The company ETX Capital has had time to change the name and complete rebranding for several years of existence. It used to be Tradition UK. Nowadays ETX Capital is regulated participant of financial markets, which gives access to trading for citizens of different countries (except the United States of America.)

English company Monecor Ltd possesses the rights of this trademark. Thus, this forex broker makes key calculations in pounds sterling, and not in US dollars.

General information about the activities of the ETX Capital

• The minimum deposit is £ 100;

• Maximum leverage level is 1: 400;

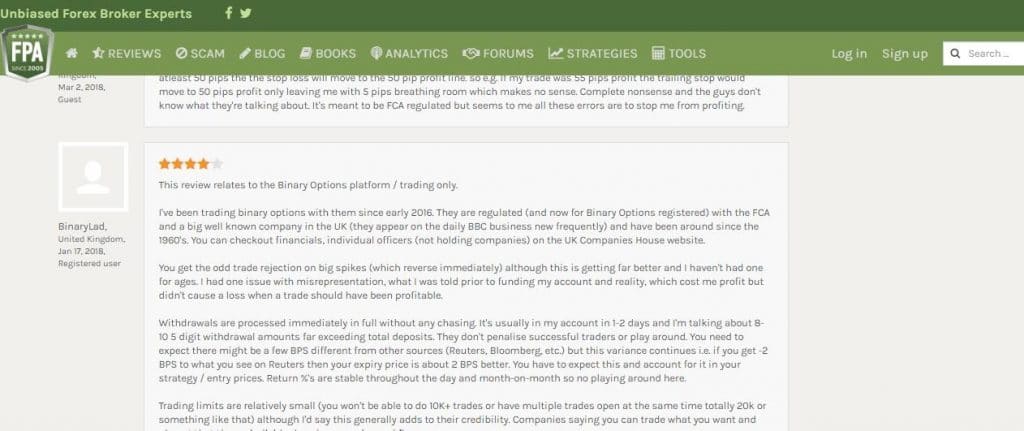

• Availability of a regulator – ”Yes”, FCA;

• The presence of welcome bonuses – “Yes”, it is 60% of the amount of deposit;

• Free demo account – “No”.

Precisely the absence of free demo account can be a deterrent factor for many traders.

Opening account with the fx broker.

Regardless of the amount of initial deposit each new client gets welcome bonuses. But you must write for this directly to the service desk on your own and provide the initial data (account number, scan-copy of documents that confirms the transaction). When you deposit £1000 thousand you will get £6000 thousand as a bonus (this is the maximum sum) But they are transferred to the bonus account. You cannot withdraw it; this money is available only as insurance and deposits your working assets. In order to withdraw the bonus money, you must have a business volume from 300% from accrual amount. Although, such rates are hard to gain (the term is restricted, within three months from the moment of deposit).

The registration at this broker is not complicated with the verification. Thus, it takes you several minutes to open access to the trading completely. You have to fill in the form for registration. The questions for the user are indicated there right down to the origin of money. The moderator has to confirm this information.

If you are a newcomer user, the company gives you access to training material for free. But they have no informative value. The question is about several recorded seminars on the trading topic.

Trading terms of ETX Capital broker

Company EXT Capital gives expand access to financial markets. In a point of fact, the client can trade in Forex market, index market, precious metals, and raw materials, obligations and companies’ shares. A total number of assets surpass traditionally 120 points. This company’s spreads don’t differ from the commission of other brokers. In average, the meanings rotate from 0.3 to 2.3. Keep an eye out the meaning the most volatile assets.

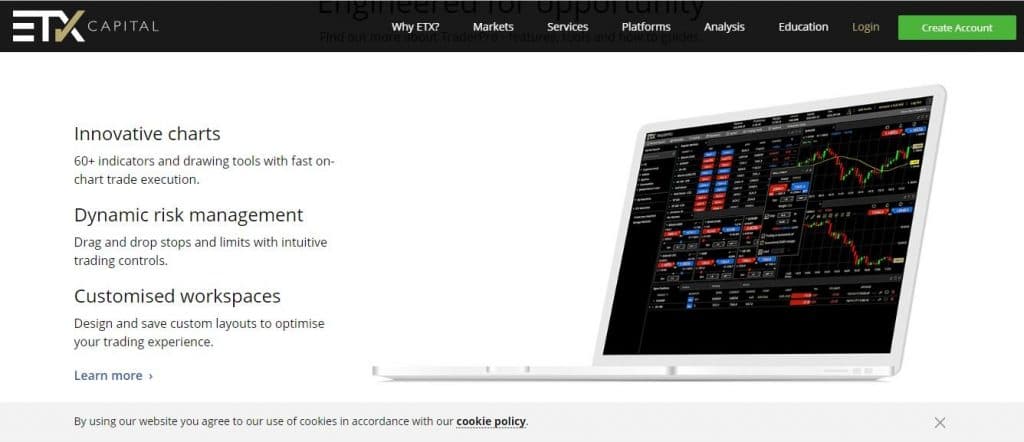

Trading terminals

It is very important that the company ETXCapital allows traders choosing a trading platform for work independently. For example, own company’s design terminal ETX Trader Pro is available. The access to it opens from the browser directly. All functionality repeats Metatrader. That is why the trader will not feel slighted.

The company used to give access to trading of binary option. Now due to regulators’ protest, such possibility is not available.

The range of additional possibilities for traditional trading is a pleasant bonus. For example, “one-click trading”, connect automatic forex robots, advisors, signal trading. Broker ETX Capital does not restrict mobile trading. You can control new analytics, graphics and, open orders.

All about deposit and withdrawal from ETX capital

The company does not make an unnecessary restriction on deposit and withdrawal. For a transaction with account the direct bank transactions, VISA/ Master Card, and electronic purses are also available. The transaction is processed within one day though bank card. If it is a direct transaction to the account, the processing will take three days or less.

A small commission is for withdrawal sum up to 100 pounds. All that is more than this sum can be withdrawn for free. The withdrawal details must be identical to those from which the account has been deposited.

Highlight the key advantages and disadvantages of the broker’s work (based on feedbacks)

Advantages of trading with ETX Capital:

• Expanded number of financial instruments;

• A relatively small minimum deposit;

• Big bonuses charged when the first deposit;

• The presence of a regulator;

• Absence of scandals from the company.

Disadvantages of trading with ETX Capital:

• Demo accounts are not available;

• The training section is not informative;

• The process of rebranding since its creation.

Leave a Reply