Source: CNBC

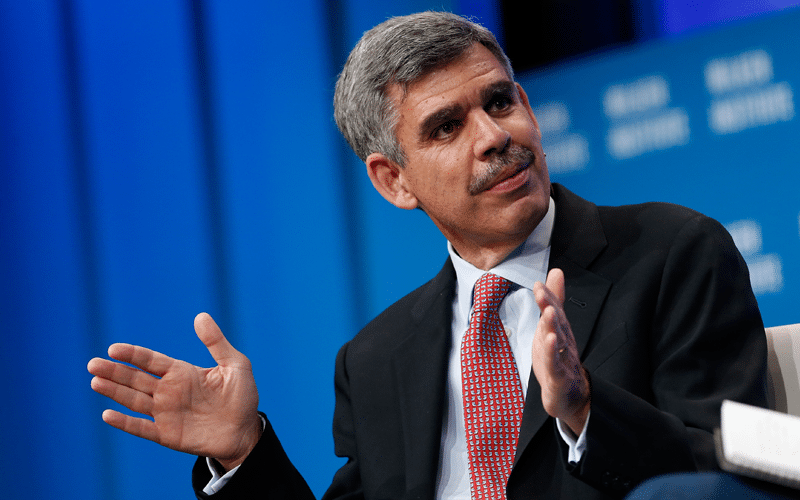

Allianz Chief Economic Adviser Mohamed El-Erian believes officials of the Federal Reserve are downplaying inflation risks which could pull the United States into another recession.

- El-Erian raised concerns on inflation as he said he sees evidence of inflation being more long term every day.

- The economist is also concerned that the Fed is falling behind and may be forced to catch up, driving more worries.

- The Federal Reserve could be pushed to hike rates and otherwise tighten monetary policy sooner than expected.

- El-Erian said recession usually comes as brakes are slammed, versus gradually slowing acceleration.

- He said data may be showing that inflation is not transitory but the market will continue to focus on Fed’s pronouncements.

- The Fed has maintained that the inflation uptick is transitory and will eventually taper down in line with its 2% target.

- The core personal consumption expenditures price index stood at 3.4% in May to mark the highest in nearly two decades or since 1992.

Leave a Reply