- Germany’s trade surplus was accompanied by a positive current account in the balance of payment (BoP) at €13.1 billion (+84.51%) for May 2021 (YoY).

- The ECB incorporated climate change into its action plan in its monetary policy statement with reflections on environmental sustainability as a financial requirement.

- The Australian government tightened its Covid-19 restrictions in the city of Sydney, forcing the ASX 200 Index to lose A$35 billion (1.6%).

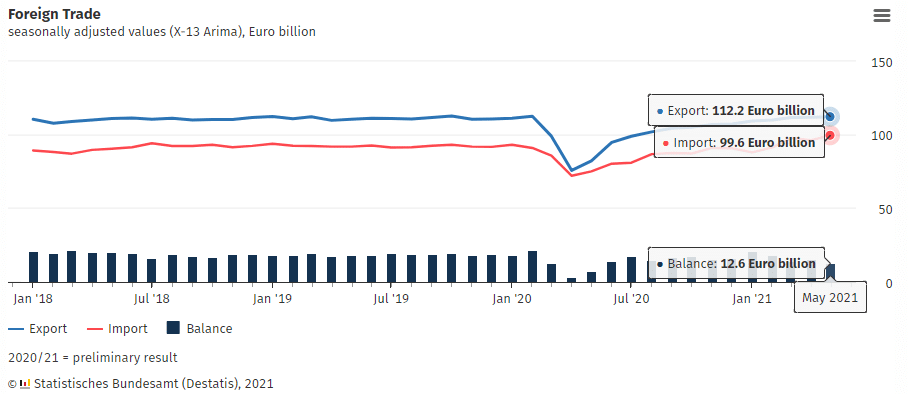

The EURAUD pair added 0.18% as of 9:21 pm GMT on July 8, 2021, from the previous day’s close. It opened at 1.5938 and hit a high of 1.5970. The euro was bolstered by heightened economic activity in Germany noted by an increase in imports to €97.1 billion at +3.4% for May 2021 (MoM). On seasonal adjustment, imports stood at €99.6 billion. It beat expectations at 0.4% and rose from a previous decline of -1.4%. On annual terms, this growth represented an upward revision of 32.6%.

Trade balance

Exports for May 2021 also surged to €109.4 billion, representing a +0.3% rise (MoM) and +36.4% (YoY). On seasonal adjustment, exports were valued at €112.2 billion.

Germany’s trade balance

The foreign trade balance (from exports and imports) declined to €12.3 billion (€12.6 billion on seasonal adjustment) from a previous reading of €15.6 billion. The trade surplus was accompanied by a positive current account in the balance of payment (BoP) at €13.1 billion (+84.51%) for May 2021 (YoY) from a low of €7.1 billion in 2020.

French economic growth

On July 8, 2021, Bruno Le Maire-French, Minister of Finance, aimed at a 5% economic growth for France in 2021. The growth was intertwined with the administration of Covid-19 vaccines that would help achieve economic recovery.

A total of 111,284 deaths were recorded, with those testing positives for Covid-19 at 5,162,157 (since the start of the pandemic). The vaccination rate of the country is at 34.3%. About 23 million people have been fully vaccinated from an administration of 57.2 million doses.

ECB Monetary Statement

In its Monetary Statement, the ECB aimed at an inflation target of 2% to maintain the price stability of the euro. To assess this stability, the bank confirmed the application of the Harmonized Index of Consumer Prices (HICP). The index will include owner-occupied housing to represent inflation among households in the eurozone.

The bank also incorporated climate change into its action plan with reflections on sustainability. It plans to set up indicators in 2022 that will guide in rolling out green financial systems to guide credit ratings.

Australia’s restrictions

The Australian government tightened its Covid-19 restrictions in the city of Sydney following a surge in positive cases. Despite the imposition of a 2-week lockdown, the state government of New South Wales (NSW) reported 38 cases on July 8, 2021, bringing the tally to 370 cases of the Delta variant. In response, the ASX 200 inched 1.6% lower on July 9, 2021, shedding off A$35 billion from the market.

About 2.02 million people, representing 8% of the population, have been fully vaccinated out of 8.57 million doses administered.

To help curb the situation, the government intends to send 300,000 Pfizer and AstraZeneca vaccines with supply problems engulfing the rollout. The National Australian Cabinet is set to meet on July 9, 2021, to discuss the transitional plan of the Covid-19 response.

Technical analysis

The EURAUD pair established a trading range from June 3, 2021, to July 8, 2021, with an uptrend preceding the pattern. Price consolidated at 1.5751, and a breakout from the range upwards may see the pair move towards 1.6023.

There is a high buying momentum, with the 14-day RSI at 67.89. If a price reversal occurs, it’s likely to decline to the down border of the range at 1.5635.

Leave a Reply