- Cryptocurrencies in recovery mode

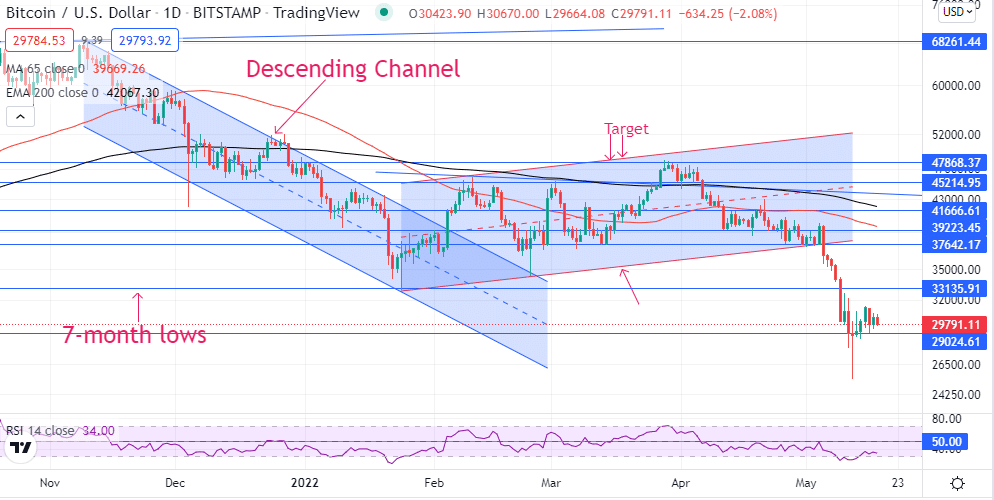

- Bitcoin struggling near $30,000

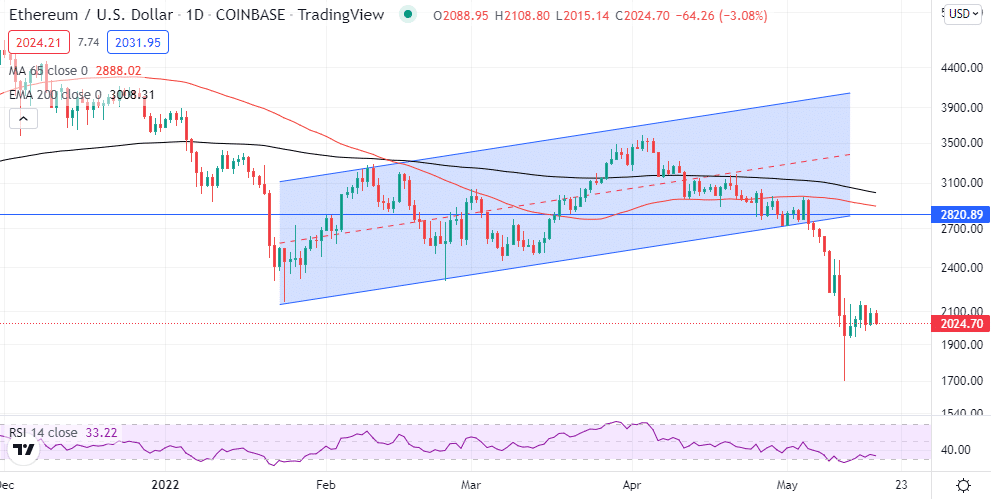

- Ethereum above $2,000 but vulnerable

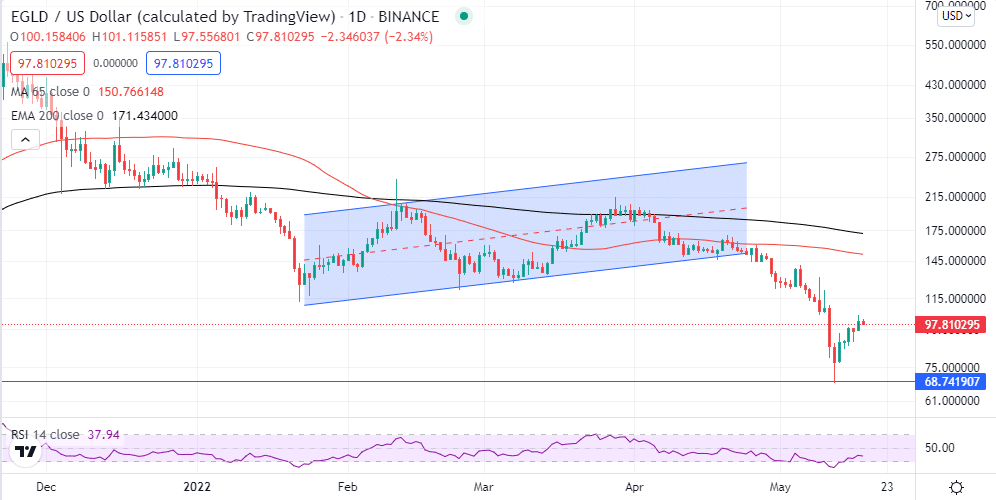

- Elrond outperforming major coins

Cryptocurrencies are in a recovery mode early Tuesday morning. However, the blood bath is far from over. Bitcoin and Ethereum are struggling to hold on to recent gains after bottoming out of 2022 lows. The recent pop-up comes at the backdrop of dollar strength easing slightly from two-decade highs.

Bitcoin below $30,000

After initially popping above the $30,000 handle, Bitcoin is struggling to hold on to the gains, with bears jumping to every opportunity to push the flagship crypto lower. A drop below the pivotal psychological level has left BTCUSD susceptible to a drop back to 2022 lows of $26,600.

On the flip side, bulls steering a rally past the $30,000 handle should fuel the prospects of further price gains as traders look to buy the coin on the dip. However, major indicators have turned bearish, signaling further downside action to continue the long-term downtrend.

Ethereum above $2,000

Ethereum, on the other hand, remains above the $2,000 level but is at risk of plunging amid the strength of the bearish momentum. After failing to power through the $2,200 handle, ETHUSD could drop below the $2,000 handle as shorts sellers take advantage of the recent bounce back.

The $2,000 level is the line on the sand below which ETHUSD could plunge to 52-week lows near the $1730 level.

Elrond outperformance

Even as Bitcoin and Ethereum show signs of weakness, Elrond shows signs of breaking out after the recent bounce back. After bouncing off 52-week lows of $68, EGLDUSD has edged higher and is on the cusp of powering through the $100 barrier.

The upward momentum has been strong, with every pull back acting as a buying opportunity from where bulls have come into the fold and helped push EGLDUSD higher. A rally followed by a close above the $100 level should pave the way for further price gains.

EGLD, the native token that powers the Elrond blockchain, continues to outperform the overall industry as many tokens remain stuck at low values. The outperformance could be attributed to the Elrond blockchain promising impressive transaction speed and low fees at a time when people are struggling to find such convenience.

The high-efficiency levels on the Elrond blockchain could be attributed to sharding. The technique allows the blockchain to be broken down into four major parts, with three dedicated to handling transactions and the fourth for coordinating information on the other three. Conversely, Elrond can process up to 15,000 transactions per second with transaction costs of as low as $0.001.

The high transaction speeds and low costs make Elrond a worthy competitor for Ethereum and other blockchains in decentralized finance. As more people put their trust in the Elrond blockchain, the native EGLD coin looks set to explode.

Final thoughts

However, Elrond, just like Bitcoin and Ethereum, could remain under pressure given the negative developments in the sector. The implosion around stablecoin TerraUSD has sent shockwaves forcing investors to be extremely cautious about digital assets.

The risk-off mood in the market, which spilled over from the stock markets following interest rate hikes, is another factor that should continue to weigh heavily on any significant price spikes in the crypto market. The dollar strength is another factor that could make it difficult for Elrond, Bitcoin, and Ethereum to power through critical levels.

Leave a Reply