- The ECB is set on divesting from fossil fuel resources.

- Green bond purchases by European banks reached €20 billion in 2021.

- London-based banks have to increase their investment in Europe to continue operations.

The euro fell 4.37% against the British pound from its 4-month high of 0.9255. The pair traded at a low 0.8851 on January 27, 2021, amid the news that the European Central Bank (ECB) was shifting its financial policy towards green bonds. This move appears as a distraction from the ECB’s primary focus on price stability. However, the bank has argued that climate change affects remittances by impacting inflation and hindering credit flow in the economy. This situation comes as the Bank of England (BoE) is also under pressure to buy green bonds. Further, the sterling has stabilized in the first quarter of 2021, with UK companies facing tough decisions post-Brexit.

Green bonds

In what is threatening to be a massive game-changer, the ECB is threatening to abandon the funding of bonds related to fossil fuels. The divestments from coal, oil, and gas resources would see Europe lose out on massive resources. In 2015, government taxes on oil & gas in the 28 European nations plus Norway amounted to €420 billion (2.7% of the EU’s GDP). This amount exceeded the total revenues gained from renewable sources such as wind and solar. While the world is moving towards a green economy, market neutrality would help the ECB enhance a green economy while boosting recovery.

The ECB had acquired (in the euro region) 24% of green bonds (listed as eligible in the public sector) while its corporate green bond hold reached close to 20%. On the downside, divestment from fossil fuels will cause high volatility. Expectations are rife that the euro’s decline may be short-term. Lawmakers in the UK are also warning the Bank of England (BoE) against buying bonds or debts of companies emitting pollutants.

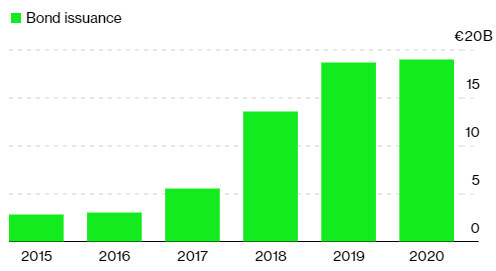

By 2020, European banks neared €20 billion in green bond purchases.

While the UK is looking to attain net-zero emissions by 2050, it still wants to maintain neutrality. Central bankers in the region are careful in the shift towards green economies. In the long-run, the British pound will favor fossil fuel investors. Brexit has, however, derailed the transition with British lenders at a crossroads with the ECB.

Building out

British international banks located in the eurozone have been asked to hold their operations in the EU as they transition post-Brexit. These banks will be required to increase their investment in the area to serve clients as the ECB updated its standards according to the Brexit agreement.

London-based lender TP ICAP Plc reported that the ECB prevented it from serving a significant portion of its EU clients. The bank failed to relocate sufficient staff to Paris. On January 4, 2021, a total of €6.3 billion ($7.7 billion) was lost by London lenders in stock trades due to this shift. The euro gained by 2.2% in the early week, trading against the GBP from 0.8848 on January 1, 2021, to 0.9043 on January 4, 2021. Continued pressure from ECB towards London lenders will drive the euro higher.

Technical analysis

In the short-term, the EUR/GBP pair faces a downside with the 14-day RSI at 32.459. The sell position is also supported by the stochastic RSI that indicates oversold at 0.000. The ultimate oscillator is at a low of 42.711, suggesting a sell position. The 50-day SMA gives support at 0.8871, while the EMA is at 0.8867.

Indications show that the GBP is gaining strength over the EUR post-Brexit. However, the ECB’s pressure on UK banks may tilt the trendline.

Leave a Reply