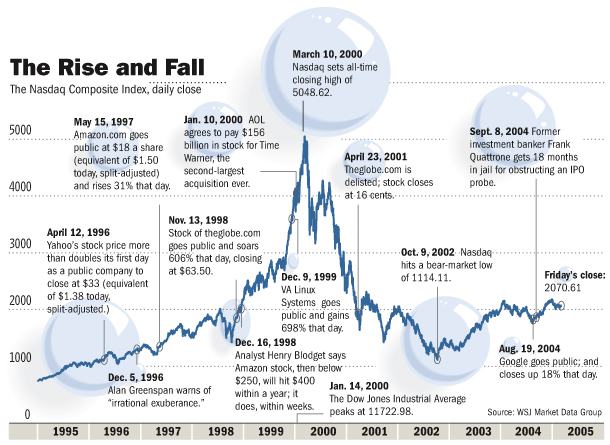

Economic bubbles leave behind a mess of carnage when they go kaboom. In the 21st century, the world of finance has already seen two major bubbles that have resulted in deep recessions after going burst. It is estimated that more than $5 trillion was wiped from the stock market after the Dotcom bubble popped in 2000.

Bubbles draw closer to popping when they turn speculative. Speculative bubbles do not come about every day. But they do have a tendency and indeed the potential to transpire from time to time. The million-dollar question here is, why do speculative bubbles occur? Do they even exist? These questions are the focus of the Efficient Market Hypothesis (EMH).

The efficient market hypothesis: Definition and explanation

Question: Does the stock market set correct prices?

The Efficient Market Hypothesis (EMH) thinks so. The theory’s core argument is that stock markets are efficient in so far as setting prices is concerned. This theory draws its beginnings from a 1960s Ph. D. dissertation by Eugene Fama, an economist.

In economics, the concept of efficiency takes on a variety of meanings, each one distinct from the other. In one sense, the concept could mean productive efficiency, referring to the non-misuse of factors of production. In another sense, efficiency could mean Pareto efficiency, referring to non-wastage of utility. Also, the concept could mean informational efficiency, referring to not being wasteful with information.

When speaking about stock markets, the type of efficiency in focus is informational efficiency. In such a market, informational efficiency is exhibited when the process of determining asset prices incorporates all the available information. It is the theoretical framework that underlies the EMH.

Economic bubbles: How they develop and eventually burst

An economic or asset bubble develops when asset prices appreciate an unrealistic rate relative to their underlying value. Two major theories have attempted to explain why asset bubbles happen.

The first one asserts that asset bubbles tend to develop when an economy’s growth momentum gains substantial speed. In such a scenario, companies’ earnings grow faster, and they increase the salaries paid to employees, and there is a general proclivity for consumers to spend more than is necessary.

For instance, a homebuyer will purchase an expensive home thinking that the price will forever go up hence making it cheaper to buy today. Investors also tend to make risky bets in the stock market in this period. The trend soon develops into a bubble as more investors join the ranks of speculators.

Alternatively, asset bubbles stem from too much liquidity in the economy. According to this theory, a growing economy increases the velocity of the money supply. Higher levels of money supply often make credit cheaply available, which means investors can lay their hands on cash relatively easily. When too much money chases fewer assets, prices tend to rise faster than expected. Extrapolate this effect to the entire economy and what you find is a massive bubble.

The theories put across solid arguments, but experts have argued that asset bubbles come out of a complex mixture of different factors. Unfortunately, many market participants and observers miss bubbles until they pop.

Explaining bubbles using EMH

EMH makes various assumptions that are central to its theoretical framework. Of them is that stock markets are efficient, and the other is that investors are rational decision-makers.

However, these assumptions have proven to be EMH’s biggest folly, according to critics. One critic argues that EMH’s insistence on the market’s efficiency implies a belief that speculative bubbles are impossible and that they do not exist. The critic goes on to say that markets cannot achieve perfect efficiency and only possible “to the extent that one can be confident that tomorrow’s prices will not diverge dramatically or arbitrarily from today’s prices, absent significant new information.”

Can then EMH reliably explain economic bubbles?

Earlier, we spoke about EMH predicating its argument on the informational efficiency of financial markets. As such, one can safely aver that financial markets can achieve efficiency. This is to say that information gets reflected quickly in asset prices.

Asset bubbles, therefore, could develop in cases of asymmetric information. Asymmetric information means different investors make trading decisions based on nonuniform information sets.

Significance of efficient market hypothesis

There are three different varieties of EMH. The strong form of the theory suggests that markets achieve informational efficiency by incorporating all the information – public, private, and confidential – when valuing a stock. However, the perfect information environment is impractical.

There is also the semi-strong form of theory. This form asserts that markets achieve informational efficiency by accounting for publicly available information when pricing an asset. From the theory’s perspective, no investor can beat market returns no matter how great they design their strategy.

Finally, there is a weak form of EMH. Under this theory, the market leverages all of an asset’s existing information, including price and trading history, when pricing it. Because this information is already accounted for in the asset’s price, no amount of technical analysis an investor does that will beat market returns.

What, then, can we learn about the significance of EMH? The main take-home here is that you should not try to outsmart the market unless you are willing to commit insider trading offenses. Instead, you are better off linking your portfolio to market performance. This way, you get to aim for the highest rates of return while remaining practical.

Conclusion

Economic bubbles are what happens when each investor wants to outdo the market’s performance. As each investor hopes to lock in the highest returns by finding and snapping up the hottest stock in the market, a rush to the top ensues, and an asset bubble begins to take shape.

The Efficient Market Hypothesis can help to explain economic bubbles and even to preempt their occurrence. However, you might only agree with the theory if you view market efficiency from the informational perspective. Ultimately, symmetric information encourages investors to make rational decisions and to avoid irrational exuberance.

Leave a Reply