- Ethereum turns bullish

- Ethereum up 34% on March 29, 2022

- UK and US digital assets regulation bid

Cryptocurrencies are racing higher amid the growing demand for speculative assets. Ethereum is one of the coins that continue to surprise after powering through key resistance levels in the recent weeks. The second-largest crypto by market cap has been in a massive bullish rise, recouping most of the losses accrued in recent months.

ETHUSD technical analysis

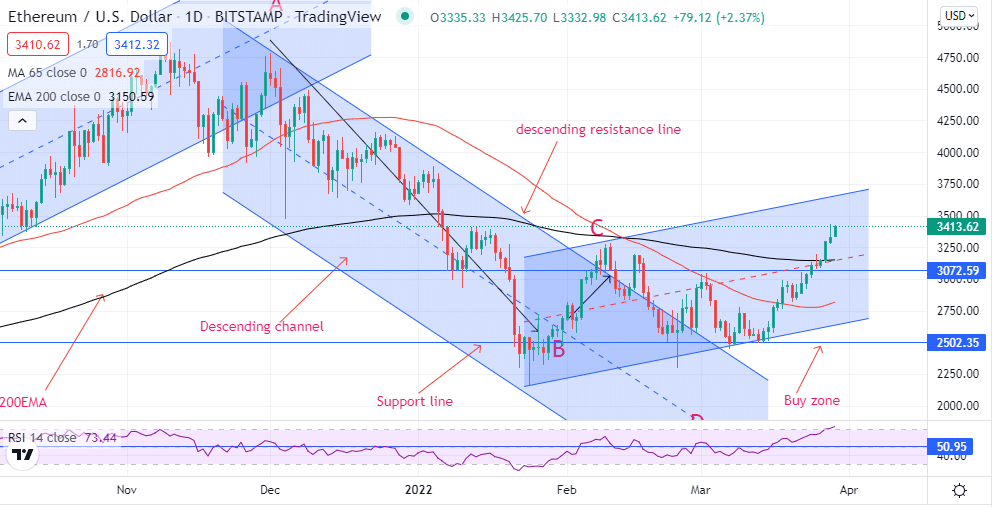

ETHUSD is already up by more than 30% in March, affirming renewed buying pressure after a steep pullback from record highs early in the year. Ethereum has turned bullish and looks set to continue posting higher highs going by recent price action.

A rally followed by a close above the $3,180 level has opened the door for ETHUSD to rally to the $3,600 mark, the next key level as part of the emerging uptrend. Price rising above the 200-day moving average affirms strong buying pressure likely to continue supporting further price gains.

In addition, the Relative Strength Index has already powered through the 50 level, affirming buyers are in control and likely to continue taking the fight to short-sellers. A daily close above $3,600 should pave the way for a $4,000 psychological level rally.

On the flip side, a pullback below the $3,200 level could leave ETHUSD susceptible to a pullback below the $3,000 psychological level. However, going by recent development on the global scene, Ethereum looks set to continue edging higher.

UK digital assets regulation

Ethereum started the week on a good note as traders reacted to news that the UK is considering regulating the burgeoning sector. While new regulations will cater to stable coins and digital assets, they are expected to be friendly to the industry, which continues to fuel demand for flagship assets.

The UK is following the US, which has also set up a multi-agency to look into ways to regulate the sector and foster innovation. The UK and the US approach have so far been positive to cryptocurrencies as opposed to a tough stance taken by China which has banned crypto trading and mining.

Russia boost

In addition to the positive news out of the UK, reports that Russia is considering requiring countries to pay for its oil and gas supplies using digital currencies offer additional support. President Vladimir Putin is under immense pressure to circumvent the hard-hitting sanctions that threaten to plunge the Russian economy into recession.

In a bid to hit back against the sanctions by the west, Russia is open to receiving crypto payments for its most valuable exports in addition to Rubble payments as the country looks it move away from the US dollar monopoly on international trade.

Ethereum upgrade

Additionally, investors have been buying Ethereum ahead of the planned blockchain transition from proof-of-work validation to proof-of-stake protocol. The transition is expected to strengthen the Blockchain’s ability to process more transactions per second and upgrade from the current 14TPS.

The upgrade will make the Ethereum blockchain more equipped to enhance the development of smart contracts and decentralized applications. Consequently, Ethereum should become a key player in decentralized finance, an area with tremendous potential.

Final thoughts

The long-term outlook is looking increasingly bullish after ETHUSD bounced back after sliding to lows of $2,170 at the start of the year. The slide came at the backdrop of a deep pullback in the broader sector. With sentiments improving amid an uptick in risk-on mood, Ethereum looks set to continue edging higher with bulls setting sights on the $4,000 handle.

Leave a Reply