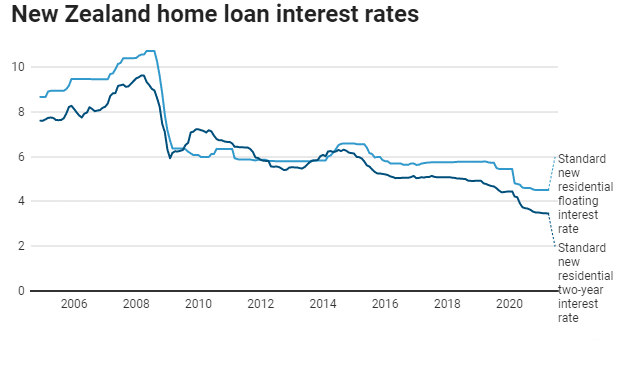

NZ Mortgage rates

The cost of servicing 2–5-year mortgages as of 2021 is lower (for longer-term interest rates) as compared to mortgages acquired in 2006. The rates are yet to reach pre-Covid levels.

According to economists, the rates for home loans will increase 1%-2% by the year 2025. Additionally, the official cash rate (OCR) set by the Reserve Bank of New Zealand (RBNZ) may be hiked from its 0.25% baseline by November 2021. This rate may peak at 1.5% in Q4 2023 or 2024.

Technical analysis

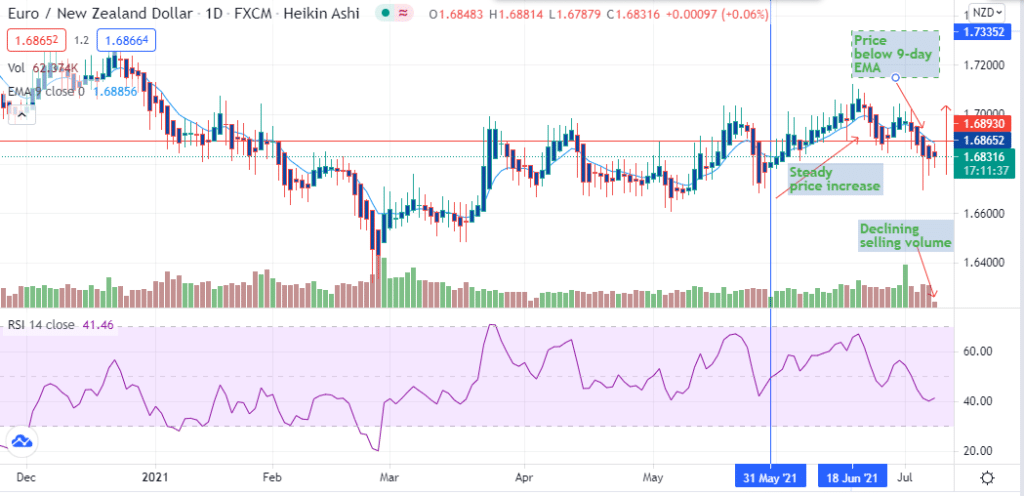

The EURNZD pair may turn bearish after the steady price movement started on May 31, 2021. At 1.6865, the pair is moving below the 9-day EMA which is at 1.6886.

Declining selling volume indicates that there is an increase in buying momentum. The 14-day RSI is at 41.36, supporting a bullish view. The trading range is expected to hit a low of 1.6832 and may retest 1.6893.

Leave a Reply