Seasoned traders, as well as newcomers, prefer to trade in the GBP/AUD since it is a highly volatile and liquid currency pair. But in order to be successful, you need to follow the latest news updates, monitor the real-time chart situations, and keep an eye on the exchange rate. Since the market is highly unpredictable, you may end up losing all your money if you don’t know the ins and outs of this particular pair.

GBP/AUD history

The history of the pound sterling is a long one, and it can be traced back to the late 8th century. In the year 1971, the decimalization of currency led to its evolution, and today we have the GBP in its present, contemporary form. In the international Forex market, the GBP ranks fourth in the list of most popular currencies, and hence, it represents a considerable volume in daily trading.

Before the 1960s, the Australian Dollar was known as the Australian pound. The archaic imperial system was ultimately replaced by the Australian government. The close proximity of the nation to the Asian countries means that this currency is affected by the flow of business between Australia and these countries.

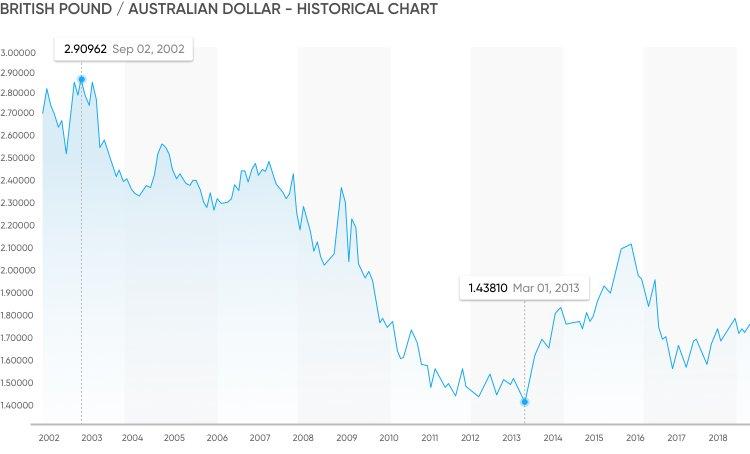

The exchange rate history of the GBP/AUD pair is shown in the figure above.

Factors influencing the GBP/AUD

These are the major factors that influence the GBP/AUD pair:

- News: Like all currency pairs, the GBP/AUD pair is also affected by major political events all around the world, and so you should always keep yourself updated with news related to Australia and the UK. The local news channels regularly release news updates, and a serious trader dealing in the GPP/AUD pair must follow them religiously.

- Export of goods: Australia exports different materials like gold, natural gas, coal, and iron ore. The prices of these key commodities greatly affect the value of AUD, thus, in turn, influencing the price of the GBP/AUD pair.

- Trade between the two countries: The United Kingdom and Australia trade with each other frequently. In the list of top foreign investment sources in Australia, the United Kingdom ranks second, and additionally, it is one of the major countries with which Australia conducts two-way trading. The GBP/AUD exchange rate reached its peak in 2001 ($3.028), while the lowest ($1.361) was back in 1985.

- Monetary policy in the United Kingdom: This refers to the measures taken by the UK’s central bank to regulate the flow of funds to individuals and businesses. It is done to efficiently manage inflation and growth. Monetary policy is generally controlled through the change in interest rate since it influences the way people save and borrow money, with the likelihood of borrowing increasing with the decrease in interest rate.

- Market conditions in the United Kingdom: The UK has one of the largest economies in the world, and in the European Union, its economic dominance is rivaled only by Germany. Since 2008, when the entire world suffered from an economic crisis, the UK has managed to revive its economy, but there is a lot of uncertainty due to the probable outcome of the country exiting the EU.

- Australian monetary policy: Many investors choose to trade in the AUD/JPY pair, and due to this, the pair has a high-interest spread of 4%. The Australian Reserve Bank changes the interest rates to regulate the economy, and if you wish to gauge the profitability of the AUD, you must know about its policies.

- Asian Economy: A large chunk of Australia’s exports consists of trades done with Asian nations. In case there is some kind of disagreement between Australia and one of these countries, it may result in a change in policies and regulations, which can alter the price of the AUD.

When to trade the GBP/AUD?

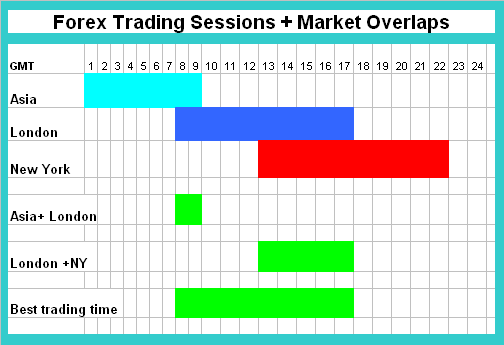

If you wish to deal in the GBP/AUD pair, it is best to do it between 1 PM to 5 PM GMT. At this time, both the New York and London markets are operating, and since trades are being placed through both these markets, it is characterized by tight spreads. During this time period, high liquidity can be observed as well.

The majority of Forex traders deal in the GBP/AUD pair when the American and European market sessions overlap. This phenomenon is shown in the figure above.

Predicting its movement

It is not easy to conduct a technical analysis on the GBP/AUD pair only with the help of traditional aspects. That being said, you can closely monitor the macroeconomic indicators for the USA to understand this pair better. While calculating the interest rates across currencies, you need to involve the USD.

After the release of the major economic indicators for the USA, the GBP and AUD don’t react at the same speed. Due to this fact, seasoned traders can diversify their portfolios by trading in the GBP/AUD pair. Since the important British and Australian news are released during the Pacific and European trading sessions, it is at these times that the pair is highly active.

How to trade the pair

If you are a trader looking to deal in the GBP/AUD pair, you have the choice of using a CFD or a Forex contract. With the former, you enter an agreement with a broker and pay them an amount equal to the difference in the pair’s value from the beginning to the conclusion of the trade. In this regard, you can enter a long or short position based on your speculations.

Conclusion

Both the Australian dollar and the British pound are traded in high volumes and dealing in the GBP/AUD lets you use unique strategies for the diversification of trading. Remember, you need to perform a thorough analysis of the market in order to forecast the price changes.

Leave a Reply