Ethereum is the second-largest cryptocurrency by market cap. While cryptocurrencies have been under pressure, long-term ETH prediction remains positive.

What is Ethereum?

Ethereum is a decentralized platform running on blockchain technology. The decentralized, scalable, and secure platform is designed to support the development of decentralized applications. It also supports the development of decentralized finance ecosystems and exchanges. Additionally, it operates as a network that supports peer-to-peer payments.

As described in a 2013 whitepaper, Ethereum has evolved to become the biggest platform hosting numerous projects and cryptocurrencies. It has also grown to become a global platform that allows users to write and run software that is resistant to censorship and fraud.

Ethereum is made up of a long chain of blocks containing information that is added to each newly created block. Contents in the block are validated through the proof-of-work consensus mechanism. In addition, no changes can be made to any information in the block unless the network reaches consensus.

The Ethereum network exists on thousands of computers spread worldwide, which makes it decentralized and immune to attacks. It does not affect the network’s operations when one computer is down.

Ether (ETH) is the native token that powers the Ethereum network and can be used to buy and sell goods and services. It also acts as a medium of exchange used to settle transaction fees on the network.

ETH coins are generated through mining, which involves using powerful computers to solve complex mathematical puzzles. Correct answers to the puzzles are normally rewarded with ETH tokens. There is no cap on the total number of ETH tokens that will ever be in circulation. Currently, there are 121 million ETH tokens in circulation with a market cap of $234.62 billion.

Is Ethereum a good investment?

Yes, Ethereum is an excellent long-term investment. The blockchain project attracts strong interest from investors who believe it will be at the heart of decentralized finance in the future. In addition, it’s become a preferred platform for developing decentralized applications. Its growing use case in powering non-fungible tokens platform all but affirms its growing utility case.

However, Ether, the native token, has shed a significant amount of market value ever since it peaked at highs of $4,700 last November, ever since it has come under pressure shedding more than 50% in market value.

In recent months, the coin has plunged below the $2,000 level at the backdrop of the overall sector correcting from record highs. Investors shunning riskier assets amid concerns about the global economy and inflationary pressures have been Ether’s biggest undoing.

Amid the sell-off, Ethereum’s long-term prospects remain intact. Once the current sell-off dust settles, Ethereum is one of the coins well-positioned to bounce back and probably rally back to all-time highs.

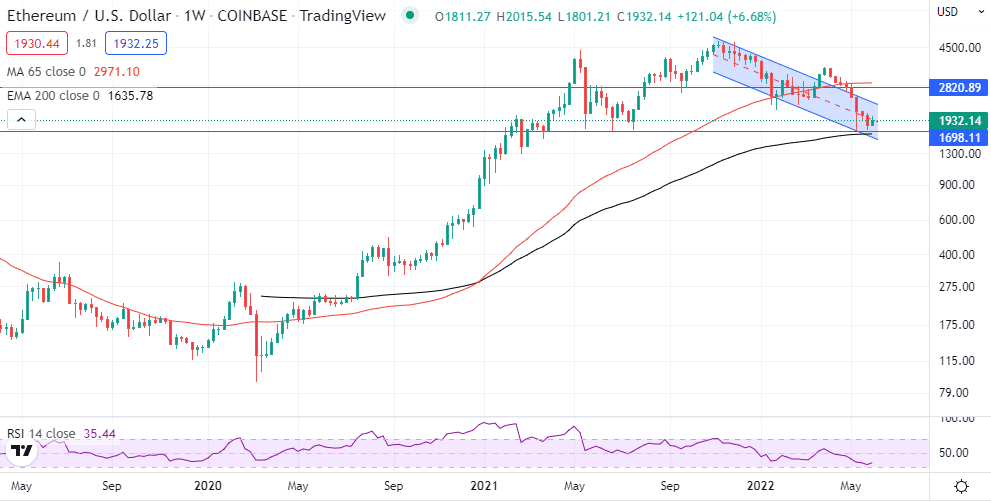

Should I buy Ethereum today: Crypto technical analysis for ETHUSD

Now may not be the best time to buy ETHUSD as it remains engulfed in a strong sell-off wave. The recent drop below the $2,000 level means the coin is susceptible to further losses in continuation of the sell-off that began late last year.

Failure to rally and find support above the $2,000 level could result in ETHUSD tanking back to the $1,700 level, seen as the next pivotal support level. On the flip side, the coin rallying and finding support above the $2,000 level could pave the way for a strong bounce back as investors rush to buy the dip.

Conversely, now may not be the best time to buy Ethereum until it rises and stabilizes above $2,000 a coin.

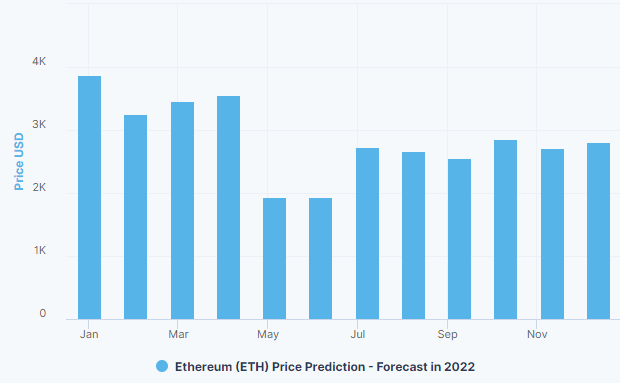

Will the Ethereum coin appreciate in a year?

A recent slide below the $2,000 level means Ethereum is flirting with oversold conditions. While the prospects of further losses are high, the coin still has what it takes to rally back to all-time highs.

Analysts at Digitalcoinprice.com expect Ethereum to bounce back and rally to highs of $2,715 before year-end, representing a 40% plus gain from current levels. On the other hand, analysts at Walletinvestor.com expect Ethereum to hit highs of $3,717 over the next year representing a 95% plus gain from current levels.

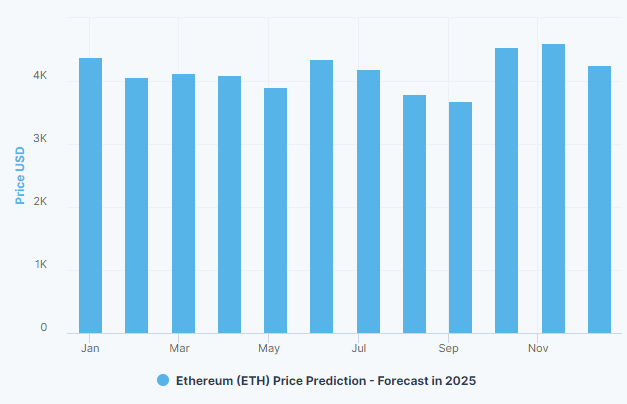

What is the Ethereum coin price prediction for 2025?

Ethereum’s short-term outlook is not encouraging as the coin remains under pressure in the market. However, that cannot be said about the coin’s long-term prospects. The growing use case of its blockchain in developing and hosting decentralized applications continues to fuel demand for the native token.

In addition, Ethereum is becoming a key player in decentralized finance and in ousting non-fungible tokens. The growing use case continues to fuel Ethereum demand. The ever-increasing use case is one factor that affirms the coin’s long-term prospects.

Consequently, Ethereum is expected to be worth more than $4,160, according to Digitalcoinprice.com estimates. Analysts at Walletinvestor.com, on the other hand, are of the opinion that Ethereum could rally to highs of $10,990 over the next five years.

The best way to buy Ethereum

The best way to buy Ethereum is through cryptocurrency exchanges such as Coinbase, Binance, Gemini, or eToro.

Leave a Reply