- Cryptocurrencies under selling pressure

- Ethereum is down 58%

- Ethereum staking for passive income

Cryptocurrencies have lost a significant market value over the past six months. Double-digit percentage losses have come into play in one of the longest sell-offs. The crypto crash in play makes it increasingly difficult to make money in the market.

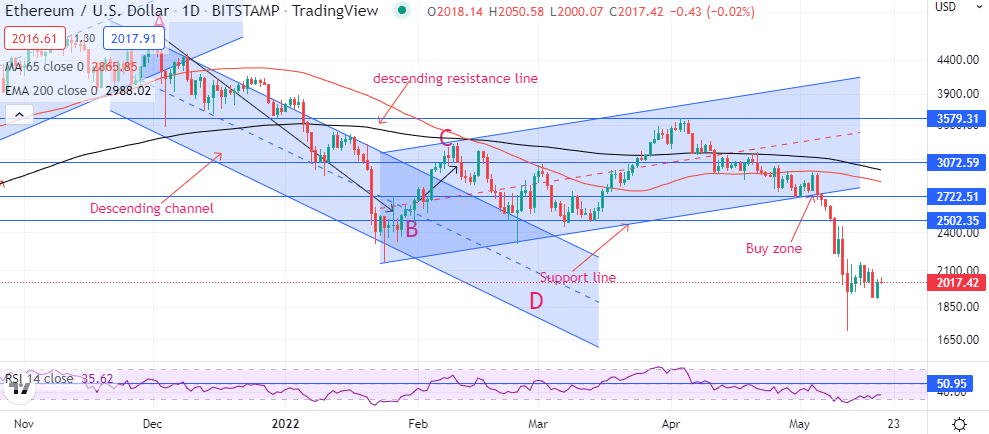

Ethereum technical analysis

Ethereum has already lost more than 50% in market value after plunging from highs of $4,800 a coin to current lows of $2010. The coin is already deep in the oversold territory with no reprieve amid the ongoing sell-off in the broader cryptocurrency industry.

ETHUSD faces an uphill task to stay above the pivotal $2,000 handle. A drop followed by a daily close below the critical support level could reignite renewed sell-off, resulting in the coin plunging back to lows of $1,700 a coin.

While all the major indicators led by the Relative Strength Index signal bearish momentum, the prospect of the coin edging lower is high as it is also trading below its 200-day moving average, however, ETHUSD rallying and finding support above the $2,100 could reignite hope of a potential bounce-back, probably back to the $2,500 level.

Below the $2,000 level, everything will be doomed for the second-largest cryptocurrency by market cap, which would be vulnerable to further losses.

While the focus is usually on making money on the Ethereum cryptocurrency racing higher, that’s not the only option. Staking of Ethereum tokens to help secure the network and validate transactions on the blockchain provides a reliable avenue of generating some passive income on the side.

Ethereum staking

While Ethereum blockchain started out as a proof-of-work model, it made the big leap into the proof-of-stake model in December of 2020 with the introduction of the Beacon chain. With the big switch, it’s become increasingly possible to stake Ethereum tokens.

Staking is essentially the process of committing tokens into the network. The networks are, in return, used to verify transactions and secure the network. During staking, one cannot sell or use the tokens for any other purpose.

How much money one can make while staking Ethereum tokens depends on a number of things. First, it depends on the exchange one is using, as they offer different annualized yields. Some exchanges are known to offer yields of up to 10%.

In addition to the yield on offer, the rate of return would depend on the length of staking the tokens. Anyone who stakes their Ether tokens much longer stands a fair chance of earning more on staking more tokens.

The rate of return will also depend on the prevailing price. During periods of Ethereum price spikes, rewards from staking are usually high, given the high Ether prices. Therefore, staking offers an ideal opportunity to generate significant returns in the form of rewards while also taking advantage of any price increases.

The only major downside to Ethereum staking is the inability to sell staked tokens. Cryptocurrency exchanges require people to stake ETH tokens for a predefined period. During this period, one may not sell their tokens even if the Ethereum price is declining. The inability to sell the tokens can be problematic as one could be left with worthless coins on price tanking significantly.

Bottom line

Ethereum has tanked significantly, going by the 50% correction from 52-week highs. With the coin deep into oversold territory, a bounce-back could be in the offing on the cryptocurrency crash dust settling. The coin-finding support above the $2,000 a coin level would make it an exciting play on the risk-reward front. In addition, staking would provide an ideal opportunity to generate passive income as the coin bottoms out.

Leave a Reply