- The dollar regains some ground against its major peers, but it will struggle to hold it for long as traders keep an eye on the Democrat administration’s spending plans.

- Traders are taking profit in the euro after the common currency surged last year, but it should soon be back up.

- China’s bid to curb the advance of yuan isn’t working as intended – at least for now.

Forex market continued to see strong activity Friday. The US government’s big spending after Democrats take control of the White House and Congress, as well as Japan’s lockdown of Tokyo, are some of the issues influencing forex trades.

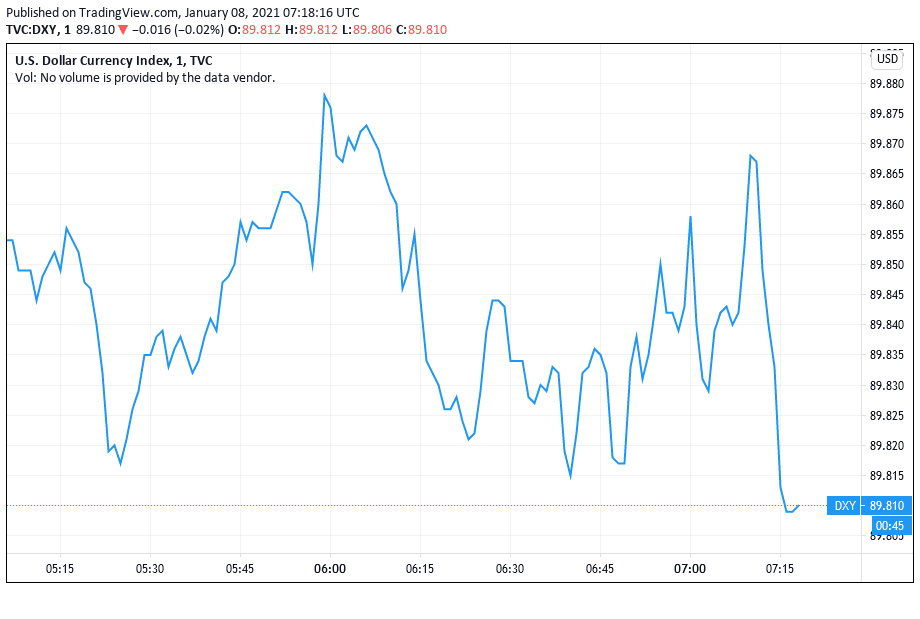

US dollar index firms up

The US dollar showed resilience against major peers on Friday in Asian trading hours. The index climbed 0.04% to 89.86. It earlier crossed 90. The index has recovered after it fell to a nearly three-year low of 89.206 on Wednesday.

Investors taking profit from the euro after the common currency recent surge and shock to the yen after Japan imposed a lockdown on Tokyo over rising COVID-19 cases seem to underpin the dollar’s advance.

The dollar index measures the strength of the greenback relative to a group of major currencies. It fell by about 7% in 2020 as the US grabbed with the COVID-19 economic fallout.

The euro accounts for about 60% of the index weight. The yen and the pound account for 13% and 12% of the weight. The other currencies in the dollar index basket are the Canadian dollar, the Swedish krona, and the Swiss franc.

The dollar’s rise against the peers came as Pfizer announced that its vaccine appears to be effective against the new, more contagious strain of the coronavirus. The more dangerous virus variant was first discovered in Britain and is spreading around the world.

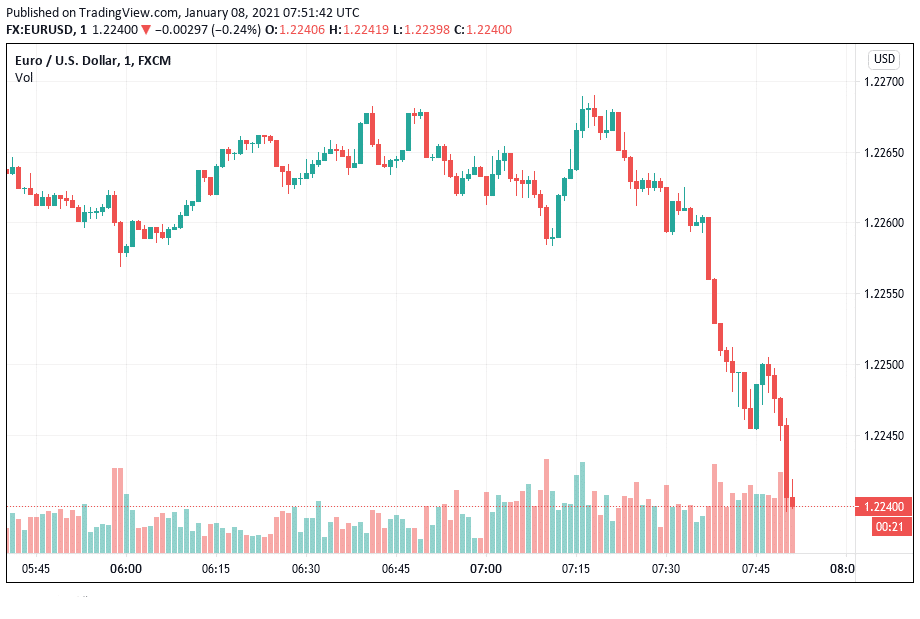

Euro heads south but may be back soon

The euro fell 0.47% to 1.222 against the dollar Friday. Concerns about the new coronavirus strain that first appeared in the Eurozone appeared to be weighing on the common currency for now. But the new strain has been here for a while, and that makes profit-taking a more likely reason the euro is coming under pressure today.

The euro gained about 9% against the dollar last year, making a strong case for some traders to book profits. That leaves room for EUR/USD to rebound after those taking profits have had their time, and other matters come into focus.

With Democrats in control of both the White House and Congress, traders anticipate big government spending, which will be a negative for the dollar.

Yuan defies Beijing intervention

China’s yuan continued to advance against the dollar Friday despite efforts by Beijing to curb its rise. Yuan rose to trade 6.465 against the dollar. In recent months, it has been the best-performing Asian currency against the dollar.

China’s central bank is fixing the yuan rate lower than expected, and state-backs selling yuan are among the signs Beijing may be uncomfortable with the domestic currency growing stronger.

The Chinese authorities attempt to curb the yuan’s rise as the strong yuan would inhibit the country’s export business and undermine the much-needed economic recovery from the coronavirus impact.

Yen yields to the dollar as Tokyo enters lockdown

The Japanese yen lost ground against the dollar Friday to trade at 104.04 compared to its previous close of 103.77. The weakening of the yen comes as Japan’s COVID-19 headache has increased. The country has been reporting record numbers of COVID-19 cases in recent days. Moreover, COVID-19 hospitalization has soared.

To prevent a bad situation from getting worse, Japan’s Prime Minister Yoshihide Suga has declared a state of emergency in the country’s capital Tokyo and the environs. Tokyo will remain on lockdown for a month, and during that period, many businesses will have to close early and sports venues to limit fans. Tokyo’s state of emergency now casts doubt on the 2021 Olympic plans in the city, and forex traders take that into account.

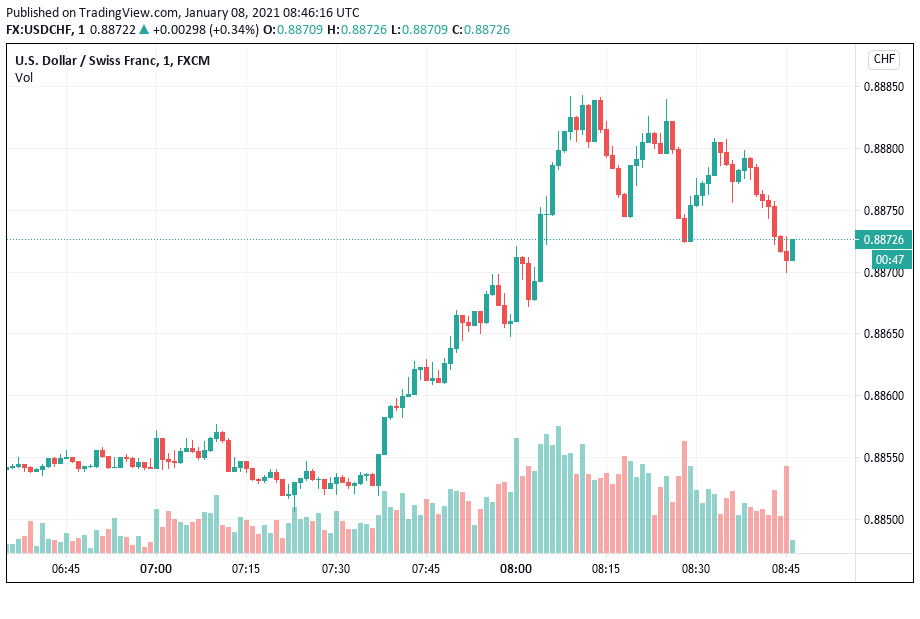

Swiss franc caves in for the dollar

Traders showed less appetite for the safe-haven Swiss franc in Asian trading Friday. The dollar advanced 0.34% to get the USD/CHF pair trading at 0.8872.

In December, the White House administration labeled Switzerland a currency manipulator after the Swiss central bank dropped a mechanism to ensure the franc’s stability.

Leave a Reply